- United States

- /

- Specialty Stores

- /

- NasdaqGS:TSCO

Tractor Supply (TSCO) Margin Decline Challenges Bullish Narratives Despite Dividend and Growth Projections

Reviewed by Simply Wall St

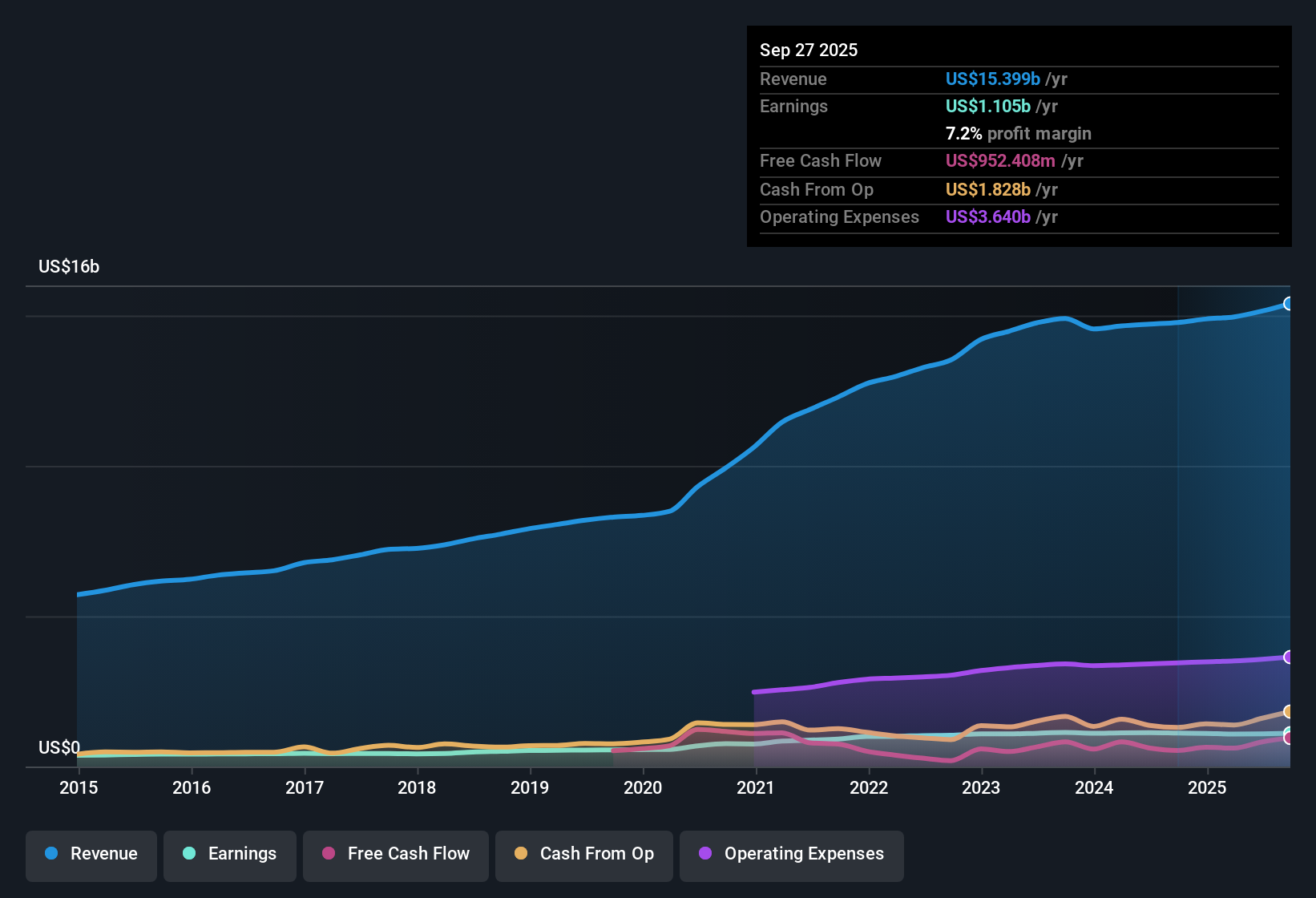

Tractor Supply (TSCO) reported a net profit margin of 7.2%, down from last year’s 7.7%, as earnings declined and broke with the company’s typical five-year average profit growth of 7% per year. While revenue is forecast to grow at 6.8% annually and annual earnings growth is projected at 8.9%, both metrics lag behind the broader US market’s expectations of 10% revenue growth and 15.5% earnings growth. Trading at $56.35, TSCO remains above its estimated fair value of $40.39, with a price-to-earnings ratio of 27.5x, which is higher than the specialty retail industry average but below the peer average. Investors continue to weigh steady projected growth and dividends against a more cautious outlook and minor risks to financial positioning.

See our full analysis for Tractor Supply.Next, we’ll see how the latest numbers compare to the broader narratives around Tractor Supply. Some assumptions may stand strong, while others could be up for debate.

See what the community is saying about Tractor Supply

Margins Projected to Recover by 2028

- Analysts forecast profit margins will rise from 7.2% today to 7.6% over the next three years, reversing the recent compression and suggesting gradual operational improvement.

- According to the analysts' consensus view, the expected margin recovery is anchored in two drivers:

- Diversifying the supply chain away from China is expected to ease tariff pressures, supporting margin expansion and earnings despite current headwinds.

- Ongoing strategic moves, like PetRx integration and boosts in customer retention, are likely to offset softness in big-ticket categories and inject stability into long-term profitability.

- A balanced take: If margins do improve as consensus expects, Tractor Supply could deliver steadier profit growth than the recent dip implied. See how the community weighs the coming bounce. 📊 Read the full Tractor Supply Consensus Narrative.

Dividend and Earnings Growth Still Outpace Most Retailers

- The company is projected to grow earnings at 8.9% a year while also maintaining an attractive dividend, offering a double benefit rare among specialty retailers with similar modest top-line growth.

- Analysts' consensus view points out that even as revenue growth lags the broader market expectation of 10%, sustained earnings expansion and a reliable dividend support optimism:

- Customer engagement and retention remain strong, which could underpin steady consumption in core categories and support resilience through slower retail cycles.

- Initiatives like Chick Days and expansion into consumable, usable, and edible categories highlight how management leans into customer loyalty to keep earnings on track.

Premium Valuation Balances Rewards and Execution Challenges

- Tractor Supply’s current price of $56.35 sits well above its discounted cash flow (DCF) fair value of $40.39 and represents a 27.5x price-to-earnings ratio, higher than the specialty retail industry average of 16.7x but below the peer group’s 41.6x multiple.

- Analysts’ consensus narrative notes this premium comes with contrasting signals:

- Modest upside to the consensus price target of $62.63 (just 11% above the current price) suggests the market sees earnings visibility but is wary of significant overperformance.

- The risk flagged is that softer performance in big-ticket categories and exposure to tariffs could quickly make the current valuation look stretched if revenue or margins don’t rebound as forecast.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Tractor Supply on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? Share your angle and craft a story from the stats in just a few minutes. Do it your way

A great starting point for your Tractor Supply research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Tractor Supply’s premium valuation, revenue growth lagging the market, and margin pressures raise questions about paying up for limited upside and execution risk.

If you want stocks where the current price looks more attractive versus future cash flows, start your search with these 876 undervalued stocks based on cash flows for investment ideas that could offer better value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tractor Supply might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSCO

Tractor Supply

Operates as a rural lifestyle retailer in the United States.

Established dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives