- United States

- /

- Retail Distributors

- /

- NasdaqGS:WEYS

Should You Buy Weyco Group, Inc. (NASDAQ:WEYS) For Its Upcoming Dividend?

It looks like Weyco Group, Inc. (NASDAQ:WEYS) is about to go ex-dividend in the next four days. The ex-dividend date is usually set to be one business day before the record date, which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. The ex-dividend date is important because any transaction on a stock needs to have been settled before the record date in order to be eligible for a dividend. In other words, investors can purchase Weyco Group's shares before the 14th of March in order to be eligible for the dividend, which will be paid on the 31st of March.

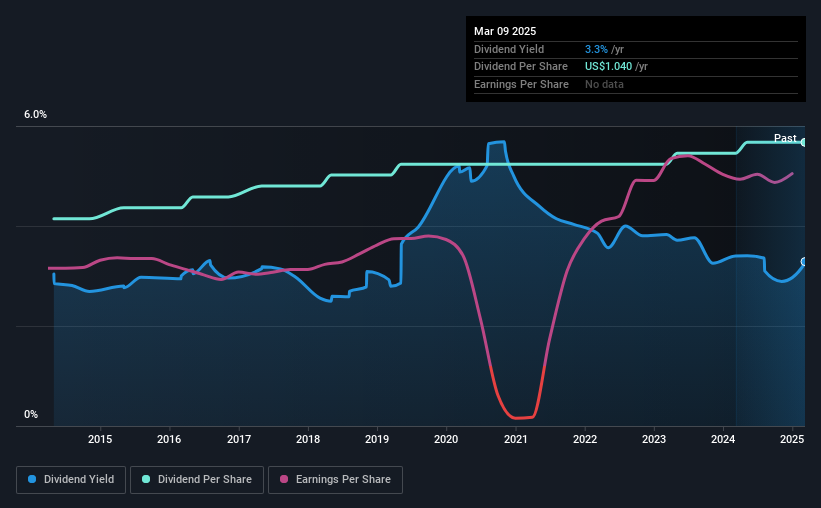

The company's upcoming dividend is US$0.26 a share, following on from the last 12 months, when the company distributed a total of US$1.04 per share to shareholders. Based on the last year's worth of payments, Weyco Group stock has a trailing yield of around 3.3% on the current share price of US$31.63. If you buy this business for its dividend, you should have an idea of whether Weyco Group's dividend is reliable and sustainable. So we need to investigate whether Weyco Group can afford its dividend, and if the dividend could grow.

Check out our latest analysis for Weyco Group

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. That's why it's good to see Weyco Group paying out a modest 32% of its earnings. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. Dividends consumed 66% of the company's free cash flow last year, which is within a normal range for most dividend-paying organisations.

It's positive to see that Weyco Group's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see how much of its profit Weyco Group paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. This is why it's a relief to see Weyco Group earnings per share are up 8.7% per annum over the last five years. While earnings have been growing at a credible rate, the company is paying out a majority of its earnings to shareholders. If management lifts the payout ratio further, we'd take this as a tacit signal that the company's growth prospects are slowing.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. In the past 10 years, Weyco Group has increased its dividend at approximately 3.2% a year on average. It's encouraging to see the company lifting dividends while earnings are growing, suggesting at least some corporate interest in rewarding shareholders.

To Sum It Up

From a dividend perspective, should investors buy or avoid Weyco Group? Earnings per share have been growing at a steady rate, and Weyco Group paid out less than half its profits and more than half its free cash flow as dividends over the last year. It might be worth researching if the company is reinvesting in growth projects that could grow earnings and dividends in the future, but for now we're not all that optimistic on its dividend prospects.

Want to learn more about Weyco Group? Here's a visualisation of its historical rate of revenue and earnings growth.

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

If you're looking to trade Weyco Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Weyco Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:WEYS

Weyco Group

Designs, markets, and distributes footwear for men, women, and children in the United States, Canada, Australia, Asia, and South Africa.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives