- United States

- /

- Specialty Stores

- /

- NasdaqGS:ODP

Here's Why We Think ODP (NASDAQ:ODP) Might Deserve Your Attention Today

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like ODP (NASDAQ:ODP). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for ODP

ODP's Improving Profits

Over the last three years, ODP has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. As a result, we'll zoom in on growth over the last year, instead. ODP's EPS shot up from US$3.56 to US$5.52; a result that's bound to keep shareholders happy. That's a commendable gain of 55%. It also seems the company is in good financial health, since it has boosted EPS by buying back shares.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. It was a year of stability for ODP as both revenue and EBIT margins remained have been flat over the past year. That's not a major concern but nor does it point to the long term growth we like to see.

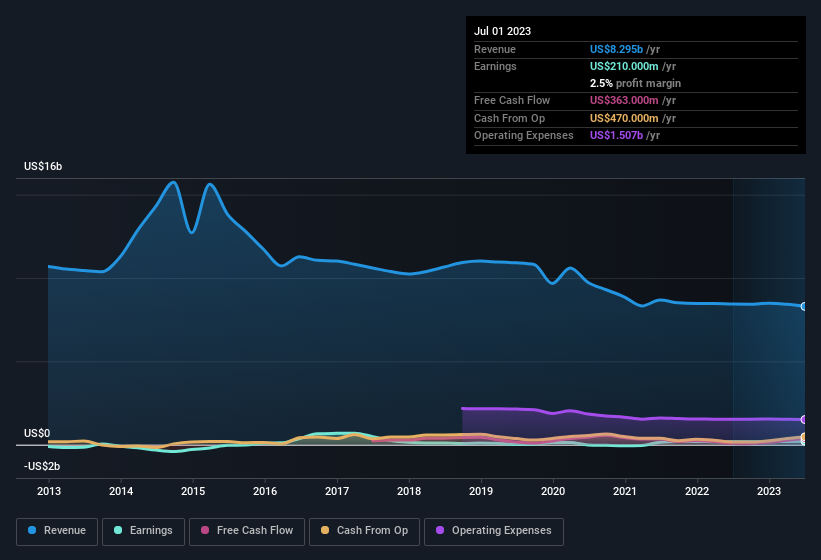

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for ODP's future profits.

Are ODP Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. Shareholders will be pleased by the fact that insiders own ODP shares worth a considerable sum. Indeed, they hold US$46m worth of its stock. That's a lot of money, and no small incentive to work hard. Despite being just 2.7% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Does ODP Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into ODP's strong EPS growth. Further, the high level of insider ownership is impressive and suggests that the management appreciates the EPS growth and has faith in ODP's continuing strength. The growth and insider confidence is looked upon well and so it's worthwhile to investigate further with a view to discern the stock's true value. You should always think about risks though. Case in point, we've spotted 2 warning signs for ODP you should be aware of, and 1 of them is potentially serious.

Although ODP certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ODP

ODP

Provides business products, services and supplies, and digital workplace technology solutions to small, medium, and enterprise-level businesses in the United States, Puerto Rico, the U.S.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives