- United States

- /

- Specialty Stores

- /

- NasdaqGS:TSCO

How Record Q3 Sales and a Cautious Outlook at Tractor Supply (TSCO) Have Shifted Its Investment Story

Reviewed by Sasha Jovanovic

- Tractor Supply Company recently reported record third-quarter results, with net sales reaching US$3.72 billion and comparable store sales increasing 3.9%, driven by strong demand, new store openings, and effective execution in seasonal and core product categories.

- Despite the quarterly outperformance, the company narrowed its full-year sales and profit guidance, highlighting continued caution among rural consumers and higher interest rates as key economic pressures weighing on big-ticket purchases.

- We'll review how Tractor Supply's cautious outlook for full-year sales, despite robust third-quarter results, influences the current investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Tractor Supply Investment Narrative Recap

To be a shareholder in Tractor Supply, one needs to believe in the long-term durability of rural lifestyle retailing and the company's ability to drive growth through new store openings, customer retention, and expanding core categories. The recent record third-quarter results reinforce the strength of these catalysts, but the narrowed full-year guidance serves as a reminder that weaker big-ticket demand and ongoing macroeconomic pressures remain the most important near-term risks. So far, this cautious adjustment to guidance is material since it directly impacts the immediate earnings expectations and sentiment. One recent announcement particularly relevant to this environment is the update to the company's share buyback program, with 1.3 million shares repurchased during the third quarter for US$75.4 million. While buybacks can underpin shareholder returns, their effectiveness in offsetting headwinds in big-ticket sales depends on how persistent these consumer pressures prove to be. On the other hand, investors should ensure they understand the risks tied to elevated interest rates and the impact these may have on Tractor Supply's...

Read the full narrative on Tractor Supply (it's free!)

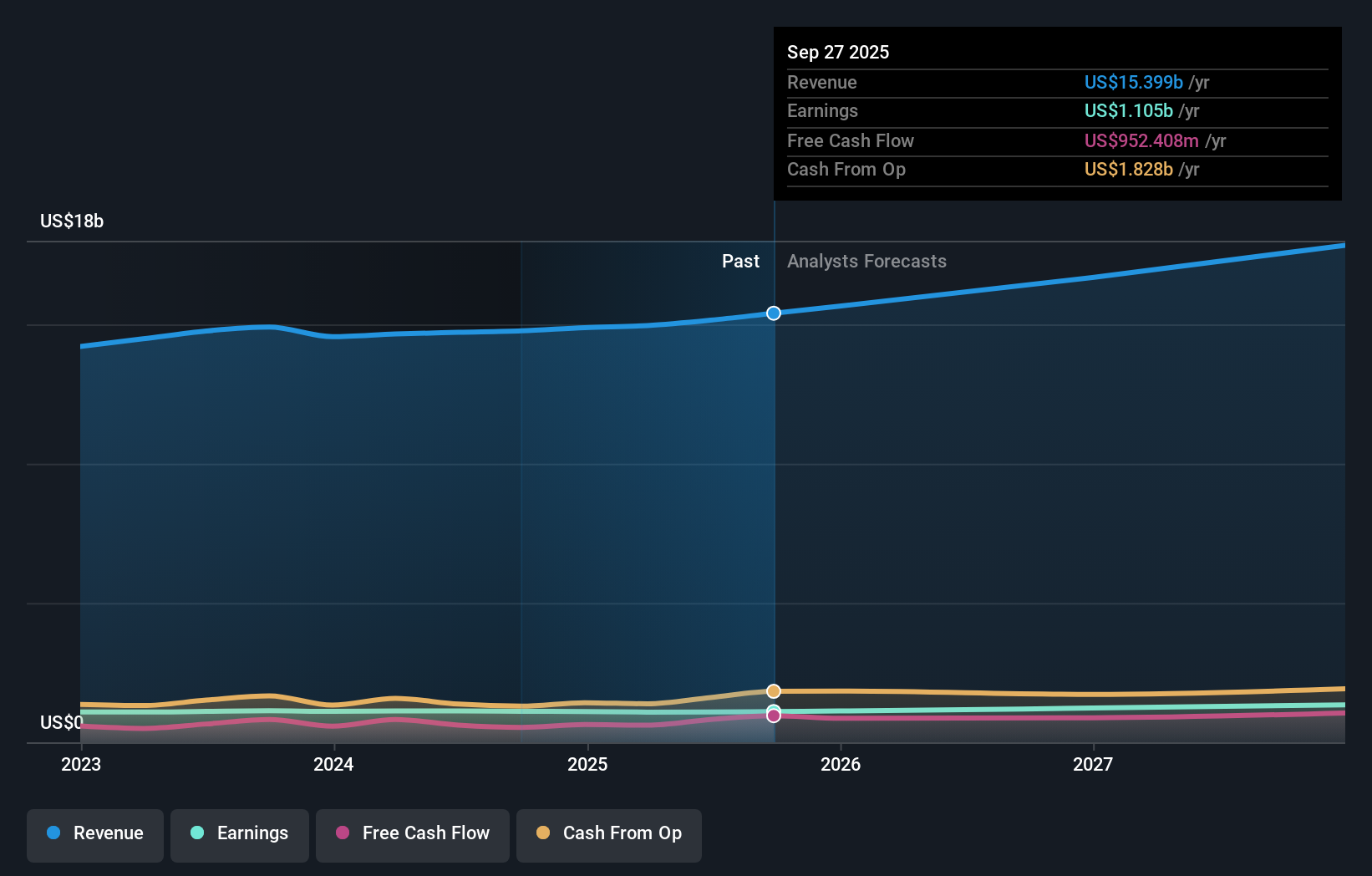

Tractor Supply's narrative projects $18.7 billion in revenue and $1.4 billion in earnings by 2028. This requires a 7.3% yearly revenue growth and a $0.3 billion increase in earnings from the current $1.1 billion.

Uncover how Tractor Supply's forecasts yield a $63.30 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Four Simply Wall St Community fair value estimates for Tractor Supply range from US$35.93 to US$63.30 per share. While many expect steady revenue from store expansion, opinions differ on the impact of weaker big-ticket spending, so it pays to compare several viewpoints.

Explore 4 other fair value estimates on Tractor Supply - why the stock might be worth as much as 12% more than the current price!

Build Your Own Tractor Supply Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tractor Supply research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Tractor Supply research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tractor Supply's overall financial health at a glance.

No Opportunity In Tractor Supply?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tractor Supply might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSCO

Tractor Supply

Operates as a rural lifestyle retailer in the United States.

Established dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives