- United States

- /

- Specialty Stores

- /

- NasdaqGS:ULTA

Ulta Beauty (ULTA): Evaluating Valuation as Holiday Promotions and Q3 Optimism Drive Investor Interest

Reviewed by Simply Wall St

Ulta Beauty (ULTA) is getting attention as it heads into the holiday season, with its third-quarter results expected to come in ahead of Wall Street forecasts. Strong demand and successful product launches are shaping the outlook for the stock.

See our latest analysis for Ulta Beauty.

Ulta Beauty’s share price has gained impressive momentum, rising 2.7% in a day and 7.6% over the past week, with a strong year-to-date share price return of nearly 25%. Big promotions, new campaigns, and resilient demand have all fueled recent optimism, helping the company achieve a total shareholder return of over 42% in the past year alone. This has outpaced many retail peers. Investors seem to be responding positively to Ulta’s ability to deliver growth and excitement through both operational execution and headline-grabbing events.

If Ulta’s holiday buzz has you rethinking your own watchlist, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

Yet with shares up nearly 25% this year and market excitement running high, the key question is whether Ulta Beauty remains undervalued or if current prices already reflect all that future growth. Is there truly a buying opportunity now, or is the market already anticipating more ahead?

Most Popular Narrative: 6.9% Undervalued

Ulta Beauty’s current fair value, based on the most widely followed narrative, sits comfortably above its most recent closing price. This may indicate that the market is missing some upside. The predominant narrative outlines a series of growth drivers and challenges that offer a richer picture than recent momentum alone.

“Wellness category expansion, exclusive partnerships, and curated marketplace enhance brand appeal to younger demographics and support stronger revenue growth and margins. Digital investments, loyalty program strength, and global expansion strategies boost customer retention, repeat purchases, and create diversified pathways for long-term profitability.”

Curious what’s powering this valuation? A mix of new customer segments, strategic partnerships, and critical financial projections are behind the narrative’s bullish stance. Want to see the full volume of future sales and profit assumptions that underpin this number? Discover how analysts build the case for long-term gains in the complete narrative.

Result: Fair Value of $574.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising costs and the loss of key partnerships could pressure Ulta’s margins, creating challenges for the growth narrative that analysts currently support.

Find out about the key risks to this Ulta Beauty narrative.

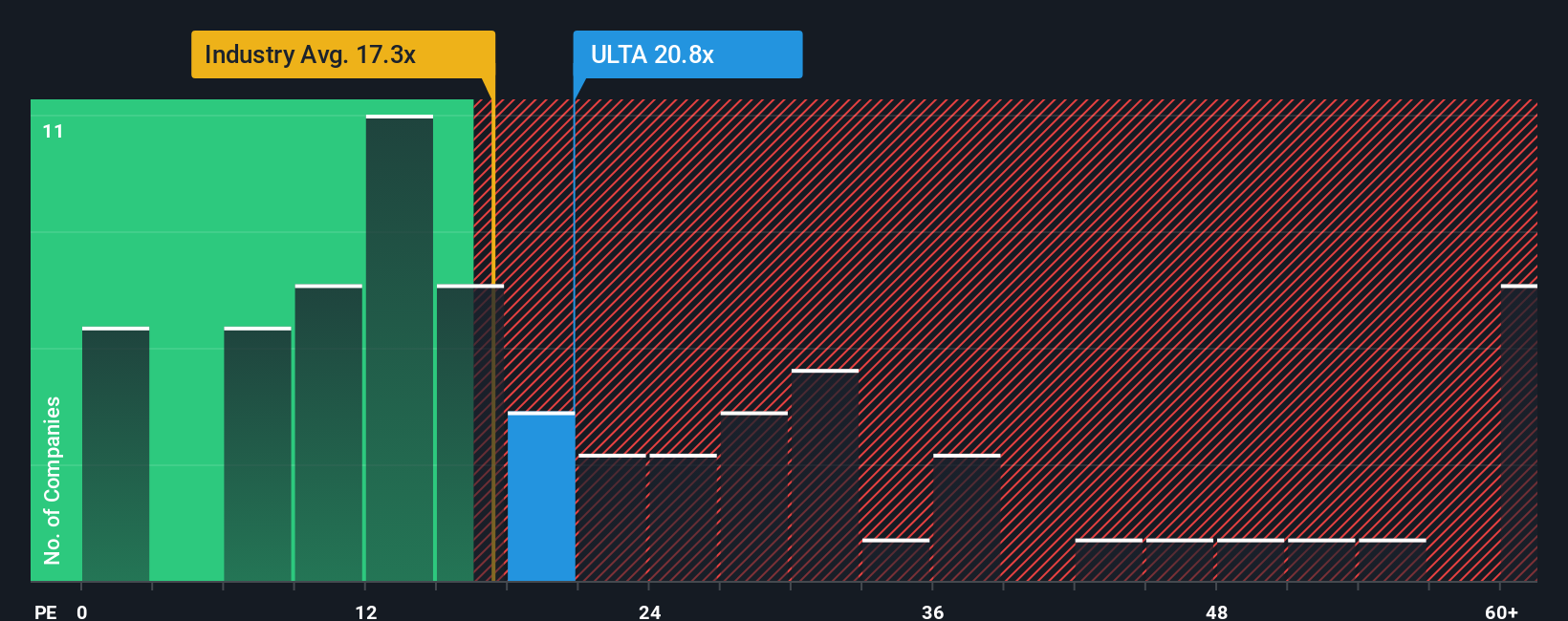

Another View: Multiples Tell a Cautionary Story

Looking at Ulta Beauty’s price-to-earnings ratio, the shares trade at 20x earnings. This makes them more expensive than both their fair ratio of 17x and the industry average of 18.9x. While this may reflect optimism, it also shows less margin for error if growth disappoints. Could the market be pricing in too much good news?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ulta Beauty Narrative

If you see things differently or want to dig into the numbers yourself, you can craft a personalized outlook in just minutes. Do it your way

Prefer to form your own view? Our platform makes it easy to explore a stock's fundamentals and create your own narrative in minutes.

Looking for more investment ideas?

Sharpen your strategy by exploring handpicked opportunities that you might not be watching yet. The next winning idea could already be breaking out.

- Capitalize on market mispricing by targeting potential bargains available across these 928 undervalued stocks based on cash flows.

- Tap into emerging healthcare breakthroughs by scouting these 30 healthcare AI stocks making waves with artificial intelligence and innovation.

- Boost your passive income with stable returns by finding these 15 dividend stocks with yields > 3% offering reliable yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ULTA

Ulta Beauty

Operates as a specialty beauty retailer in the United States, Mexico, and Kuwait.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success