- United States

- /

- Specialty Stores

- /

- NasdaqGS:ULTA

Is UB Marketplace and New Leadership Shaping Ulta Beauty’s Long-Term Trajectory (ULTA)?

Reviewed by Sasha Jovanovic

- Ulta Beauty recently launched UB Marketplace, a curated online platform on ulta.com and the Ulta Beauty app featuring over 100 new brands across beauty, wellness, and lifestyle categories in partnership with Mirakl.

- This expansion comes as new CEO Kecia Steelman leads the company through e-commerce growth and operational changes, and the board names Christopher DelOrefice as incoming CFO to further strengthen executive leadership.

- We'll examine how the debut of UB Marketplace and leadership transitions may influence Ulta Beauty's long-term growth prospects and investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Ulta Beauty Investment Narrative Recap

To own Ulta Beauty stock, you need to believe the company can expand its digital and wellness offerings while maintaining profit growth in the face of shifting consumer habits and margin pressures from store-related costs. The launch of UB Marketplace demonstrates Ulta's commitment to e-commerce expansion, but the most important near-term catalyst, accelerating digital sales, may not be materially impacted in the short term, while the largest risk remains rising costs for physical retail and the approaching loss of the Target partnership.

Ulta’s recent announcement of exclusive launches, such as the Fenty Skin body care collection available only in its stores, highlights how the company aims to strengthen its market position through differentiated in-store and online experiences. This focus aligns with Ulta’s need to drive both traffic and loyalty as its digital mix and assortment broaden in a competitive sector.

Yet, on the flip side, investors should be aware of the potential for store-related cost increases and declining profitability if...

Read the full narrative on Ulta Beauty (it's free!)

Ulta Beauty's narrative projects $13.8 billion in revenue and $1.3 billion in earnings by 2028. This requires 5.9% yearly revenue growth and a $0.1 billion earnings increase from the current $1.2 billion.

Uncover how Ulta Beauty's forecasts yield a $574.57 fair value, a 10% upside to its current price.

Exploring Other Perspectives

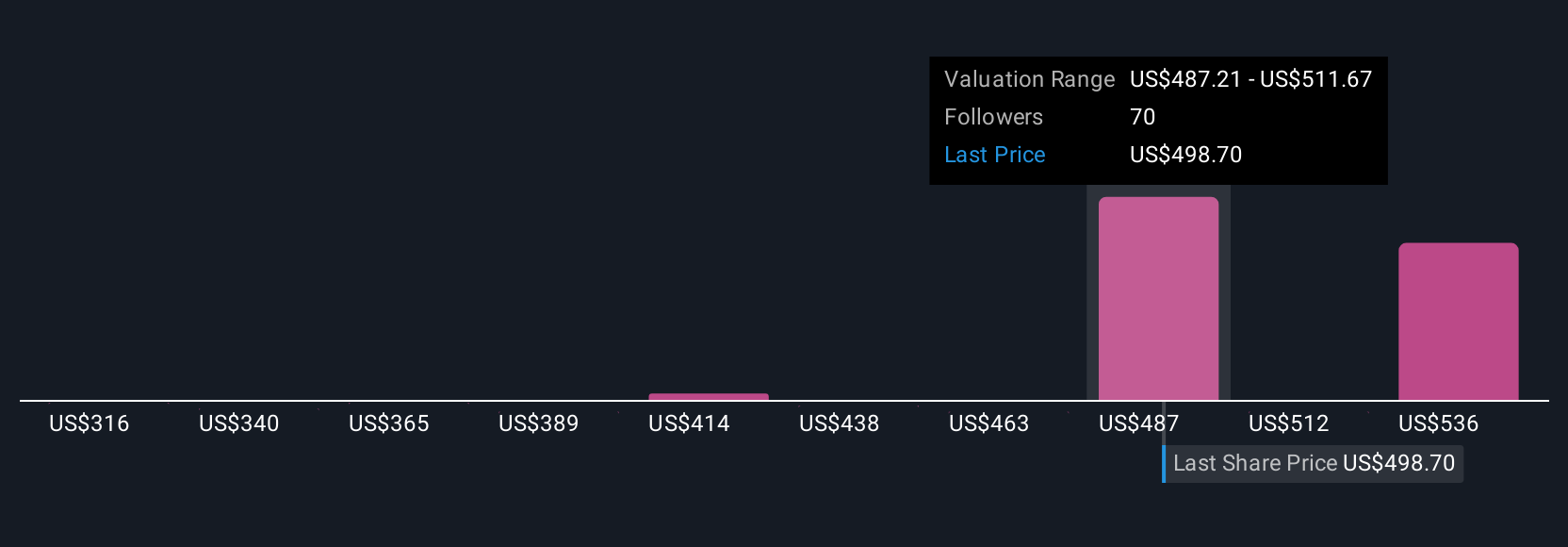

Nine fair value estimates from the Simply Wall St Community currently range widely from US$358.79 to US$574.57 per share. While investor opinions differ, many are watching how Ulta’s ability to offset rising store costs could influence future results.

Explore 9 other fair value estimates on Ulta Beauty - why the stock might be worth as much as 10% more than the current price!

Build Your Own Ulta Beauty Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ulta Beauty research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Ulta Beauty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ulta Beauty's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ULTA

Ulta Beauty

Operates as a specialty beauty retailer in the United States and Mexico.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives