- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:PDD

Can PDD Holdings’ (PDD) Divergent Earnings Trends Reveal More About Its Competitive Positioning?

Reviewed by Sasha Jovanovic

- PDD Holdings Inc. recently reported its third quarter 2025 earnings, with sales reaching CNY 108.28 billion and net income at CNY 29.33 billion, both increases from the prior year’s quarter.

- While third quarter performance improved, the company’s nine-month net income and earnings per share were lower compared to the same period last year, highlighting contrasts within its operational results.

- To assess how robust quarterly financials affect PDD’s outlook, we’ll examine what the latest income jump means for its investment narrative.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

PDD Holdings Investment Narrative Recap

To invest in PDD Holdings, you need confidence in the company’s ability to turn large-scale ecosystem investments into long-term growth in e-commerce. The latest quarterly results show a rebound in sales and net income, but with nine-month net earnings still down year-on-year, the key short-term catalyst of margin recovery remains uncertain. Any sustained earnings pressure from heavy spending continues to be the biggest risk, and the recent results alone do not materially alter this risk-reward balance.

Among recent corporate developments, the appointment of Ernst & Young as the new auditor in July 2025 stands out. While not directly tied to Q3 financials, this move may signal a focus on strengthening regulatory and compliance standards, an important consideration for investors watching both margin catalysts and headline risks.

The flip side is that while quarterly profits have rebounded, the risk of persistent margin pressure due to ongoing heavy investment is still something investors need to be aware of...

Read the full narrative on PDD Holdings (it's free!)

PDD Holdings' outlook anticipates CN¥555.7 billion in revenue and CN¥147.1 billion in earnings by 2028. This scenario implies a 10.7% annual revenue growth rate and a CN¥49.2 billion earnings increase from current earnings of CN¥97.9 billion.

Uncover how PDD Holdings' forecasts yield a $145.77 fair value, a 29% upside to its current price.

Exploring Other Perspectives

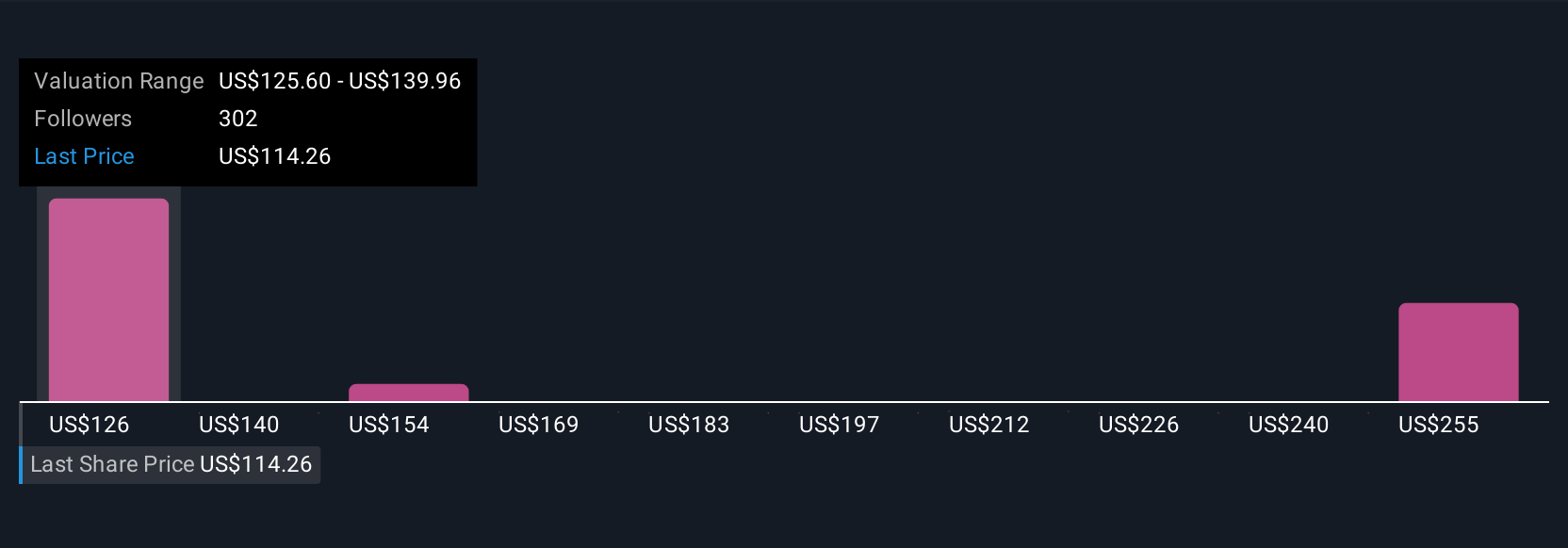

Nineteen individual estimates from the Simply Wall St Community value PDD Holdings shares between CNY 145.77 and CNY 341.79, showing wide variance in opinions. Despite this, margin pressure from ongoing ecosystem investments could keep the company’s profit trajectory in focus for all shareholders seeking growth.

Explore 19 other fair value estimates on PDD Holdings - why the stock might be worth over 3x more than the current price!

Build Your Own PDD Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PDD Holdings research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free PDD Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PDD Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PDD

PDD Holdings

A multinational commerce group that owns and operates a portfolio of businesses.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives