- United States

- /

- Specialty Stores

- /

- NasdaqGS:ROST

Ross Stores (ROST): Assessing Valuation After 13% Three-Month Share Price Gain

Reviewed by Simply Wall St

See our latest analysis for Ross Stores.

Ross Stores has shown impressive follow-through lately, with its 13% 3-month share price return helping to build positive momentum on top of a solid 12-month total shareholder return of nearly 10%. It seems the combination of strong earnings and stable demand for value-focused retail is keeping sentiment upbeat, even though the share price movement has been more modest so far this year.

If this kind of steady momentum has you thinking bigger, now’s an excellent time to broaden your perspective and discover fast growing stocks with high insider ownership

With solid longer-term gains but only a small discount to analyst targets, the next question for investors is clear: is Ross Stores undervalued, or is the market already pricing in all the future growth potential?

Most Popular Narrative: 3.4% Undervalued

Ross Stores’ current share price is trading just below the narrative's fair value, suggesting the market is only lightly discounting its future prospects. With analyst projections using a discount rate of 8.33% and consensus grounded in solid growth expectations, all eyes are on the company’s ability to deliver on these assumptions.

“The expansion into new and underpenetrated geographic markets, including successful entries into the New York Metro area and Puerto Rico, leverages ongoing population shifts to urban and suburban clusters. This provides a tangible runway for both revenue and earnings growth through increased store count and enhanced productivity of new locations.”

Want to know what powers this optimistic valuation? One element of the narrative is a projected runway for growth that rivals the industry’s top performers. Find out how key assumptions about future revenues, margins, and multiple expansion could propel Ross to new highs. Curious which factors are driving the price target? You’ll want to see the narrative in full.

Result: Fair Value of $162.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing margin pressures from tariffs and the company's limited digital presence could challenge the bullish view and test investor confidence in the period ahead.

Find out about the key risks to this Ross Stores narrative.

Another View: Room for Caution on Market Multiples

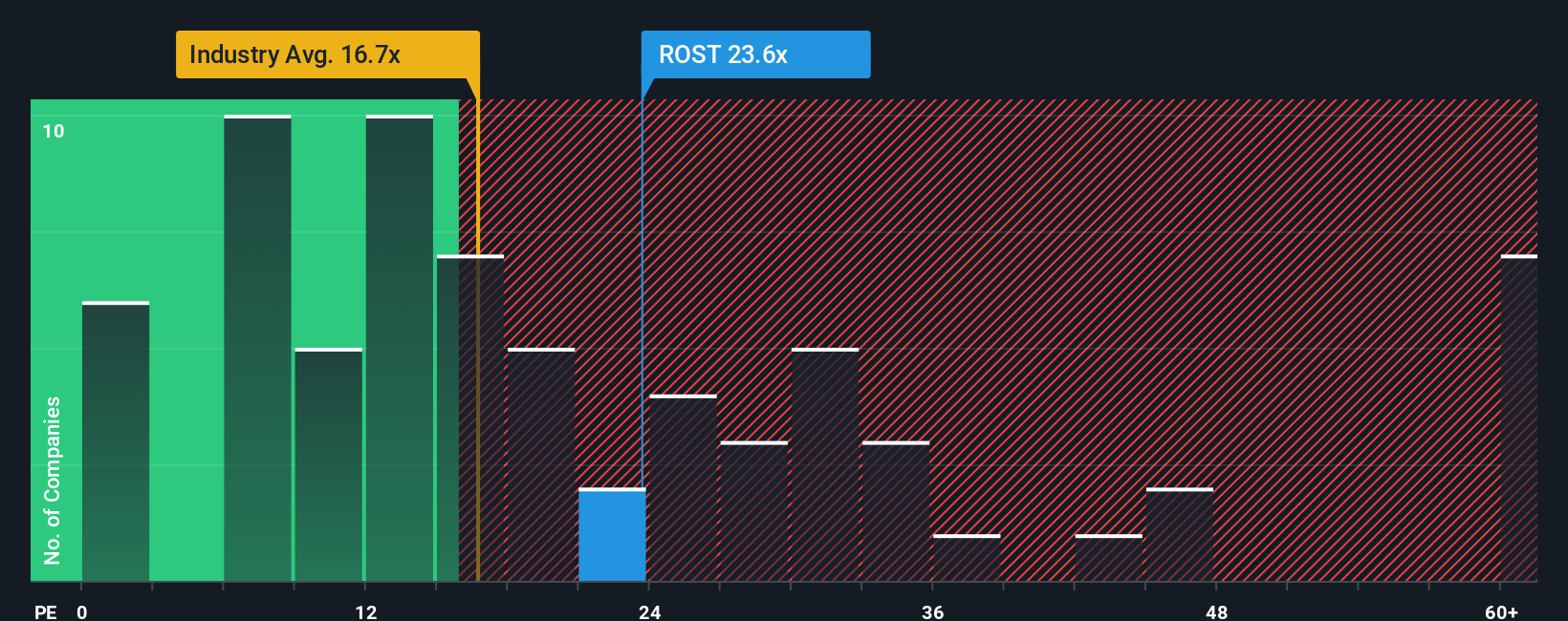

Taking a different approach, Ross Stores currently trades at 24.7 times earnings, which is noticeably higher than both the US Specialty Retail industry average of 16.9 times and its peer group at 21.2 times. Importantly, this is still above the fair ratio of 18.2 that the market could gravitate toward. This suggests a risk that the stock might be priced for a more optimistic scenario than consensus forecasts. Will investor expectations hold up, or will sentiment adjust if growth slows?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ross Stores Narrative

If you’d rather analyze the numbers and draw your own insights, you can put together a personalized narrative for Ross Stores in just a few minutes. Do it your way

A great starting point for your Ross Stores research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t settle for one great idea when you could be ahead of the curve with several. These uniquely curated screens can uncover tomorrow’s winners for your portfolio.

- Capture the upside by targeting these 877 undervalued stocks based on cash flows that the market is currently overlooking and put yourself ahead of the crowd.

- Boost your income strategy by locking in consistent yields through these 17 dividend stocks with yields > 3% offering more than 3% payouts.

- Ride the next wave of disruption and get access to innovators in healthcare by checking out these 33 healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROST

Ross Stores

Operates off-price retail apparel and home fashion stores under the Ross Dress for Less and dd’s DISCOUNTS brands in the United States.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives