- United States

- /

- Specialty Stores

- /

- NasdaqGM:WINA

How Winmark’s (WINA) Shift to Franchising and Sustainability May Shape Its Investment Case

Reviewed by Sasha Jovanovic

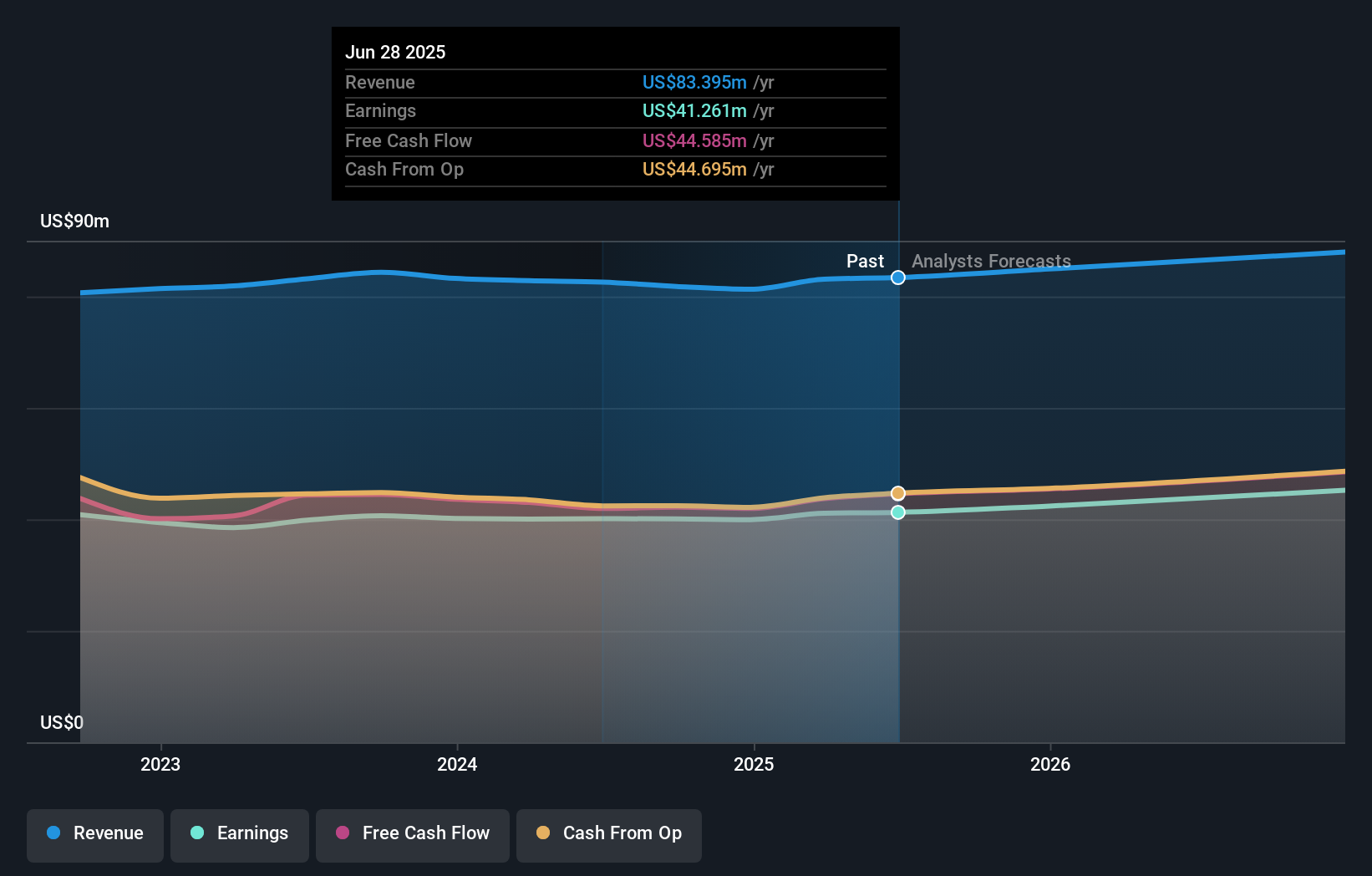

- Winmark Corporation reported continued progress in its transition away from the leasing segment to focus on franchising retail stores selling secondhand goods across North America, supporting higher margins and sustainable business practices.

- This shift, paired with cash reserves exceeding US$39.7 million in Q3 2025 and a consistent track record of dividend increases, highlights the company's alignment with circular economy trends.

- We'll examine how Winmark's emphasis on sustainability and higher-margin franchising is influencing its investment narrative moving forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Winmark's Investment Narrative?

The core belief for shareholders in Winmark today rests on the company’s ability to drive growth and resiliency by focusing on its franchised resale brands and the larger circular economy. The recent decision to officially exit the leasing segment is meaningful, sharpening Winmark’s retail focus and aligning the business with changing consumer and investor priorities. This announcement supports near-term catalysts like higher-margin expansion and the sustainability story. Recent news regarding hefty dividends and solid cash reserves reinforces confidence in capital returns, although the substantial special payout will draw scrutiny to future dividend coverage and the capital flexibility needed for growth investments. The sharp drop in share price last month suggests the market is weighing these factors closely. Most significant risks now tilt toward profit margin sustainability, high valuation levels, and how well Winmark manages its franchise-driven transition. In contrast, margin compression from sector-wide franchise headwinds is not an abstract risk for investors.

Winmark's share price has been on the slide but might be up to 30% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Explore another fair value estimate on Winmark - why the stock might be worth 23% less than the current price!

Build Your Own Winmark Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Winmark research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Winmark research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Winmark's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 38 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Winmark might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:WINA

Winmark

A resale company, operates as a franchisor for small business in the United States and Canada.

Slight risk with acceptable track record.

Similar Companies

Market Insights

Community Narratives