- United States

- /

- Specialty Stores

- /

- NasdaqGS:ODP

ODP (ODP) Net Margin Falls to 0.7%: One-Off Loss Challenges Bull Case

Reviewed by Simply Wall St

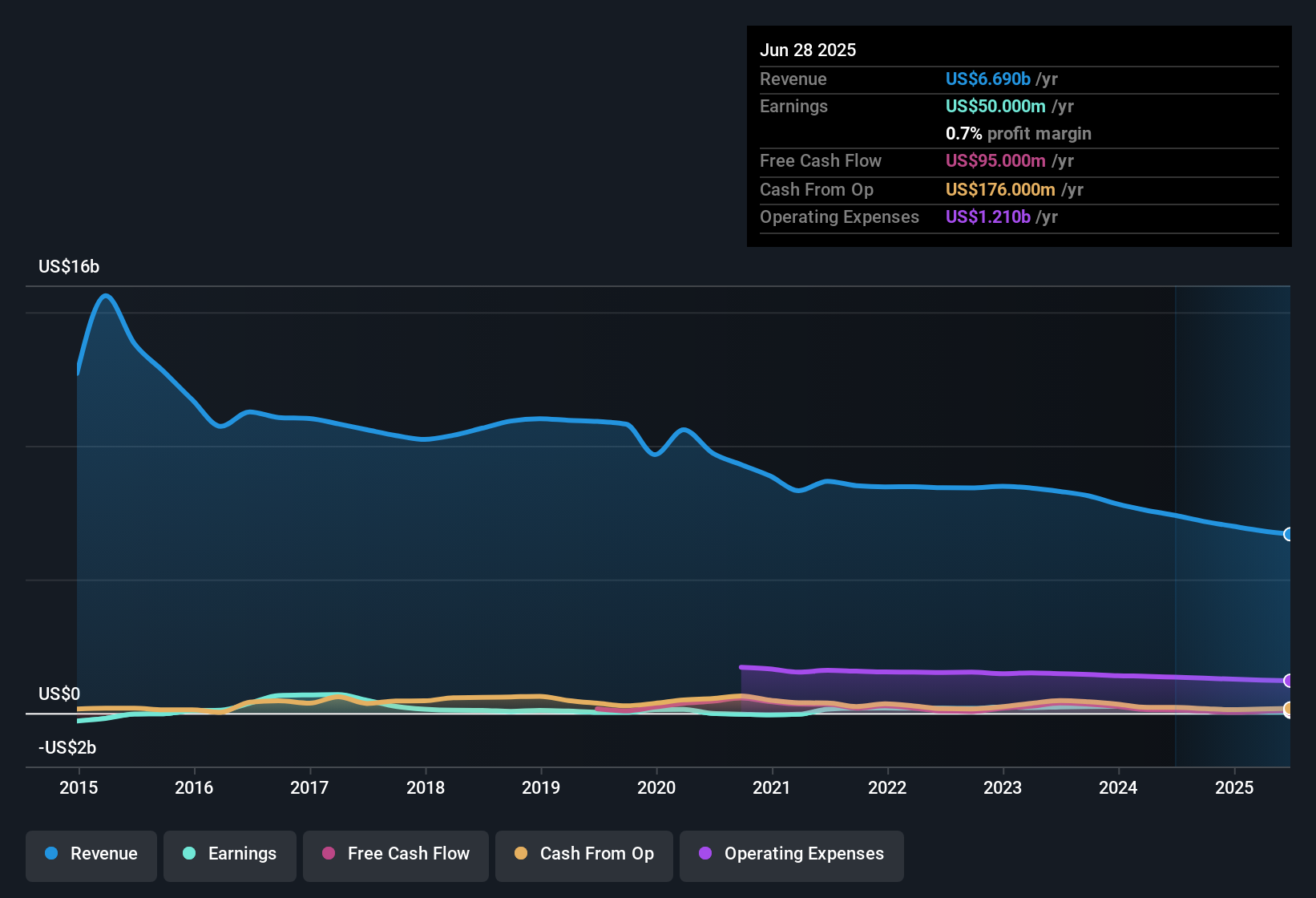

ODP (ODP) reported a net profit margin of 0.7%, down from 2% a year ago, as a one-off loss of $107.0 million weighed on performance over the last twelve months. While the company has averaged 12.3% annual earnings growth since turning profitable, upcoming years are expected to bring a 2.5% annual revenue decline. Investors now face a mixed picture, with ongoing margin pressure and the recent one-off loss on one side, but relative value compared to peers providing a potential bright spot.

See our full analysis for ODP.Now let’s see how these results compare to the dominant narratives circulating in the market. The next section will dig into whether the numbers confirm or challenge those stories.

See what the community is saying about ODP

Profit Margin Seen Rising to 2.5% by 2026

- Analysts predict ODP’s net profit margin will climb from 0.7% today to 2.5% in three years, offsetting recent margin compression and the $107.0 million one-off loss reported in the last twelve months.

- According to analysts’ consensus view, ODP’s shift to higher-margin B2B services and digital supply chain investments is expected to support this margin recovery.

- Consensus narrative notes the business mix is evolving, with recurring B2B revenue streams and digital infrastructure helping stabilize earnings even as traditional retail shrinks.

- However, ongoing cost challenges and the organizational impact of store closures could mean these margin gains take time to fully materialize.

Revenue Set for 2.9% Annual Decline

- ODP’s revenue is forecast to fall by 2.9% per year through 2026, building on the trend of an 8% drop year-over-year and reflecting structural decline in traditional office supplies and ongoing store closures.

- Analysts’ consensus view acknowledges that while ODP is winning new hospitality clients and launching adjacent business lines, these gains have yet to offset persistent pressure on core retail and B2B sales.

- Recent large contract wins and B2B expansion are still at an early stage, so their contribution may remain limited near term versus declines in legacy categories.

- Consensus highlights that continued rationalization of retail stores (down 60 year-on-year) and shift to digital channels are critical steps, but slow progress could drag longer-term growth.

DCF Fair Value Implies 73% Upside

- ODP trades at $27.89, which is well below its DCF fair value estimate of $48.27. This suggests a significant 73% potential upside if underlying earnings and margins rebound as forecast.

- Analysts’ consensus narrative highlights that with a current price-to-earnings ratio of 16.8x (slightly under peers’ 17.1x but above the specialty retail sector’s 16.4x), ODP’s valuation looks attractive only if margin and earnings growth materialize as modelled.

- The $31.67 consensus price target is already 13.6% above the current share price but still well below DCF fair value, reflecting lingering caution about the pace of transformation and execution risk.

- Consensus also warns that if revenue continues to decline and one-off losses reoccur, this upside may not be realized even with current value signals versus peers.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for ODP on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the numbers? Quickly craft your perspective and share your view on ODP in just a few minutes. Do it your way

A great starting point for your ODP research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

ODP faces persistent revenue declines, uncertain progress from new initiatives, and lingering risk that margin improvements may take time to materialize.

If you want companies with more reliable sales and profits, check out stable growth stocks screener (2074 results) to focus on those consistently delivering steady results year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ODP

ODP

Provides business products, services and supplies, and digital workplace technology solutions to small, medium, and enterprise-level businesses in the United States, Puerto Rico, the U.S.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion