- United States

- /

- Specialty Stores

- /

- NasdaqCM:NEGG

Newegg (NEGG) Valuation Check After Founder Fred Chang Rejoins Board as Primary Minority Appointee

Reviewed by Simply Wall St

Newegg Commerce (NEGG) just saw founder Fred Chang put himself back on the board and into the Primary Minority Board Appointee role, a governance shakeup that could subtly reshape strategy.

See our latest analysis for Newegg Commerce.

The timing of Chang’s return is interesting, with Newegg’s 1 day share price return down 5.1 percent but its 90 day share price return still up about 110 percent, and the 1 year total shareholder return above 480 percent. This suggests that momentum has cooled while the broader rerating story remains intact.

If this kind of leadership shift has you rethinking where growth might show up next, it could be worth scanning high growth tech and AI stocks for other tech names reshaping their industries.

With shares up more than 480 percent over the past year, but recent momentum cooling and profits still in the red, the key question now is whether Newegg is a genuine mispriced turnaround or if markets already see the next leg of growth.

Price to Sales of 1.2x: Is it justified?

On a price to sales basis, Newegg trades at roughly 1.2 times revenue, which screens as expensive against the broader US Specialty Retail space.

The price to sales multiple compares a company’s market value to the revenue it generates, a useful yardstick for loss making or low margin retailers where earnings are not yet a reliable guide. For an electronics focused e commerce business like Newegg, this ratio effectively shows how much investors are willing to pay today for each dollar of current sales.

Simply Wall St’s data indicates that Newegg sits at 1.2 times sales, in line with its peer group average multiple but notably above the 0.5 times sales typical across the US Specialty Retail industry. That suggests the market is assigning Newegg a premium relative to the wider sector, despite its ongoing losses, likely baking in expectations that management can stabilise earnings and eventually convert its meaningful revenue base into sustainable profits.

Compared to the industry, the gap is clear. Newegg’s 1.2 times price to sales ratio is more than double the 0.5 times industry average, which implies that investors are pricing in a stronger trajectory than for many specialty retail peers.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to Sales of 1.2x (OVERVALUED)

However, Newegg’s lack of sustained profitability, along with the absence of analyst coverage or clear growth forecasts, could quickly undermine confidence in the rerating story.

Find out about the key risks to this Newegg Commerce narrative.

Another Angle on Value

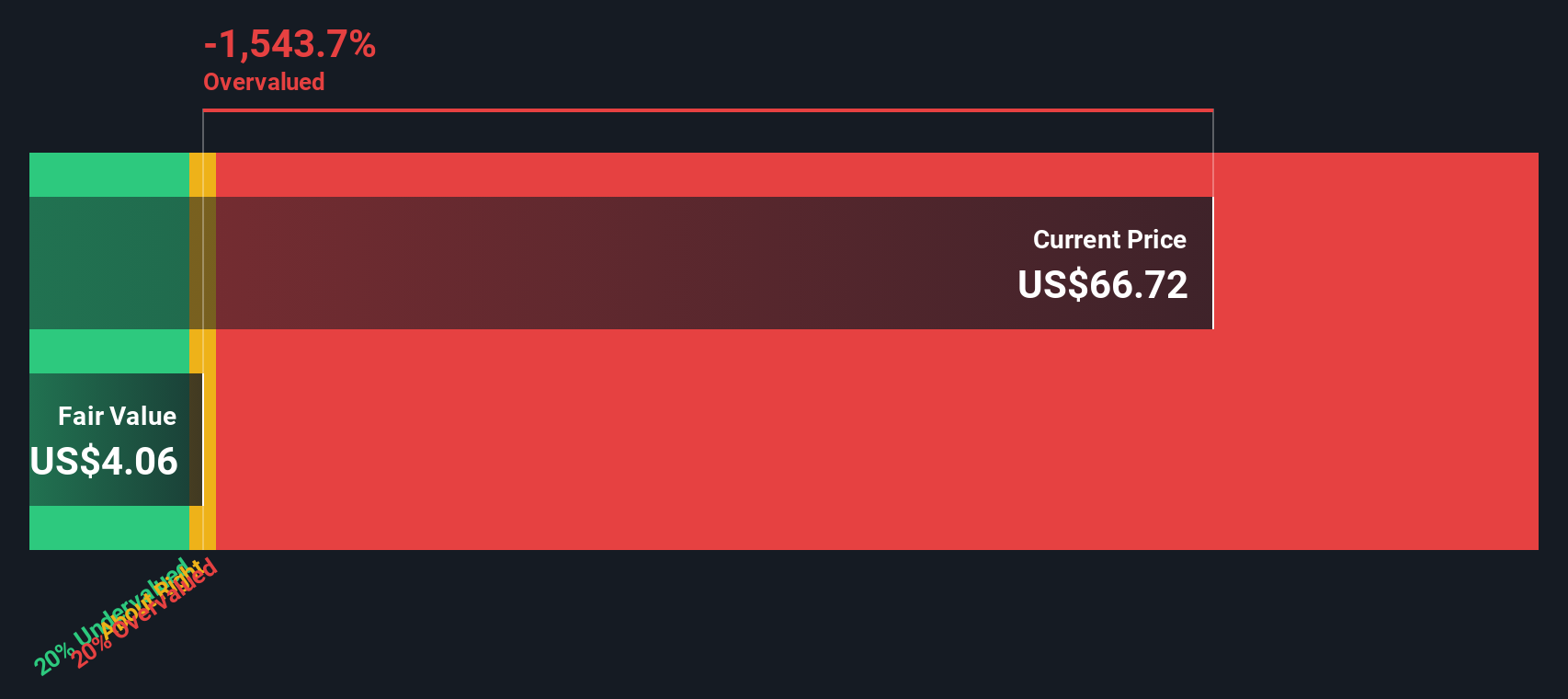

Our DCF model tells a very different story, putting Newegg’s fair value closer to $4.08 per share versus the current $74.06, which looks heavily overvalued on cash flow assumptions. If both methods are right in their own way, which signal should investors trust more?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Newegg Commerce for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 902 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Newegg Commerce Narrative

If you see the numbers differently or want to stress test your own thesis, you can build a fresh narrative in minutes using Do it your way.

A great starting point for your Newegg Commerce research is our analysis highlighting 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, explore targeted stock ideas on Simply Wall Street’s Screener so you can review potential opportunities in advance rather than reacting later.

- Capture high potential opportunities early by reviewing these 3578 penny stocks with strong financials that pair low share prices with balance sheet strength and improving business momentum.

- Position your portfolio for the next technology wave by evaluating these 26 AI penny stocks powering developments in automation, analytics, and intelligent software.

- Strengthen your income and stability profile by focusing on these 15 dividend stocks with yields > 3% that offer attractive yields supported by robust underlying businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Newegg Commerce might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NEGG

Newegg Commerce

Operates as an electronics-focused e-retailer in the United States, Canada, and internationally.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)