- United States

- /

- Specialty Stores

- /

- NasdaqGS:ROST

Ross Stores (ROST): Examining Valuation After a Period of Steady Share Price Growth

Reviewed by Simply Wall St

See our latest analysis for Ross Stores.

Ross Stores has seen its share price climb steadily, supported by a 4.2% gain over the past month and a solid 10.1% share price return in the last quarter. This reflects growing investor confidence in the retailer’s outlook. The longer-term view is strong as well, with the stock delivering an impressive 14.97% total shareholder return over the past year. This highlights that momentum is building as management continues to execute its strategy.

If you’re looking to uncover what’s powering market momentum right now, now’s a great opportunity to branch out and discover fast growing stocks with high insider ownership

The question for investors now is whether Ross Stores is trading below its true value or if the market has already factored in the company’s future growth prospects, leaving little room for upside.

Most Popular Narrative: 2.7% Undervalued

With Ross Stores closing at $161.83 and the most widely followed narrative assigning a fair value near $166, market watchers are seeing a modest upside built into today’s price. This situation prompts an important debate among analysts and investors over what’s driving that value call.

Enhanced merchandising strategy, including a higher mix of closeout inventory and refined vendor negotiations, is mitigating tariff impacts and supporting gross margin stability. Over time, expected price equilibrium across the sector will enable improvement in merchandise margin and earnings.

Want to know what bold assumptions gave rise to this bullish price target? The narrative reveals a striking outlook: steady profit margins and a future earnings multiple that only category leaders can justify. Unpack the factors behind this value and see what drives the projected upside for Ross Stores.

Result: Fair Value of $166.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost pressures and the lack of digital presence remain potential headwinds that could challenge Ross Stores's long-term growth narrative.

Find out about the key risks to this Ross Stores narrative.

Another View: Assessing the Price Tag

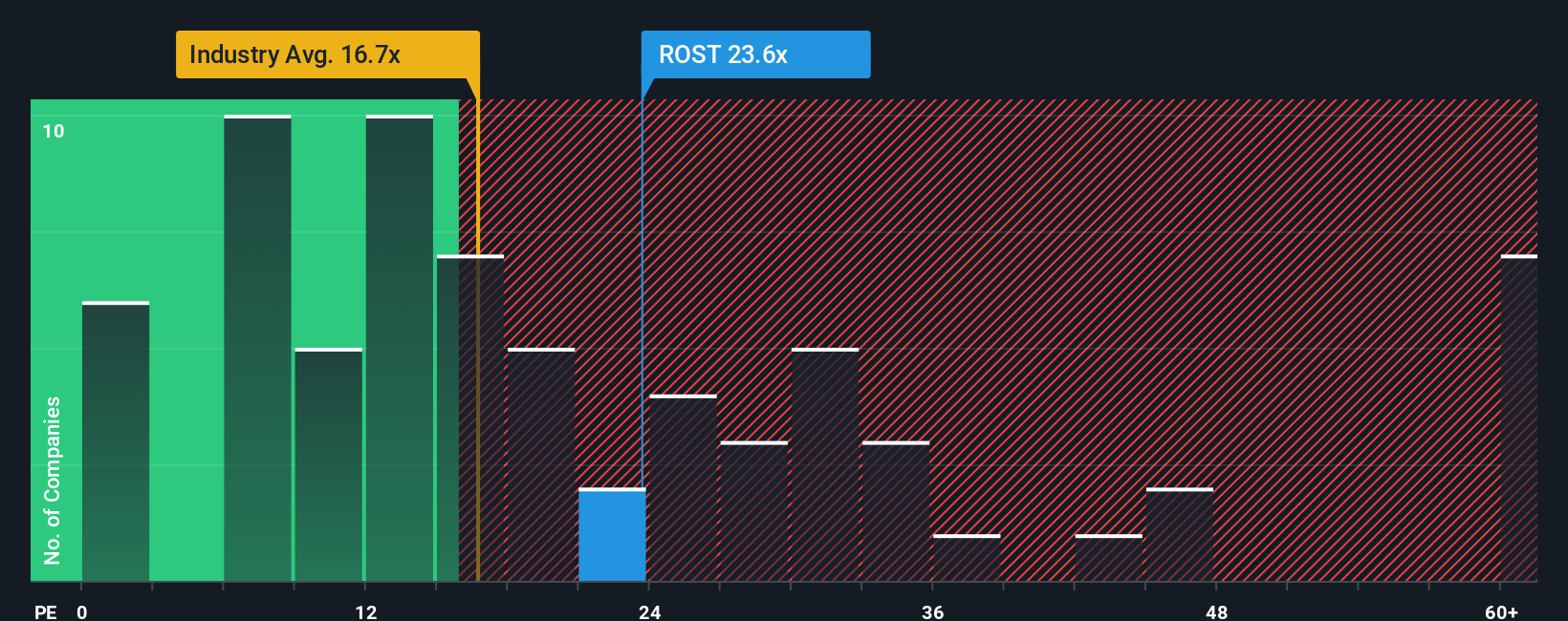

While some see modest upside based on future earnings, a glance at the price-to-earnings ratio reveals a different story. Ross Stores trades at 25.5 times earnings, more expensive than both its peer average of 21.8 and the industry’s 17.8, and also above a fair ratio of 18.4. This implies limited margin for error. If growth disappoints, investors could be overpaying. Does this higher valuation reflect genuine leadership or just impatience for future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ross Stores Narrative

If your take differs from the current market view, or you want to dive into the numbers yourself, crafting a custom narrative takes just a few minutes, so why not Do it your way?

A great starting point for your Ross Stores research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors move fast. Don’t miss your chance to tap into fresh opportunities. Let the Simply Wall Street Screener point you to tomorrow’s potential winners today.

- Power up your portfolio with these 27 AI penny stocks that are transforming industries and driving the next wave of technological breakthroughs.

- Boost your income by targeting these 15 dividend stocks with yields > 3% delivering sustainable yields above 3% for steady returns in any market conditions.

- Catalyze your growth strategy by hunting for value among these 870 undervalued stocks based on cash flows trading below their cash flow potential and set to surprise the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROST

Ross Stores

Operates off-price retail apparel and home fashion stores under the Ross Dress for Less and dd’s DISCOUNTS brands in the United States.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives