- United States

- /

- Specialty Stores

- /

- OTCPK:LMPX

Loss-making LMP Automotive Holdings (NASDAQ:LMPX) sheds a further US$20m, taking total shareholder losses to 33% over 1 year

It's easy to match the overall market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Investors in LMP Automotive Holdings, Inc. (NASDAQ:LMPX) have tasted that bitter downside in the last year, as the share price dropped 33%. That falls noticeably short of the market return of around 37%. Because LMP Automotive Holdings hasn't been listed for many years, the market is still learning about how the business performs. Unfortunately the share price momentum is still quite negative, with prices down 17% in thirty days.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

See our latest analysis for LMP Automotive Holdings

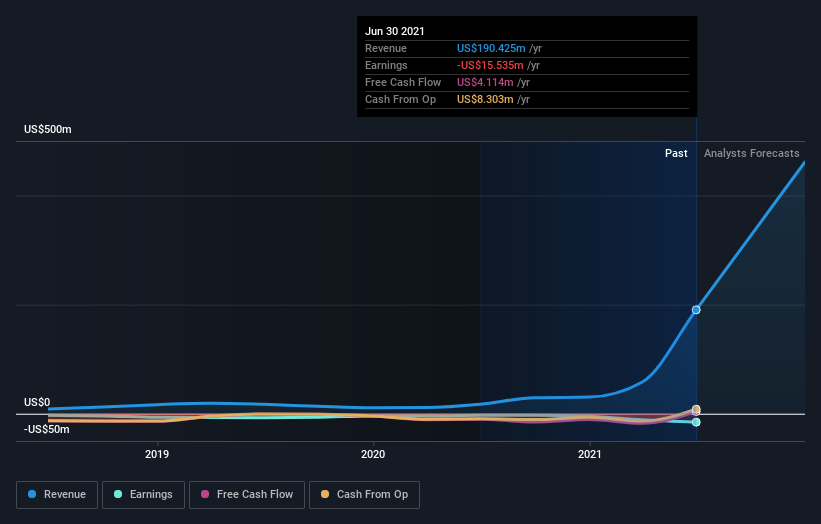

Because LMP Automotive Holdings made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year LMP Automotive Holdings saw its revenue grow by 1,002%. That's well above most other pre-profit companies. Given the revenue growth, the share price drop of 33% seems quite harsh. Our sympathies to shareholders who are now underwater. On the bright side, if this company is moving profits in the right direction, top-line growth like that could be an opportunity. Our monkey brains haven't evolved to think exponentially, so humans do tend to underestimate companies that have exponential growth.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. So it makes a lot of sense to check out what analysts think LMP Automotive Holdings will earn in the future (free profit forecasts).

A Different Perspective

Given that the market gained 37% in the last year, LMP Automotive Holdings shareholders might be miffed that they lost 33%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. The share price decline has continued throughout the most recent three months, down 7.0%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. It's always interesting to track share price performance over the longer term. But to understand LMP Automotive Holdings better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for LMP Automotive Holdings (of which 1 can't be ignored!) you should know about.

LMP Automotive Holdings is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading LMP Automotive Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OTCPK:LMPX

LMP Automotive Holdings

Through its subsidiaries, buys, sells, rents and subscribes for, and obtains financing for automobiles online and in person in the United States.

Low risk with weak fundamentals.

Market Insights

Community Narratives