- United States

- /

- Specialty Stores

- /

- NasdaqGS:ODP

The ODP Corporation's (NASDAQ:ODP) Price Is Right But Growth Is Lacking

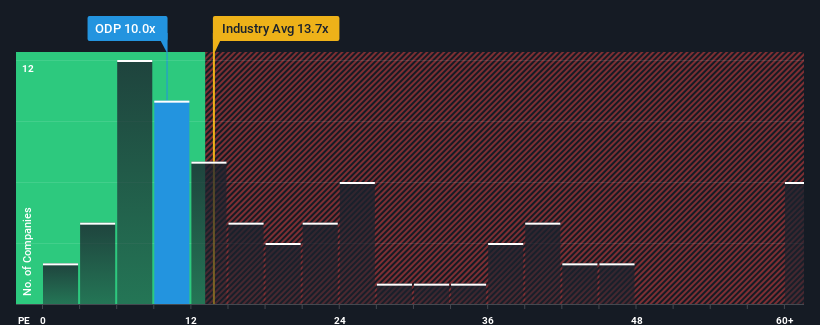

The ODP Corporation's (NASDAQ:ODP) price-to-earnings (or "P/E") ratio of 10x might make it look like a buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 17x and even P/E's above 33x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With its earnings growth in positive territory compared to the declining earnings of most other companies, ODP has been doing quite well of late. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for ODP

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like ODP's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 48% last year. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Turning to the outlook, the next year should generate growth of 5.5% as estimated by the five analysts watching the company. With the market predicted to deliver 10% growth , the company is positioned for a weaker earnings result.

In light of this, it's understandable that ODP's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of ODP's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for ODP with six simple checks on some of these key factors.

Of course, you might also be able to find a better stock than ODP. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ODP

ODP

Provides business products, services and supplies, and digital workplace technology solutions to small, medium, and enterprise-level businesses in the United States, Puerto Rico, the U.S.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026