- United States

- /

- Specialty Stores

- /

- NasdaqGS:TDUP

After losing 33% in the past year, ThredUp Inc. (NASDAQ:TDUP) institutional owners must be relieved by the recent gain

Key Insights

- Institutions' substantial holdings in ThredUp implies that they have significant influence over the company's share price

- The top 8 shareholders own 51% of the company

- Recent sales by insiders

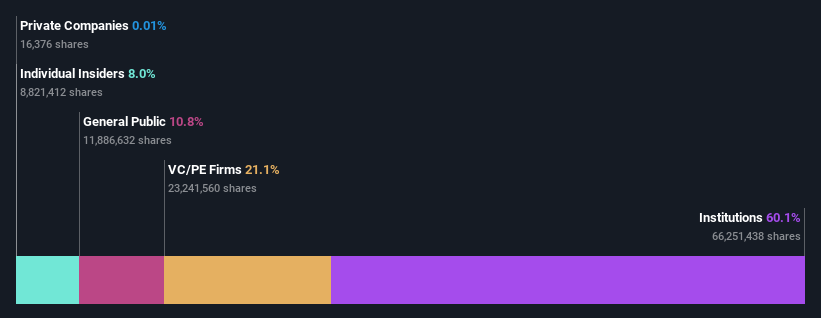

Every investor in ThredUp Inc. (NASDAQ:TDUP) should be aware of the most powerful shareholder groups. We can see that institutions own the lion's share in the company with 60% ownership. Put another way, the group faces the maximum upside potential (or downside risk).

Institutional investors would appreciate the 12% increase in share price last week, given their one-year losses have totalled a disappointing 33%.

Let's delve deeper into each type of owner of ThredUp, beginning with the chart below.

See our latest analysis for ThredUp

What Does The Institutional Ownership Tell Us About ThredUp?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

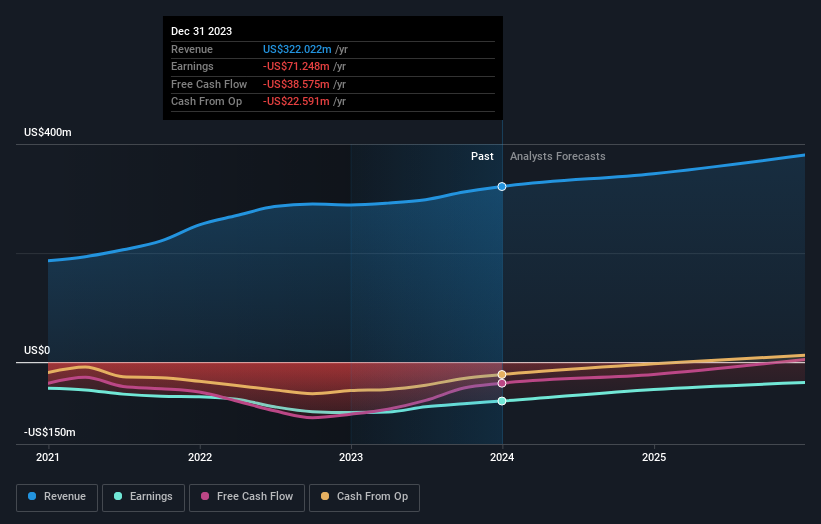

We can see that ThredUp does have institutional investors; and they hold a good portion of the company's stock. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at ThredUp's earnings history below. Of course, the future is what really matters.

Since institutional investors own more than half the issued stock, the board will likely have to pay attention to their preferences. ThredUp is not owned by hedge funds. Capital Research and Management Company is currently the largest shareholder, with 7.8% of shares outstanding. In comparison, the second and third largest shareholders hold about 7.6% and 7.0% of the stock. Furthermore, CEO James Reinhart is the owner of 3.8% of the company's shares.

We also observed that the top 8 shareholders account for more than half of the share register, with a few smaller shareholders to balance the interests of the larger ones to a certain extent.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too.

Insider Ownership Of ThredUp

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Shareholders would probably be interested to learn that insiders own shares in ThredUp Inc.. It has a market capitalization of just US$198m, and insiders have US$16m worth of shares, in their own names. Some would say this shows alignment of interests between shareholders and the board, though we generally prefer to see bigger insider holdings. But it might be worth checking if those insiders have been selling.

General Public Ownership

The general public, who are usually individual investors, hold a 11% stake in ThredUp. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Private Equity Ownership

With an ownership of 21%, private equity firms are in a position to play a role in shaping corporate strategy with a focus on value creation. Sometimes we see private equity stick around for the long term, but generally speaking they have a shorter investment horizon and -- as the name suggests -- don't invest in public companies much. After some time they may look to sell and redeploy capital elsewhere.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand ThredUp better, we need to consider many other factors. For example, we've discovered 2 warning signs for ThredUp that you should be aware of before investing here.

Ultimately the future is most important. You can access this free report on analyst forecasts for the company.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if ThredUp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TDUP

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion