- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:MELI

Is Margin Compression From Heavy Spending Shifting MercadoLibre's Long-Term Outlook (MELI)?

Reviewed by Simply Wall St

- MercadoLibre reported its second quarter 2025 results this past week, delivering US$6.79 billion in revenue, a 33.9% jump from a year prior, while net income edged down slightly to US$523 million.

- Despite surpassing revenue expectations, heavy investments in free shipping and marketing led to margin compression and earnings per share missing analyst estimates.

- We'll explore how MercadoLibre's margin pressures from increased spending may influence its long-term investment narrative and profitability outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

MercadoLibre Investment Narrative Recap

To own MercadoLibre stock, I believe you need to see the long-term opportunity in its dual e-commerce and fintech ecosystems delivering lasting user growth and monetization across Latin America. The latest Q2 2025 results, marked by robust 33.9% revenue growth but squeezed margins from higher shipping and marketing costs, put near-term profitability in question but do not fundamentally change the key catalyst: ongoing expansion of active users and payment volumes. Short-term, the biggest risk remains how aggressive spending to win market share could continue to challenge earnings if scale benefits take longer to materialize. One recent announcement with direct relevance is MercadoLibre’s plan to boost investment in Brazil by 48% this year, focusing on logistics, technology, and marketing. This significant commitment underpins the company’s drive for user acquisition and engagement, which remains at the heart of MercadoLibre’s growth strategy, even as it pushes net margins lower in the quarters ahead. By contrast, investors should also be aware that sustained increases in sales and marketing spending can expose the business to...

Read the full narrative on MercadoLibre (it's free!)

MercadoLibre's narrative projects $45.5 billion revenue and $5.3 billion earnings by 2028. This requires 23.6% yearly revenue growth and a $3.2 billion increase in earnings from $2.1 billion today.

Uncover how MercadoLibre's forecasts yield a $2848 fair value, a 22% upside to its current price.

Exploring Other Perspectives

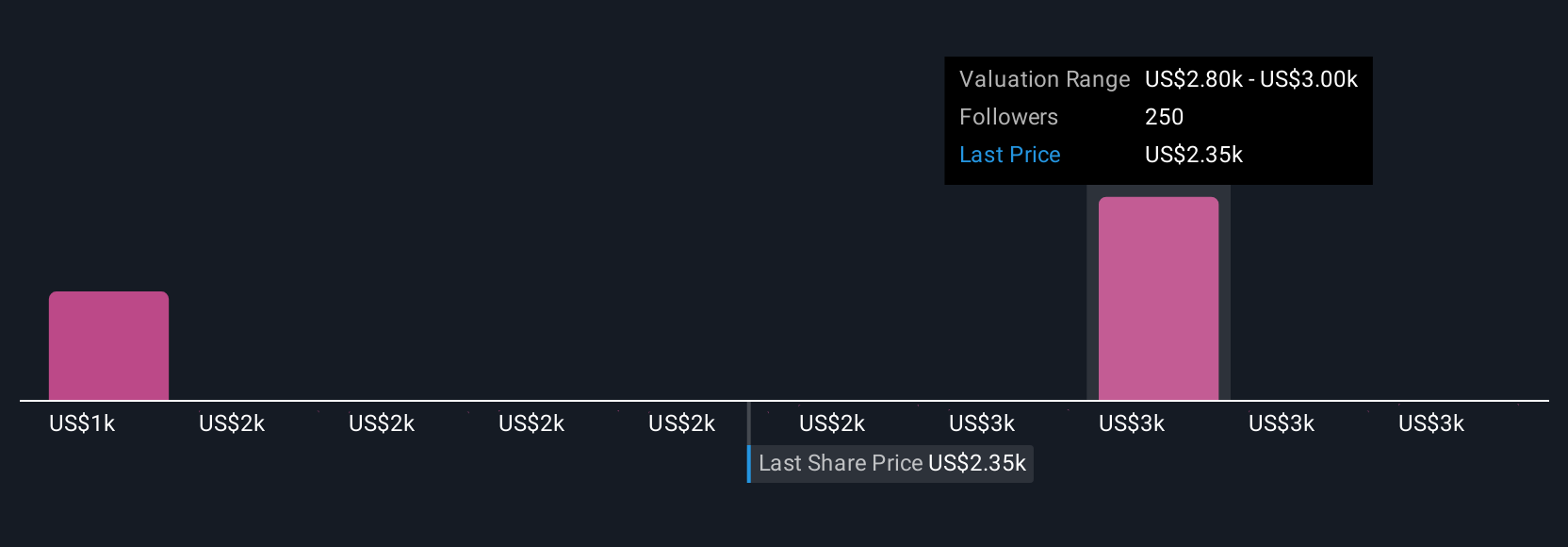

According to 29 fair value estimates from the Simply Wall St Community, valuations for MercadoLibre range from US$1,399 to US$3,406 per share. While many are focused on margin pressure from mounting logistics and marketing spend, opinions across the Community show just how much expectations around profitability can shape forecasts for the company's future.

Explore 29 other fair value estimates on MercadoLibre - why the stock might be worth 40% less than the current price!

Build Your Own MercadoLibre Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MercadoLibre research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MercadoLibre research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MercadoLibre's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MELI

MercadoLibre

Operates online commerce platforms in Brazil, Mexico, Argentina, and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives