- United States

- /

- Specialty Stores

- /

- NasdaqGS:ORLY

O'Reilly Automotive (ORLY): Assessing Valuation After $2 Billion Boost to Share Buyback Program

Reviewed by Simply Wall St

O'Reilly Automotive (ORLY) just announced a $2 billion increase to its share buyback program, which now totals $29.75 billion and extends the plan for another three years. Management signals ongoing confidence in the company’s outlook.

See our latest analysis for O'Reilly Automotive.

O'Reilly Automotive has been making headlines with its sustained buyback activity and more recently by raising its outlook for full-year comparable sales. At $98.7 per share, its 24.65% share price return year-to-date highlights growing investor optimism. A 24.53% total shareholder return over the past year and impressive 233% five-year total return show that momentum is firmly intact, both in the short and long term.

If this kind of resilience sparks your interest, now is the perfect moment to broaden your perspective and discover See the full list for free.

But with shares already up nearly 25% this year and another profit guidance increase in the books, investors now face a critical question: Is O'Reilly Automotive undervalued, or is all that growth already factored into the price?

Most Popular Narrative: 10.3% Undervalued

With O'Reilly Automotive's fair value estimated at $110.00, the narrative points to the stock offering upside from its last close at $98.70. The stage is set for a price rerating as investors weigh future catalysts against current momentum.

O'Reilly's strategic emphasis on inventory and distribution capabilities, including a plan to increase average inventory per store by 5% in 2025, positions the company to maintain high availability and service levels. This approach is likely to support sustained or increased revenue growth. The company is maintaining its strategy of sourcing diversification by reducing reliance on Chinese products to mitigate tariff impacts. This effort can help stabilize gross margins by decreasing future cost pressures.

Is there a bold revenue climb or a profit margin leap hiding behind this projected value? The most widely followed narrative here hints at ambitious expansion and a profit formula not often seen in standard retail. Want to know which forecasts and financial pivots make this stock a standout? Uncover the surprising assumptions that anchor this compelling price target.

Result: Fair Value of $110.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing trade tensions and rising operational costs could dampen O'Reilly's current momentum. These factors may potentially nudge both margins and revenue off their projected path.

Find out about the key risks to this O'Reilly Automotive narrative.

Another View: What Do Valuation Multiples Say?

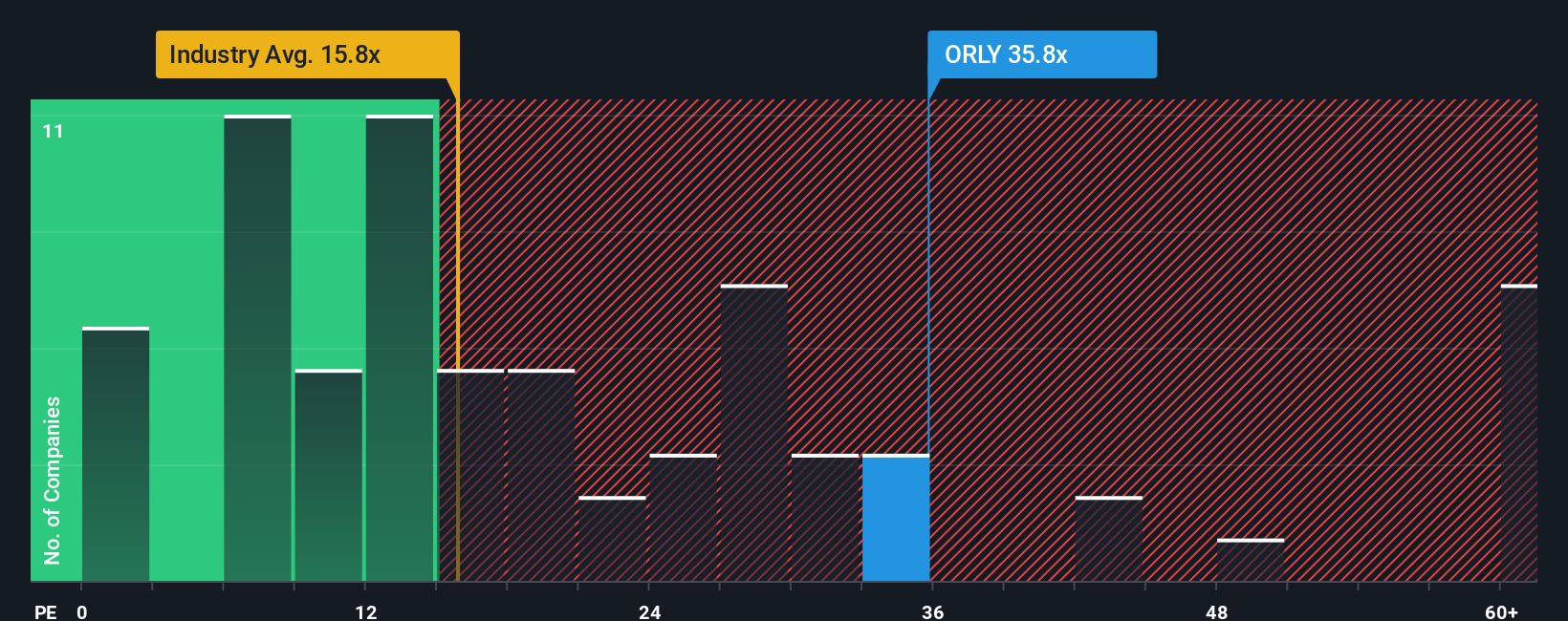

Taking a look through the lens of valuation ratios, O'Reilly Automotive stands out as expensive, trading at a price-to-earnings ratio of 33.5x. This is notably higher than both the average for its peer group (29.6x) and the US Specialty Retail industry (16.6x). The fair ratio is estimated to be just 19.1x. There is a significant gap that could mean valuation downside if the market sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own O'Reilly Automotive Narrative

If you have a different take on the numbers or want to back your own conclusions, dig into the details and craft your own perspective in just a few minutes. Do it your way

A great starting point for your O'Reilly Automotive research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always look beyond a single stock. Act now to unlock powerful opportunities across sectors using these handpicked ideas. There is real potential you will not want to miss out on.

- Tap into the unstoppable trend in artificial intelligence by checking out these 26 AI penny stocks, which are redefining how technology impacts our lives and portfolios.

- Secure steadily growing income with these 15 dividend stocks with yields > 3%, featuring reliable companies rewarding their shareholders with consistent high yields over 3%.

- Explore the forefront of digital finance and innovation by looking at these 81 cryptocurrency and blockchain stocks, highlighting dynamic businesses leveraging blockchain and cryptocurrency advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ORLY

O'Reilly Automotive

Operates as a retailer and supplier of automotive aftermarket parts, tools, supplies, equipment, and accessories in the United States, Puerto Rico, Mexico, and Canada.

Low risk with limited growth.

Similar Companies

Market Insights

Community Narratives