- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:MELI

Is MercadoLibre's Share Price Justified After 30% Rally and Expansion News?

Reviewed by Bailey Pemberton

- Ever wondered if MercadoLibre is really worth its hefty share price, or if now is actually a smart time to buy in? You're not alone. We are about to dig deep into the numbers to find out.

- After an impressive 30.6% gain year-to-date and a steady 10.3% return over the past 12 months, MercadoLibre's stock has definitely caught the market's attention again.

- Recent headlines have celebrated the company's expansion across Latin America, with new partnerships and fintech offerings rolling out in key markets. This momentum has helped fuel optimism, but it has also raised fresh questions about risk and sustainability for current and future investors.

- When it comes to valuation, MercadoLibre scores a 4 out of 6 on our check for undervalued companies. This is solid but far from perfect, so let's walk through the standard approaches and why there might be an even smarter way to judge value by the time we reach the end.

Find out why MercadoLibre's 10.3% return over the last year is lagging behind its peers.

Approach 1: MercadoLibre Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and then discounting those values back to today's dollars. This helps investors understand what a business might truly be worth based on its ability to generate cash in the years ahead.

For MercadoLibre, the latest reported Free Cash Flow is $8.8 billion. Over the next decade, analysts forecast continued robust growth. Further projections suggest Free Cash Flow could reach roughly $15.5 billion by 2035. It is important to note that while analysts provide up to five years of direct estimates, longer-term projections are extrapolated using methodologies like those used by Simply Wall St.

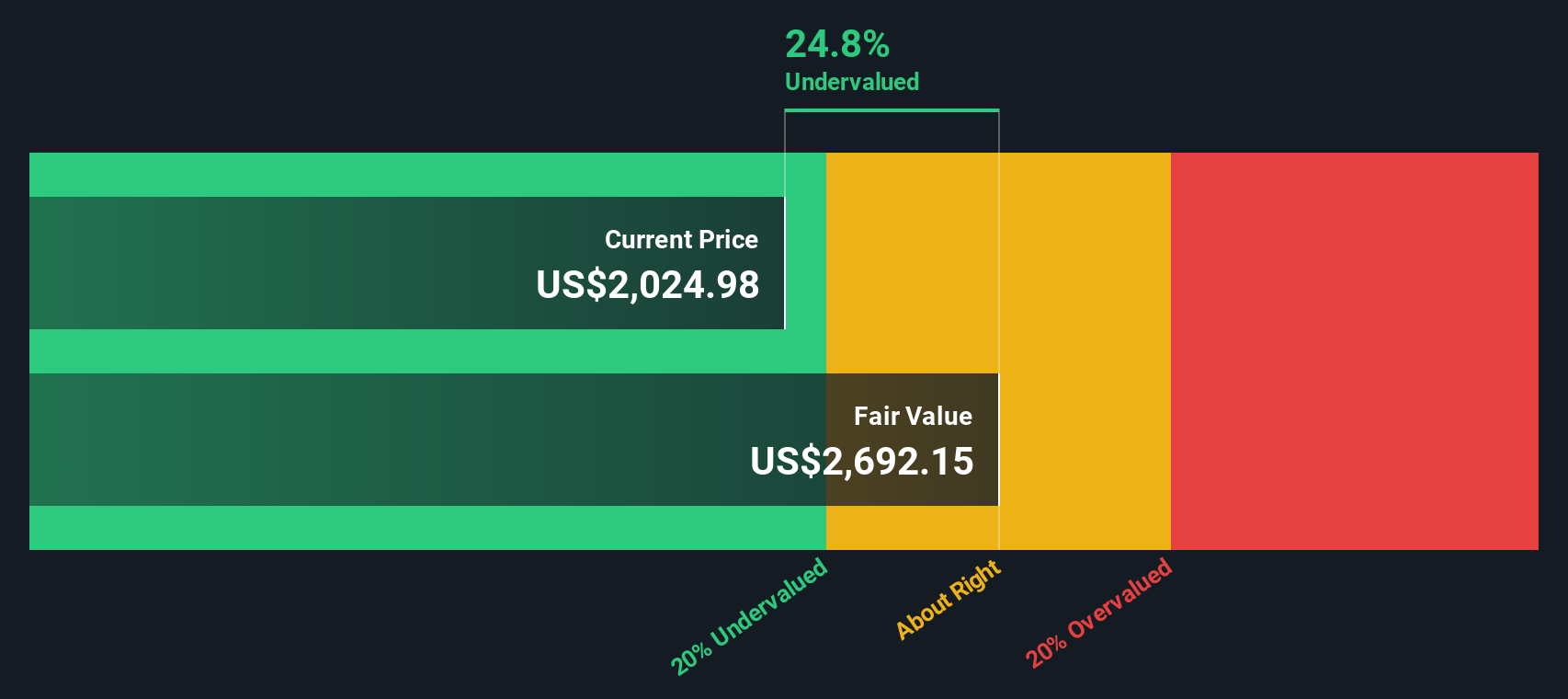

According to this DCF analysis, the intrinsic value estimate for MercadoLibre is $2,910 per share. Since this valuation implies the stock is currently trading at about a 20.8% discount to its estimated worth, MercadoLibre appears undervalued by a significant margin today.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests MercadoLibre is undervalued by 20.8%. Track this in your watchlist or portfolio, or discover 839 more undervalued stocks based on cash flows.

Approach 2: MercadoLibre Price vs Earnings (PE)

For profitable companies like MercadoLibre, the Price-to-Earnings (PE) ratio is a widely used metric because it directly connects a company's share price to its reported profits. This makes it a helpful tool for assessing whether a stock’s valuation aligns with the actual earnings it generates for shareholders.

The PE ratio does not exist in a vacuum, though. Generally, higher PE ratios are warranted for companies delivering strong earnings growth or operating in sectors with lower risk. Conversely, slower growth or added uncertainties typically justify lower PE multiples. It is all about calibrating expectations for future performance and risk.

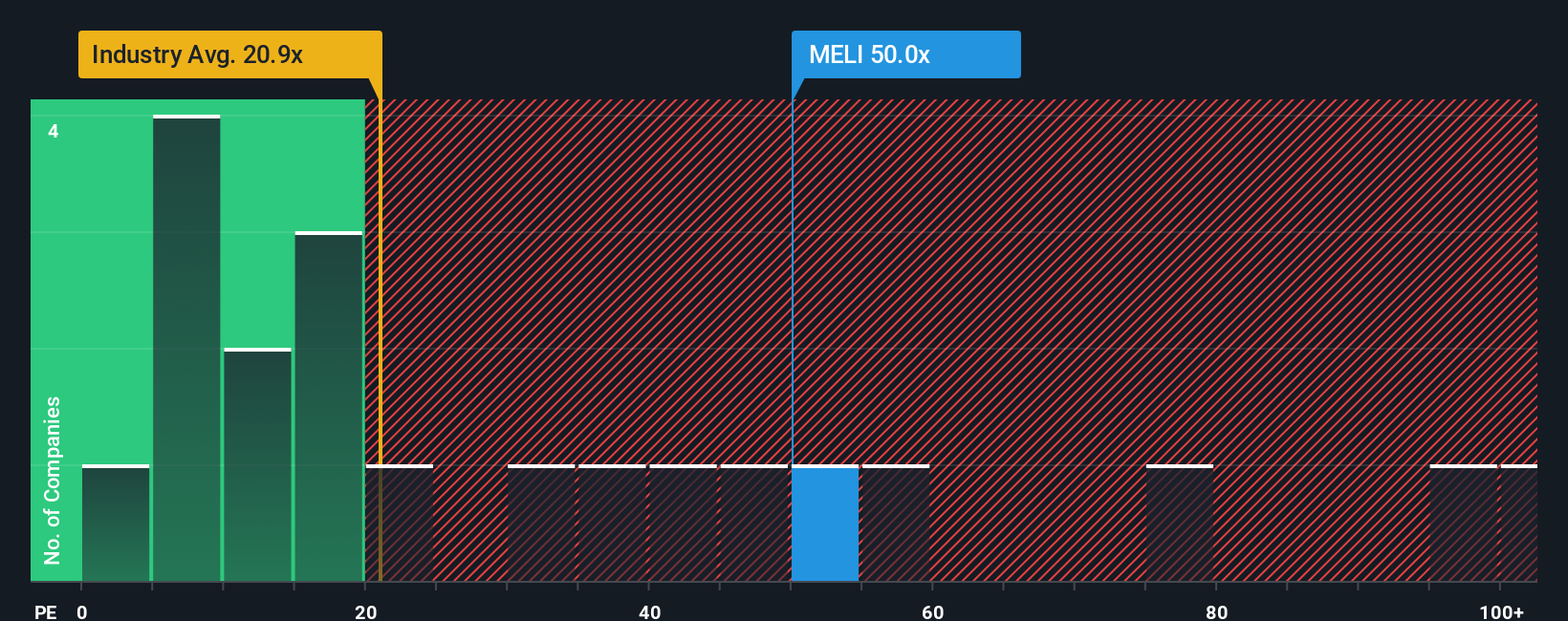

MercadoLibre currently trades at a PE ratio of 56.3x. That is much higher than the Multiline Retail industry average of 19.5x and above its peer group’s average of 65.0x. However, these simple benchmarks may not capture the full picture given MercadoLibre's unique growth prospects and profitability profile in Latin America.

This is where Simply Wall St’s Fair Ratio comes in. The Fair Ratio, here calculated as 32.7x, estimates what a sensible PE multiple for MercadoLibre should be, factoring in aspects like earnings growth, risk, industry trends, margins, and market cap. Unlike the usual apples-to-apples comparisons with peers or broader industry, the Fair Ratio is custom-tailored to the company's real fundamentals and outlook.

By comparing MercadoLibre’s current PE (56.3x) to its Fair Ratio (32.7x), we see the stock is trading above what would be considered reasonable for its current profile. This suggests that MercadoLibre may be slightly overvalued at the moment based on its earnings power and outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your MercadoLibre Narrative

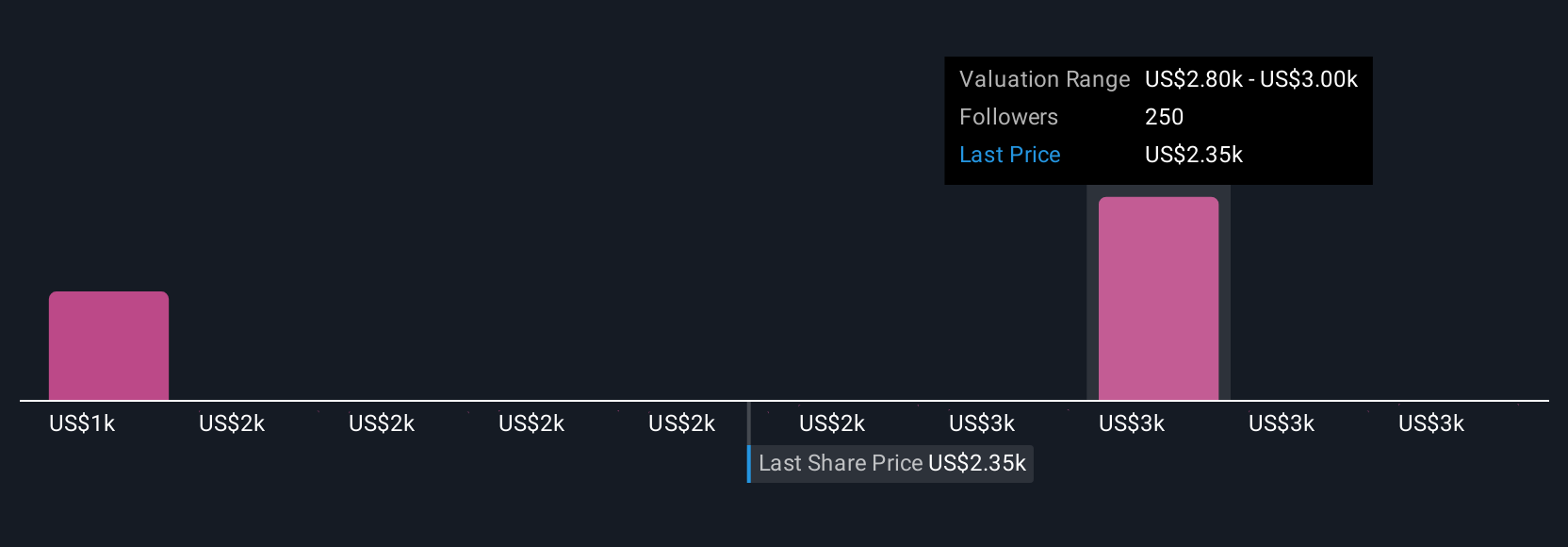

Earlier we mentioned there is an even better way to make sense of a stock’s valuation, so let’s introduce you to Narratives. In simple terms, a Narrative is your unique perspective or story about a company, shaped by your own beliefs about its future growth, profitability, and risks. Rather than just crunching numbers, you combine your view—why MercadoLibre might keep winning, or what risks truly matter—with forecasts for future revenue, margins, and fair value, turning those inputs into a clear investment roadmap.

Narratives make investing more personal and dynamic, connecting the story you believe in to a custom financial model that estimates today’s fair value. On Simply Wall St’s Community page, millions of investors can easily create, read, and update these Narratives so you are always seeing the latest views as news or earnings are released. Narratives make it easy to check if the current price offers a “margin of safety” or flags a potential risk, helping you decide when to buy or sell based on your view of fair value versus the market price.

For example, the most bullish Narrative for MercadoLibre expects profits to surge, justifying a price target as high as $3,500, while the most cautious expects much slower growth and sets a target around $2,170, demonstrating how different stories, even with the same facts, can lead to very different conclusions.

Do you think there's more to the story for MercadoLibre? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MELI

MercadoLibre

Operates online commerce platforms in Brazil, Mexico, Argentina, and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives