- United States

- /

- General Merchandise and Department Stores

- /

- OTCPK:NOGN.Q

Nogin, Inc.'s (NASDAQ:NOGN) 57% Cheaper Price Remains In Tune With Revenues

Unfortunately for some shareholders, the Nogin, Inc. (NASDAQ:NOGN) share price has dived 57% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 99% loss during that time.

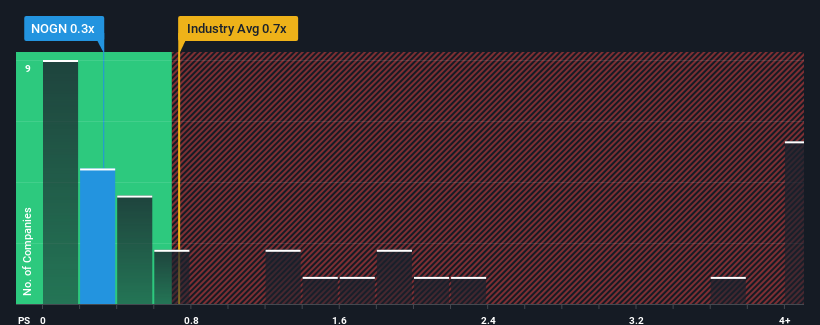

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Nogin's P/S ratio of 0.3x, since the median price-to-sales (or "P/S") ratio for the Multiline Retail industry in the United States is also close to 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Nogin

What Does Nogin's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Nogin's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. However, if this isn't the case, investors might get caught out paying to much for the stock.

Keen to find out how analysts think Nogin's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Nogin?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Nogin's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 6.8%. Even so, admirably revenue has lifted 131% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 12% per year as estimated by the lone analyst watching the company. With the industry predicted to deliver 12% growth per annum, the company is positioned for a comparable revenue result.

With this in mind, it makes sense that Nogin's P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From Nogin's P/S?

With its share price dropping off a cliff, the P/S for Nogin looks to be in line with the rest of the Multiline Retail industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've seen that Nogin maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

Having said that, be aware Nogin is showing 6 warning signs in our investment analysis, and 3 of those shouldn't be ignored.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Nogin might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:NOGN.Q

Nogin

Nogin, Inc. provides an e-commerce and technology platform in the apparel and ancillary industry’s multichannel retailing, business-to-consumer, and business-to-business domains.

Slightly overvalued with weak fundamentals.

Market Insights

Community Narratives