- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:MELI

MercadoLibre (NasdaqGS:MELI): Assessing Valuation as Growth Investments and Flexible Capital Moves Shape 2025 Outlook

Reviewed by Simply Wall St

MercadoLibre (MELI) has filed a mixed shelf registration, which gives the company the option to raise capital through a variety of securities. This move adds flexibility for financing future growth plans as well as ongoing strategic investments.

See our latest analysis for MercadoLibre.

MercadoLibre’s share price has held up well in 2025, gaining 16.7% year-to-date as investors react to a steady drumbeat of news, including quarterly results that topped revenue forecasts but revealed some margin compression tied to ongoing investments and new logistics initiatives. While momentum has cooled in recent months, its three-year total shareholder return still stands out at 113.9%. This underlines strong long-term value creation driven by strategic expansion and continued reinvestment.

If MercadoLibre’s strategy has you thinking bigger, now’s a great time to broaden your universe and discover fast growing stocks with high insider ownership

With analysts lowering their price targets but maintaining bullish ratings, and with the stock still trading at a notable discount to targets, the real question is whether MercadoLibre is undervalued or if the market already reflects its future potential.

Most Popular Narrative: 28.1% Undervalued

With MercadoLibre’s fair value estimate at $2,861.96, the stock closed last at $2,058.81, highlighting a large gap investors are eyeing. The most widely followed narrative brings focus to the significant upside, relying on core business strengths and expansion plays to back its case.

Heavy spend on customer acquisition and high-profile marketing campaigns is delivering strong user growth and engagement. Together with ongoing AI-driven efficiency in both marketing and advertising, this approach will likely enhance operating leverage and support long-term earnings growth once initial margin pressure normalizes.

Curious what drives this bullish fair value? The valuation hinges on relentless customer acquisition, a bold digital push, and margin recovery bets backed by ambitious growth assumptions. You'll want to see which projections power this outlook, especially if you want to catch the next wave of MercadoLibre's story before the market does.

Result: Fair Value of $2,861.96 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain: rising competition in Brazil and growing credit exposure could both challenge the narrative if market share or loan quality waver.

Find out about the key risks to this MercadoLibre narrative.

Another View: Is the Market Multiple Telling a Different Story?

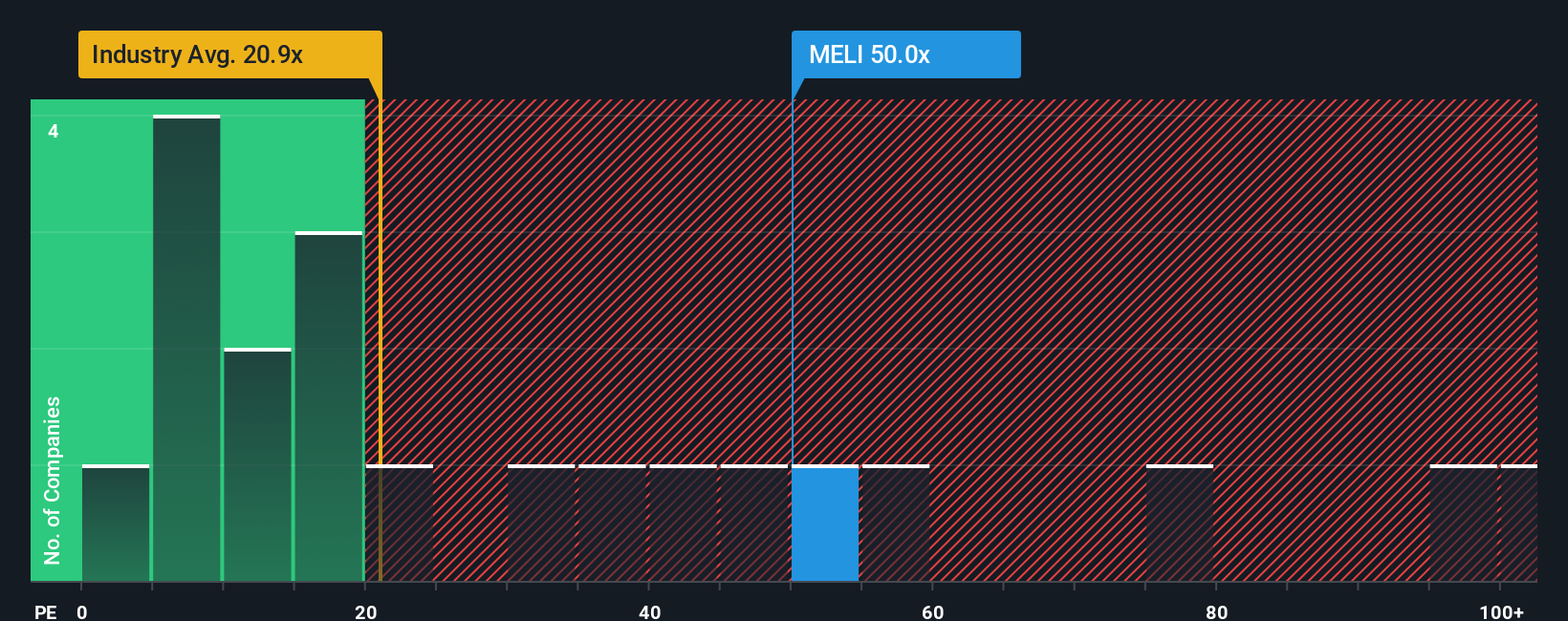

Looking beyond fair value estimates, MercadoLibre’s price-to-earnings ratio stands at 50.3x, which is notably higher than both the global industry average of 19.2x and its fair ratio of 31.5x. This premium suggests investors are paying a steep price for growth. Will the business deliver enough upside to make it worthwhile?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MercadoLibre Narrative

If you see things differently or want to dig deeper into MercadoLibre’s numbers, you can craft your own view and share it in just a few minutes. Do it your way

A great starting point for your MercadoLibre research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors stay ahead by keeping their options open. Don’t let opportunity pass you by. Go beyond MercadoLibre and spot the next winners with these handpicked ideas:

- Start building your portfolio’s passive income by targeting steady payers with these 18 dividend stocks with yields > 3% offering yields above 3%.

- Ride the AI innovation wave and see which companies could transform entire industries with these 27 AI penny stocks.

- Tap into unique value opportunities with these 901 undervalued stocks based on cash flows that the market may have overlooked based on their cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MELI

MercadoLibre

Operates online commerce platforms in Brazil, Mexico, Argentina, and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives