- United States

- /

- Retail Distributors

- /

- NasdaqGS:POOL

Reassessing Pool (POOL): Has Valuation Stretched Too Far Despite Ongoing Housing and Discretionary Spending Headwinds?

Reviewed by Simply Wall St

Pool (POOL) is back in the spotlight as fresh commentary underscores how weak pool construction, softer discretionary spending, and a sluggish housing market are still pressuring its earnings outlook and challenging the stock’s valuation.

See our latest analysis for Pool.

The stock has drifted steadily lower this year, with a year to date share price return of minus 26.48 percent and a one year total shareholder return of minus 33.48 percent, signaling fading momentum as investors reassess earnings risk and valuation.

If Pool’s slump has you rethinking where growth could come from next, this may be a good time to explore fast growing stocks with high insider ownership for fresh, high conviction ideas.

With earnings still under pressure but the share price already down by roughly a third from its highs, the key debate now is whether Pool is quietly becoming undervalued or if markets are correctly pricing in muted growth.

Most Popular Narrative Narrative: 26.6% Undervalued

With Pool last closing at $244.73 against a most popular narrative fair value of $333.27, the valuation gap hinges on moderate growth and stable margins.

The aging installed U.S. pool base continues to create steady, nondiscretionary demand for renovation, maintenance, and parts, partially insulating revenues from new build cyclicality and underpinning durable long term earnings growth.

What kind of growth outlook justifies this higher fair value, despite sluggish housing and only gradual margin expansion? Unpack the revenue, margin, and earnings roadmap driving this target.

Result: Fair Value of $333.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent housing market weakness and inflation-driven cost pressures could undermine Pool’s growth runway and challenge the case for sustained multiple expansion.

Find out about the key risks to this Pool narrative.

Another Angle on Valuation

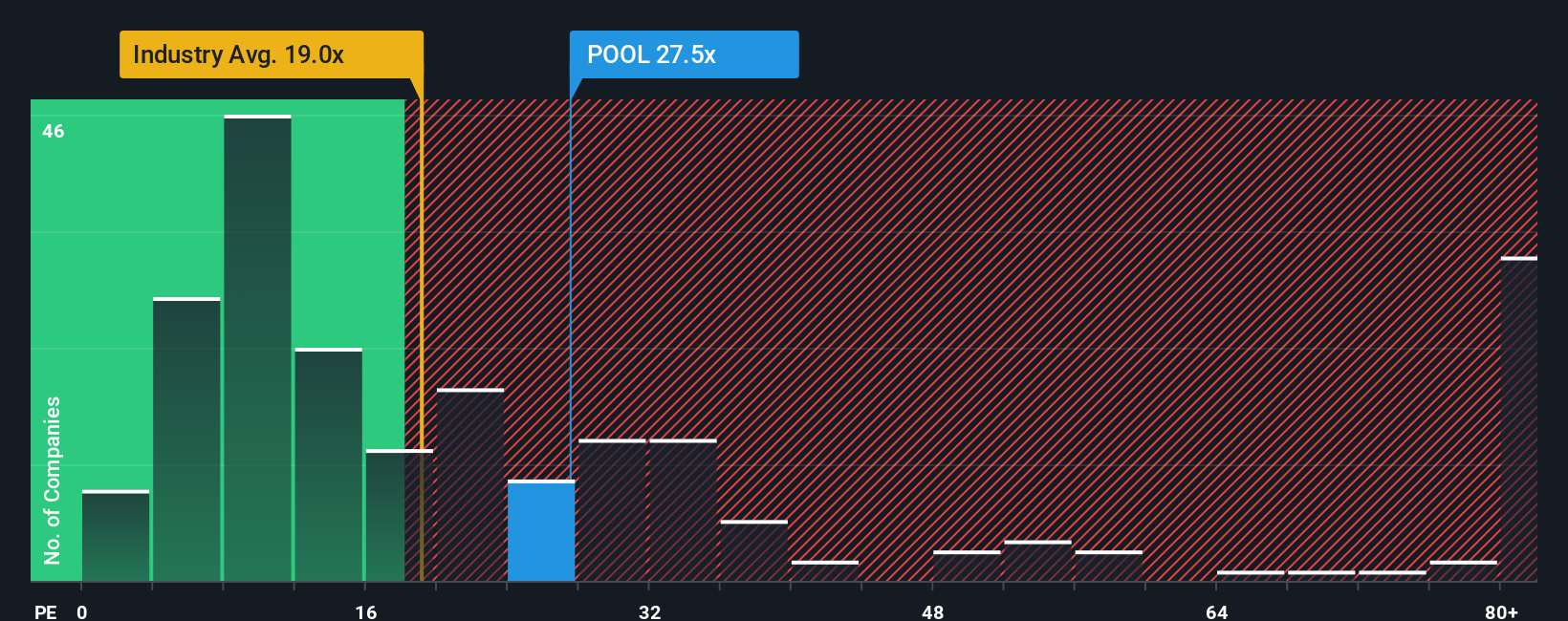

While narratives and analyst targets point to upside, a simple earnings multiple tells a tougher story. Pool trades at 22.2 times earnings versus a fair ratio of 15.5 times, and above the global Retail Distributors average of 17.8 times, suggesting limited margin for error if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pool Narrative

If you want to dig into the numbers yourself and challenge these assumptions, you can easily build a custom view in just a few minutes: Do it your way.

A great starting point for your Pool research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, explore your next potential opportunities with targeted stock ideas from the Simply Wall Street Screener that match your strategy and risk appetite.

- Capture early stage momentum by hunting for undervalued niche plays through these 3570 penny stocks with strong financials that already show improving fundamentals.

- Position your portfolio for structural growth by targeting companies at the heart of digital transformation with these 24 AI penny stocks.

- Focus on businesses trading below intrinsic value using these 933 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:POOL

Pool

Distributes swimming pool supplies, equipment, related leisure, irrigation, and landscape maintenance products in the United States and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026