- United States

- /

- Specialty Stores

- /

- NasdaqGS:ROST

Should Ross Stores’ (ROST) 40 New Stores Prompt a Closer Look From Investors?

Reviewed by Sasha Jovanovic

- Recently, Ross Stores completed its fiscal 2025 store expansion by opening 40 new locations, increasing its total store count to 2,273 and attracting positive attention from analysts.

- This growth milestone underscores investor confidence in the company’s ability to execute expansion and capitalize on shifting consumer preferences toward value retail.

- We’ll now examine how the completion of Ross Stores’ latest expansion program could shape the company’s broader investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Ross Stores Investment Narrative Recap

Ross Stores’ shareholders are likely to believe in the company’s ability to harness resilient demand for value retail, expand its physical footprint, and protect margins as it enters new markets. The recent opening of 40 new stores, attracting analyst upgrades and a brief share price rally, may support the near-term growth narrative but doesn’t materially offset the current biggest risk: rising distribution costs and ongoing margin pressures from tariffs. For now, these headwinds remain the central concern for short-term earnings stability. One relevant announcement that ties directly to this news is the company’s updated earnings guidance, which projects comparable store sales growth of 2% to 3% for the remainder of the year. While this guidance suggests management’s confidence in absorbing the expansion’s costs, it remains closely linked to the catalysts discussed, such as improved store productivity and customer traffic driven by the recent openings. Yet, in contrast to the optimism surrounding expansion, investors should be aware of the company’s vulnerability to persistent inflation and the potential limitations of its...

Read the full narrative on Ross Stores (it's free!)

Ross Stores is projected to reach $25.0 billion in revenue and $2.4 billion in earnings by 2028. This outlook assumes a yearly revenue growth rate of 5.1%, with earnings rising by $0.3 billion from the current $2.1 billion.

Uncover how Ross Stores' forecasts yield a $164.59 fair value, in line with its current price.

Exploring Other Perspectives

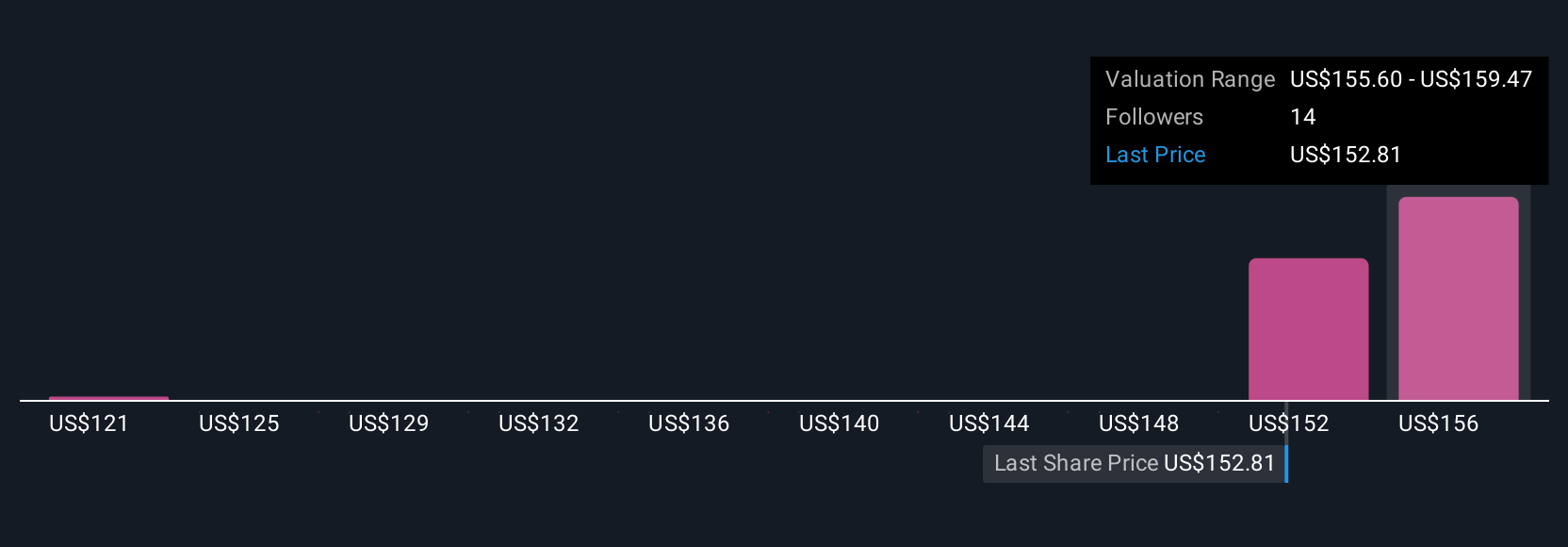

Simply Wall St Community members provided five fair value estimates for Ross Stores, ranging from US$10.84 to US$164.59. While estimates vary widely, many participants still point to distribution cost inflation as a challenge that could weigh on future profitability and growth. Explore these diverse viewpoints and see how your outlook compares.

Explore 5 other fair value estimates on Ross Stores - why the stock might be worth less than half the current price!

Build Your Own Ross Stores Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ross Stores research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ross Stores research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ross Stores' overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROST

Ross Stores

Operates off-price retail apparel and home fashion stores under the Ross Dress for Less and dd’s DISCOUNTS brands in the United States.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives