- United States

- /

- Retail Distributors

- /

- NasdaqGS:POOL

Pool Corp (POOL) Valuation in Focus After FTSE All-World Index Removal

Reviewed by Kshitija Bhandaru

Pool (POOL) Drops from FTSE All-World Index: What Does It Mean for Investors?

Pool (POOL) landing outside the FTSE All-World Index is the sort of event that can throw even the most level-headed investor a curveball. Index deletions, while mechanical, tend to cause ripples for stocks like Pool as funds that track the index adjust their holdings. There have been no major updates from Pool itself or big shifts in its core business, so this change stands out as a trading-driven catalyst, not a performance signal from the company. Still, it prompts an important question for shareholders and those watching from the sidelines: how much does index exclusion actually affect long-term value?

Pricewise, Pool has been on a bit of a ride this year, down nearly 14% in the past twelve months and in the red year-to-date. That said, it did see nearly 4% upside in the past three months before the recent selloff triggered by its index exit. Looking back over three and five years, returns are modestly positive but are no longer keeping pace with the indexes. Momentum appears to be slowing. Recent annual sales and earnings growth are decent, but short-term sentiment has clearly shifted with this event.

After this year’s turbulence, is Pool looking attractively priced for believers in its fundamentals, or is the market already factoring in slower future growth?

Most Popular Narrative: 6.2% Undervalued

The most widely followed narrative judges Pool as modestly undervalued, pointing to a fair value moderately above the current share price based on its future earnings trajectory and market position.

Sustained migration to high-growth Sun Belt regions like Florida and Arizona, with POOLCORP increasing local branches and franchise presence, positions the company to capture outsized revenue and market share gains as demographic shifts boost both new installations and recurring maintenance activity.

Growing consumer emphasis on home-based leisure and wellness is maintaining structurally elevated demand for pools and related services. This drives resilient recurring revenue for maintenance and enhancements, which should support top-line stability and growth even during new construction lulls.

Curious about the financial logic behind this value call? One key metric sets Pool apart and could rewrite the company’s growth story. The model powering this narrative features ambitious projections on earnings and market share that could surprise even seasoned investors. Want the full picture of Pool’s fair value? Dig into the main narrative and discover the numbers analysts are betting on.

Result: Fair Value of $333.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, continued high interest rates and weaker housing turnover could easily undercut Pool’s growth trajectory and quickly turn analysts’ optimism into caution.

Find out about the key risks to this Pool narrative.Another View: Looking at it Through a Different Lens

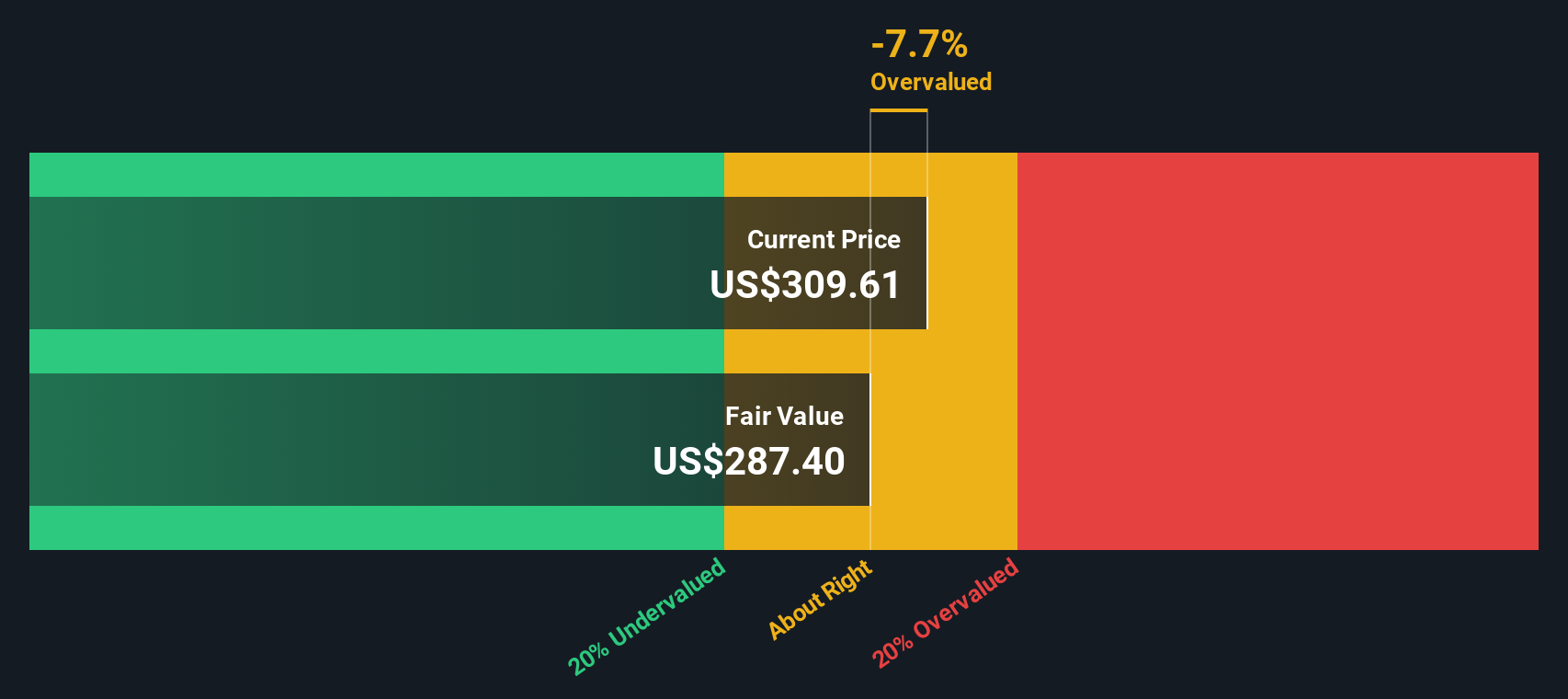

While analyst projections point to a slightly undervalued stock, our DCF model paints a less optimistic picture. It judges Pool as overvalued based on future cash flows. Which approach will best capture reality?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding Pool to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Pool Narrative

If you want to dig deeper or have a different perspective, you can dive into the data yourself and shape your own take on Pool’s outlook. Do it your way.

A great starting point for your Pool research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Seize your next opportunity today. Simply Wall Street’s screeners help you act quickly on today's emerging trends and find quality stocks before others catch on. Don’t let more potential winners pass you by.

- Tap into the next wave of artificial intelligence innovation and spot future leaders by checking out our selection of AI penny stocks.

- Uncover bargains in the market that are trading beneath their true value with our curated list of undervalued stocks based on cash flows.

- Jump on the momentum of generous payouts by exploring companies offering dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:POOL

Pool

Distributes swimming pool supplies, equipment, related leisure, irrigation, and landscape maintenance products in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives