- United States

- /

- Specialty Stores

- /

- NasdaqGS:TSCO

A Fresh Look at Tractor Supply's (TSCO) Valuation After Robust Q3 Earnings and Raised Guidance

Reviewed by Simply Wall St

Tractor Supply (TSCO) delivered third quarter earnings that came in stronger than Wall Street was expecting, with both profit and same-store sales topping estimates. The momentum was driven by demand across its core businesses as well as continued expansion plans.

See our latest analysis for Tractor Supply.

Tractor Supply’s strong quarter and upbeat guidance have helped the stock maintain steady momentum, with the share price rising 7.5% year-to-date. Over the past year, investors saw a total shareholder return of nearly 6%. The company’s five-year total return stands out at an impressive 129%, illustrating its ability to deliver for long-term holders even amid economic headwinds and shifting consumer trends.

If you’re interested in uncovering more companies showing strong growth and resilience, now is an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

With Tractor Supply shares on a steady climb and analysts raising price targets, the real question is whether the stock still offers value at these levels or if future gains are already reflected in the market price.

Most Popular Narrative: 11.1% Undervalued

With Tractor Supply’s widely followed narrative, the fair value is pegged at $63.30, which is well above its last close of $56.28. This suggests headroom for further gains. This places the spotlight on the bold assumptions and strategic shifts that underpin the narrative’s outlook and fuel the current debate.

Tractor Supply's strategy to reduce reliance on Chinese imports and diversify its supply chain, from over 90% to closer to 50% by year-end, could mitigate tariff impacts, potentially improving net margins and earnings. Strong transaction growth, unit growth in consumable, usable, and edible categories, and record customer retention indicate sustained demand, likely bolstering future revenue.

Curious what’s driving this big valuation gap? The narrative is grounded in aggressive profit margin gains and a revenue trajectory typically reserved for sector pace-setters. There is one future metric in particular, higher than what most rivals boast, that looms large in the fair value calculation. Want to see the full financial playbook powering this price target?

Result: Fair Value of $63.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a slowdown in comparable store sales or more cautious consumer spending could quickly undermine these bullish forecasts for Tractor Supply.

Find out about the key risks to this Tractor Supply narrative.

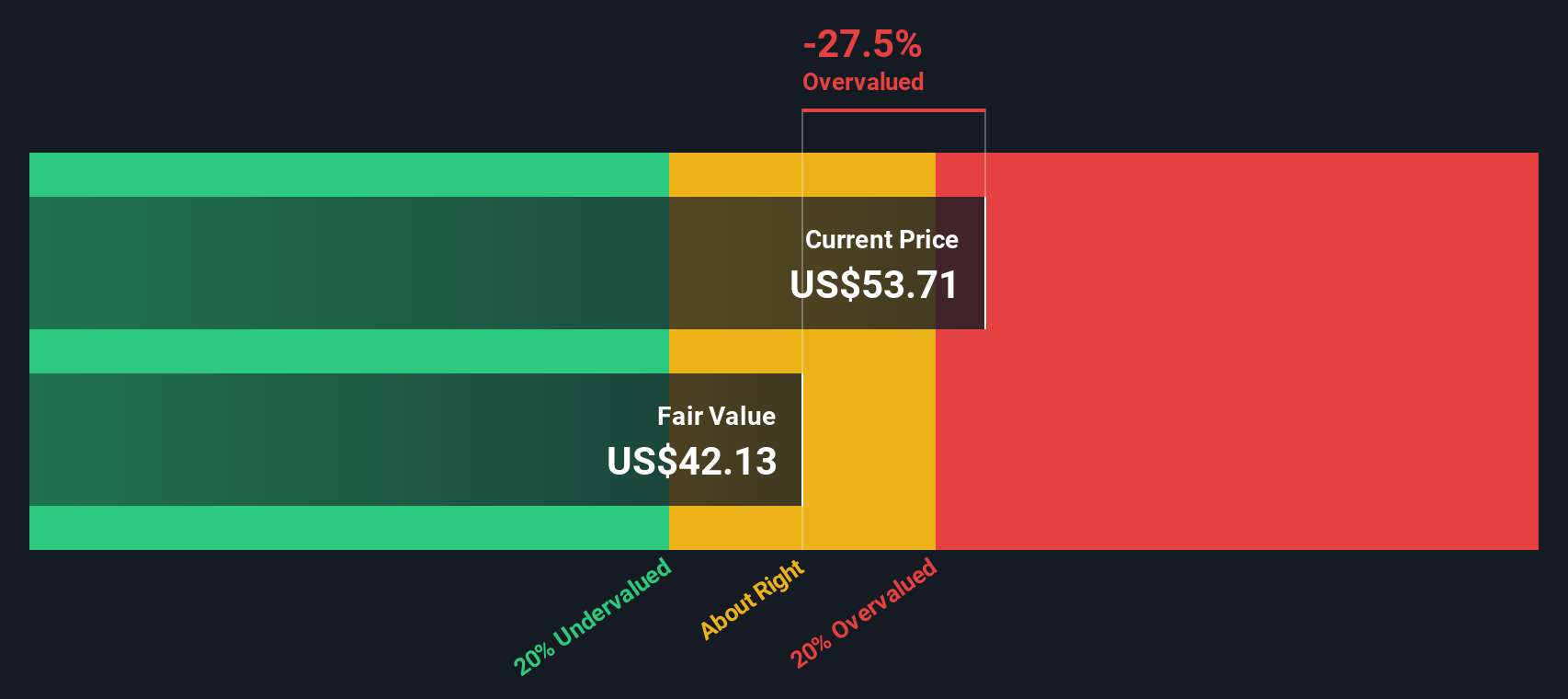

Another View: DCF Model Paints a Different Picture

While the analyst consensus points to Tractor Supply being undervalued, our SWS DCF model suggests otherwise. Based on projected cash flows, the DCF values the company at just $35.80, meaning the shares trade substantially above this estimate. Why does this fundamental model diverge so much from analyst targets?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tractor Supply for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tractor Supply Narrative

If you’d rather chart your own course, you can dive into the financials and assemble a narrative tailored to your own perspective in just a few minutes, or simply Do it your way.

A great starting point for your Tractor Supply research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investing Opportunities?

Take your research up a notch by tapping into unique stock lists designed to help you spot tomorrow’s standout portfolio winners before the crowd catches on.

- Explore next-level tech by scanning these 27 AI penny stocks, where artificial intelligence trends could influence significant growth.

- Find reliable income streams when you review these 17 dividend stocks with yields > 3%, featuring companies with yields over 3% built to weather any market.

- Discover undervalued gems that others might overlook by checking out these 872 undervalued stocks based on cash flows, highlighting stocks with potential upside based on cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tractor Supply might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSCO

Tractor Supply

Operates as a rural lifestyle retailer in the United States.

Established dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives