- United States

- /

- Specialty Stores

- /

- NasdaqGS:TDUP

ThredUp (TDUP): Assessing Valuation as Investor Optimism Lifts 2024 Returns

Reviewed by Kshitija Bhandaru

ThredUp (TDUP) has been on the radar of many investors lately, especially after a string of returns over the past three months. The online resale platform has captured attention with its recent performance data, raising questions about the outlook ahead.

See our latest analysis for ThredUp.

ThredUp's share price has steadily gained ground in 2024, reflecting growing optimism after strong quarterly returns and a renewed spotlight on circular fashion. Over the past year, its total shareholder return has climbed 10.8%, signaling that momentum is building as investors reassess the company’s growth potential and risk profile.

If the recent momentum in ThredUp’s story has you rethinking your watchlist, now is a great time to discover fast growing stocks with high insider ownership

But with ThredUp still trading at a meaningful discount to analyst price targets, is there an attractive buying opportunity here? Or has the market already priced in the company’s improving fundamentals and future growth prospects?

Most Popular Narrative: 27.5% Undervalued

With ThredUp’s last close at $9.43, the most followed narrative suggests fair value sits much higher. This highlights a belief that fundamentals and industry tailwinds have not been fully recognized by the market. This valuation scenario sets the stage for a closer look at some bold growth catalysts analysts see ahead.

Rising consumer awareness of sustainability and growing interest in circular fashion models continue to expand the addressable market for online resale, creating lasting demand tailwinds that are likely to boost volume growth and top-line revenue for ThredUp. ThredUp's continued, multi-year investment in AI-driven product experience, personalization, and supply chain automation has led to record-high new buyer acquisition, improved conversion, and elevated gross margins. As the technology scales, this has improved both revenue and net margins.

Curious what’s fueling such an optimistic outlook? It’s not just about top-line momentum. The narrative hinges on one major metric shift that could reshape future profitability and valuation multiples. Uncover which financial levers are projected to power this upside and decide if the story holds up under your own scrutiny.

Result: Fair Value of $13.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising customer acquisition costs or slower adoption of ThredUp’s B2B partnerships could quickly challenge the bullish outlook and stall future gains.

Find out about the key risks to this ThredUp narrative.

Another View: What Do Revenue Multiples Say?

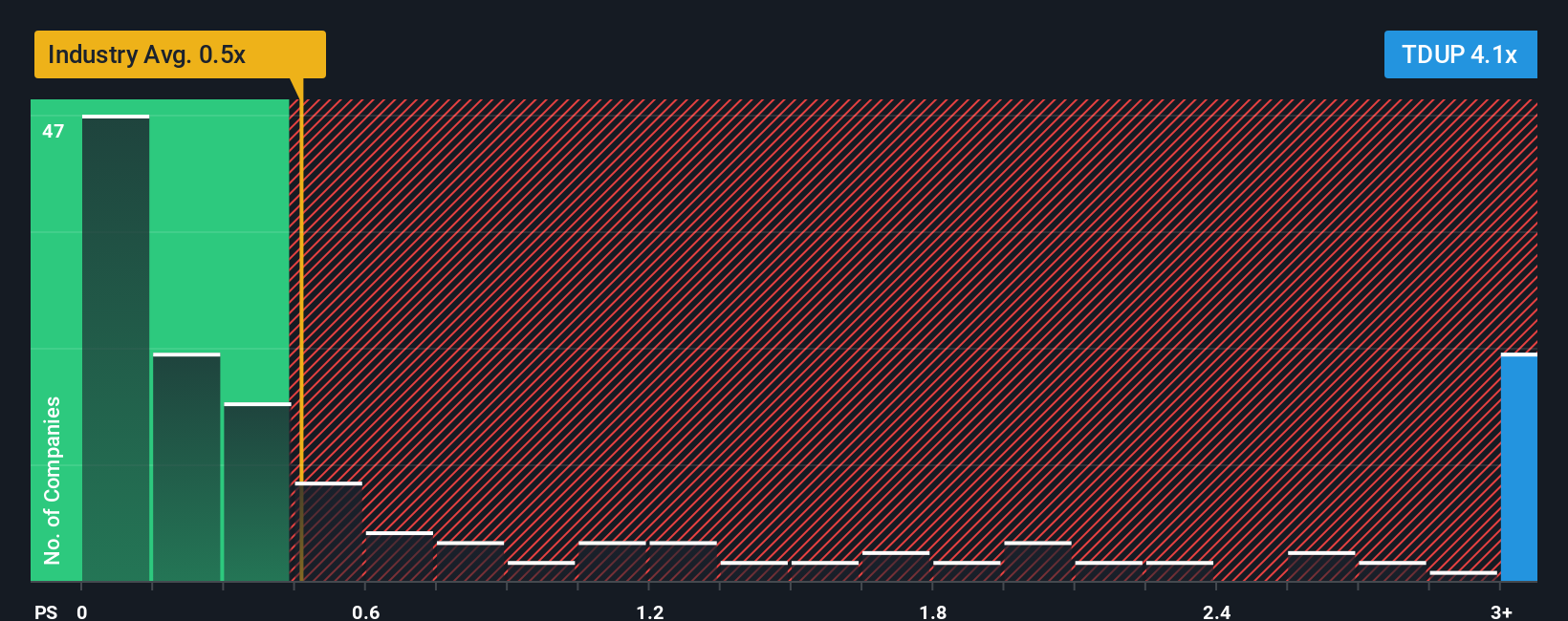

Looking from a different angle, the market is valuing ThredUp at 4.2 times its annual sales. This is much higher than the Specialty Retail industry average of just 0.5 times and the peer average of 1.1 times. The fair ratio projection suggests that 1.6 times sales could be more reasonable. Such a wide gap points to some valuation risk if investor enthusiasm cools, but it also hints at the potential for multiple expansion if growth truly accelerates. Which side of the story will play out?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ThredUp Narrative

If the current narrative doesn’t fit your perspective, or you want to dive deeper into the numbers, you can shape your own story in just a few minutes: Do it your way

A great starting point for your ThredUp research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit yourself to just one opportunity. Unlock real potential by tapping into tailored screens packed with promising stocks that fit your strategy and ambitions.

- Capture tomorrow’s megatrends by scanning these 24 AI penny stocks featuring promising advances in artificial intelligence and automation.

- Grow your wealth with confidence by targeting these 886 undervalued stocks based on cash flows selected for value-driven returns based on solid fundamentals.

- Boost your passive income stream by seeking out these 19 dividend stocks with yields > 3% that offer strong yields and financial resilience, so your money works as hard as you do.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ThredUp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TDUP

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives