- United States

- /

- General Merchandise and Department Stores

- /

- OTCPK:NOGN.Q

Analysts Have Lowered Expectations For Nogin, Inc. (NASDAQ:NOGN) After Its Latest Results

Last week, you might have seen that Nogin, Inc. (NASDAQ:NOGN) released its quarterly result to the market. The early response was not positive, with shares down 9.1% to US$0.70 in the past week. Revenues were in line with expectations, at US$13m, while statutory losses ballooned to US$1.13 per share. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

View our latest analysis for Nogin

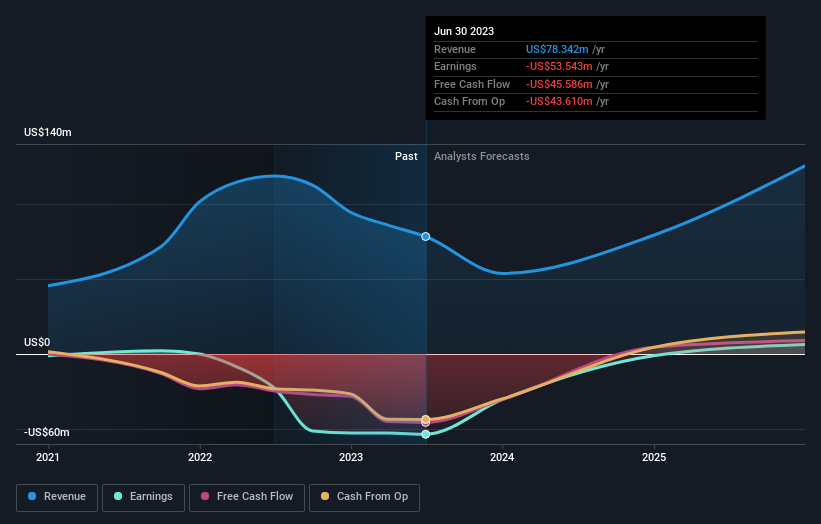

Taking into account the latest results, the three analysts covering Nogin provided consensus estimates of US$53.7m revenue in 2023, which would reflect a concerning 31% decline over the past 12 months. Losses are predicted to fall substantially, shrinking 25% to US$3.64. Before this latest report, the consensus had been expecting revenues of US$70.1m and US$3.20 per share in losses. So there's been quite a change-up of views after the recent consensus updates, withthe analysts making a serious cut to their revenue outlook while also expecting losses per share to increase.

The average price target fell 55% to US$2.50, implicitly signalling that lower earnings per share are a leading indicator for Nogin's valuation. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. The most optimistic Nogin analyst has a price target of US$3.50 per share, while the most pessimistic values it at US$1.00. This is a fairly broad spread of estimates, suggesting that analysts are forecasting a wide range of possible outcomes for the business.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Nogin's past performance and to peers in the same industry. Over the past year, revenues have declined around 34% annually. Worse, forecasts are essentially predicting the decline to accelerate, with the estimate for an annualised 53% decline in revenue until the end of 2023. Compare this against analyst estimates for companies in the broader industry, which suggest that revenues (in aggregate) are expected to grow 11% annually. So it's pretty clear that, while it does have declining revenues, the analysts also expect Nogin to suffer worse than the wider industry.

The Bottom Line

The most important thing to take away is that the analysts increased their loss per share estimates for next year. On the negative side, they also downgraded their revenue estimates, and forecasts imply they will perform worse than the wider industry. Furthermore, the analysts also cut their price targets, suggesting that the latest news has led to greater pessimism about the intrinsic value of the business.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. At Simply Wall St, we have a full range of analyst estimates for Nogin going out to 2025, and you can see them free on our platform here..

Don't forget that there may still be risks. For instance, we've identified 5 warning signs for Nogin (3 make us uncomfortable) you should be aware of.

Valuation is complex, but we're here to simplify it.

Discover if Nogin might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:NOGN.Q

Nogin

Nogin, Inc. provides an e-commerce and technology platform in the apparel and ancillary industry’s multichannel retailing, business-to-consumer, and business-to-business domains.

Slightly overvalued with weak fundamentals.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.