- United States

- /

- Retail Distributors

- /

- NasdaqGS:POOL

Assessing Pool Corp (POOL) Valuation: Is Recent Momentum Signaling a Shift in Outlook?

Reviewed by Kshitija Bhandaru

See our latest analysis for Pool.

Despite modest upward movement in recent weeks, Pool’s 1-year total shareholder return remains in negative territory, highlighting a period of sluggish performance after years of steady expansion. However, the latest share price trends suggest momentum is starting to build again as market views on the company’s outlook improve.

If you’re open to new opportunities beyond retail, now is an ideal time to broaden your search and discover fast growing stocks with high insider ownership

With analyst targets just 7 percent above the current price and recent results showing only modest growth, the question is whether Pool is an underrated opportunity or if the market has already factored in its future prospects.

Most Popular Narrative: 6.4% Undervalued

Pool closed at $312.05, which sits modestly below the narrative’s fair value estimate of $333.27. With the consensus viewing Pool as attractively priced relative to expected growth, the spotlight shifts to the company’s structural tailwinds and why certain analysts see further room to run.

Sustained migration to high-growth Sun Belt regions like Florida and Arizona, with POOLCORP increasing local branches and franchise presence, positions the company to capture outsized revenue and market share gains as demographic shifts boost both new installations and recurring maintenance activity.

What is really powering this valuation? It is not just more pools. The model is fueled by assumptions about future profit margins, declining share count, and a bold growth curve other retailers might envy. Want to see the full playbook?

Result: Fair Value of $333.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high interest rates and ongoing housing market headwinds could limit Pool’s revenue growth and challenge analysts’ expectations for stronger long-term returns.

Find out about the key risks to this Pool narrative.

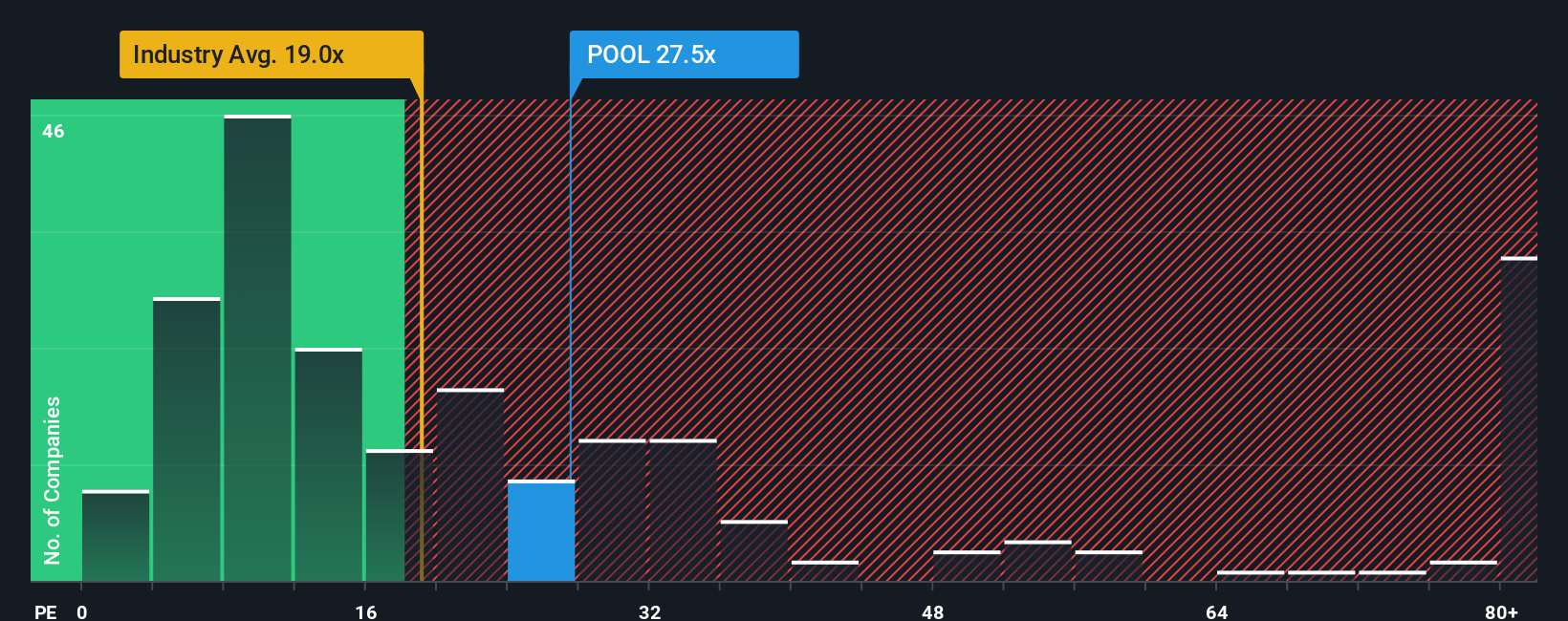

Another View: High Price Compared to Peers

Taking a different angle, Pool is trading at 28.5 times earnings, which is much higher than the global retail distributors average of 18.8 and its peers’ average of 20.2. The fair ratio for Pool is estimated at 15.8, suggesting the stock may be priced for perfection. Does this premium signal a risk for new buyers, or could the company’s strengths justify it?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pool Narrative

If you think there is more to the story, or prefer digging into the numbers yourself, you can easily shape your own view in just a few minutes. Do it your way

A great starting point for your Pool research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Step up your investing game by checking out standout opportunities beyond Pool. Don’t miss smart plays in fast-moving sectors. Be first, not last, to find the next big winner using these handpicked lists.

- Catch potential market upswings and boost your yield with these 19 dividend stocks with yields > 3% boasting established performance above 3%.

- Uncover industry frontrunners in healthcare as breakthroughs accelerate by accessing these 31 healthcare AI stocks reshaping diagnostics and patient outcomes.

- Position yourself early in game-changing tech. Tap into these 26 quantum computing stocks reshaping everything from encryption to supercomputing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:POOL

Pool

Distributes swimming pool supplies, equipment, related leisure, irrigation, and landscape maintenance products in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives