- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:PDD

PDD Holdings (PDD) Is Up 5.2% After Major Institutional Investors Expand Their Stakes

Reviewed by Simply Wall St

- Earlier this month, Li Lu’s Himalaya Capital made a significant investment of approximately US$480 million by acquiring 4,608,000 shares of PDD Holdings Inc., making it the firm’s second-largest holding; at the same time, Duan Yongping also increased his stake in the company.

- This wave of high-profile institutional buying has drawn market focus to PDD Holdings, reflecting major investors’ conviction in its business prospects and its growing influence among professional investors.

- We’ll examine how this recent show of institutional confidence could influence PDD Holdings’ investment narrative and future outlook.

Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

PDD Holdings Investment Narrative Recap

For anyone considering PDD Holdings as a potential investment, the core belief centers on its capacity to drive sustainable growth through continued platform and merchant ecosystem enhancements. News of significant share purchases by leading investors like Li Lu and Duan Yongping may boost market sentiment, but does not directly change the importance of execution on supply chain improvements or address persistent legal and regulatory risks, which remain the most important short-term catalysts and risks, respectively. Among recent announcements, Temu’s partnership with FITI Testing & Research Institute to introduce third-party quality checks speaks to PDD Holdings’ ongoing focus on strengthening consumer trust and operational efficiency. While not directly linked to institutional buying, such moves aim to support lasting revenue gains by addressing the demands of a global user base and enhancing the reliability of its marketplace. However, investors should also recognize that, despite positive headlines, ongoing regulatory uncertainties demand attention...

Read the full narrative on PDD Holdings (it's free!)

PDD Holdings is projected to reach CN¥585.3 billion in revenue and CN¥135.1 billion in earnings by 2028. This forecast assumes a 13.3% annual revenue growth rate and an increase in earnings of CN¥35.9 billion from the current level of CN¥99.2 billion.

Uncover how PDD Holdings' forecasts yield a $125.49 fair value, a 6% upside to its current price.

Exploring Other Perspectives

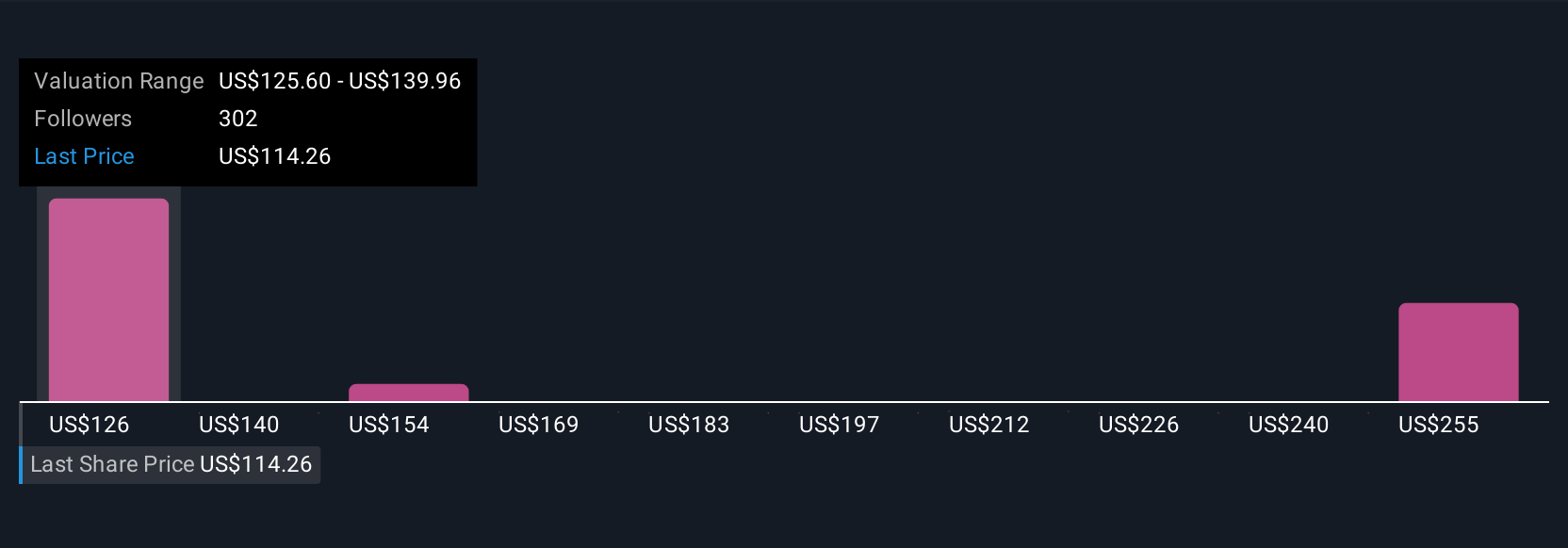

Nineteen individual fair value estimates from the Simply Wall St Community range from US$125.49 to US$268.83 per share. While many see significant growth potential from the company’s efforts to reinforce its ecosystem, differing opinions highlight just how important it is to weigh both execution and regulatory risks when considering PDD Holdings.

Explore 19 other fair value estimates on PDD Holdings - why the stock might be worth just $125.49!

Build Your Own PDD Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PDD Holdings research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free PDD Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PDD Holdings' overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PDD

PDD Holdings

A multinational commerce group that owns and operates a portfolio of businesses.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives