- United States

- /

- Specialty Stores

- /

- NasdaqGS:URBN

How Urban Outfitters' (URBN) Expanded UGG Collaboration Is Shaping Its Experiential Retail Investment Narrative

Reviewed by Sasha Jovanovic

- Urban Outfitters recently launched the next phase of its On Rotation experiential retail concept, collaborating with global lifestyle brand UGG® to create immersive installations in select stores across the US, with the initiative beginning on November 4, 2025.

- This partnership strengthens Urban Outfitters' position as a gifting destination for the holiday season and highlights its ongoing efforts to connect with Gen Z through unique retail experiences and high-profile brand collaborations.

- We'll now examine how the expanded UGG partnership and experiential retail concept may influence Urban Outfitters' broader investment narrative and growth outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Urban Outfitters Investment Narrative Recap

To be a shareholder in Urban Outfitters, you would need to believe in the company’s ability to drive sustained revenue and profit growth by staying culturally relevant with Gen Z and Millennials amid a fast-changing retail environment. The new UGG collaboration is a creative extension of the brand’s experiential strategy and could strengthen its holiday sales appeal, but its short-term impact on the key catalysts, like driving traffic and engagement, may take time to materialize. The biggest near-term risk remains pressure on margins from rising tariffs and high operational costs, which this announcement is unlikely to meaningfully offset right away.

The October launch of new, customer-centric store concepts in Houston and Glendale stands out as a companion announcement, reinforcing Urban Outfitters’ push to reimagine the in-store experience and align more closely with current shopping preferences. As experiential retail takes center stage, these initiatives may support the company’s efforts to deepen engagement and drive top-line growth among its core demographic, but investors should still monitor for early signals of sales conversion and cost leverage from these investments.

On the other hand, persistent headwinds from elevated marketing and expansion spending could weigh on margins if sales growth fails to keep pace…

Read the full narrative on Urban Outfitters (it's free!)

Urban Outfitters' narrative projects $7.2 billion in revenue and $508.4 million in earnings by 2028. This requires 7.1% yearly revenue growth and a $33 million earnings increase from current earnings of $475.4 million.

Uncover how Urban Outfitters' forecasts yield a $79.67 fair value, a 30% upside to its current price.

Exploring Other Perspectives

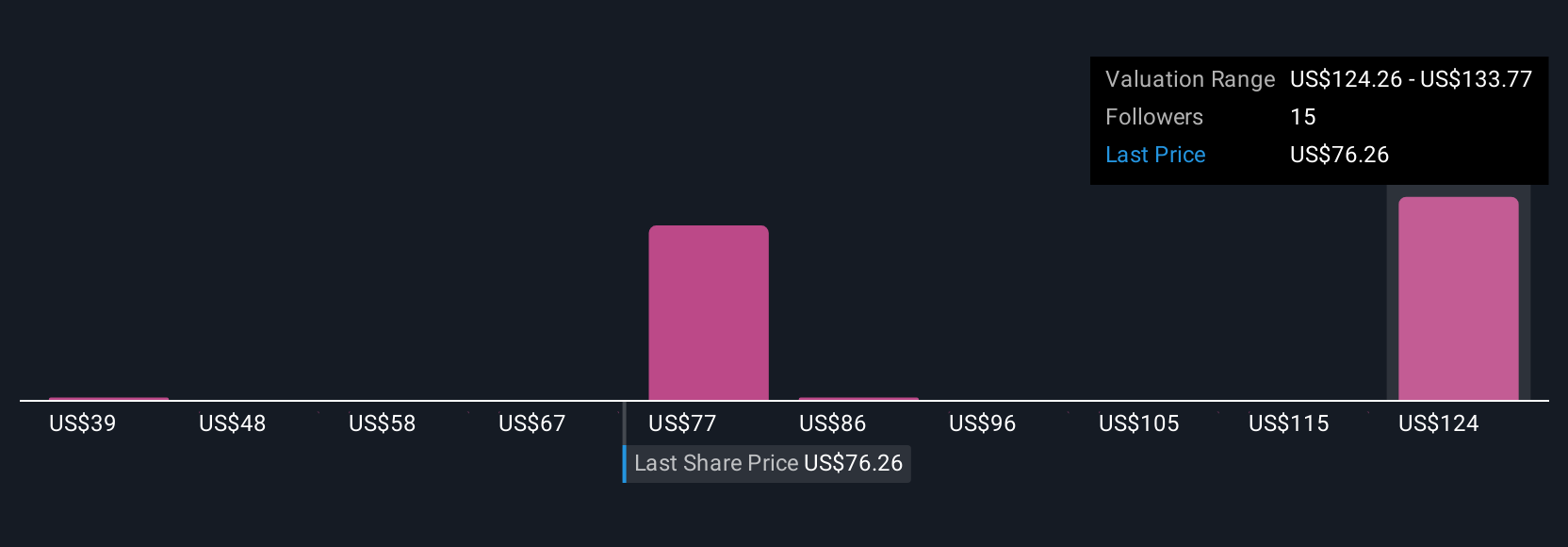

Four recent fair value estimates from the Simply Wall St Community span from US$38.76 to US$80.14 per share. With operational and marketing costs growing alongside innovative retail concepts, readers can explore how differing opinions on business execution and margin pressures shape views on Urban Outfitters’ outlook.

Explore 4 other fair value estimates on Urban Outfitters - why the stock might be worth 37% less than the current price!

Build Your Own Urban Outfitters Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Urban Outfitters research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Urban Outfitters research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Urban Outfitters' overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:URBN

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives