- United States

- /

- Specialty Stores

- /

- NasdaqGS:LESL

There's Reason For Concern Over Leslie's, Inc.'s (NASDAQ:LESL) Massive 34% Price Jump

Leslie's, Inc. (NASDAQ:LESL) shareholders are no doubt pleased to see that the share price has bounced 34% in the last month, although it is still struggling to make up recently lost ground. But the last month did very little to improve the 85% share price decline over the last year.

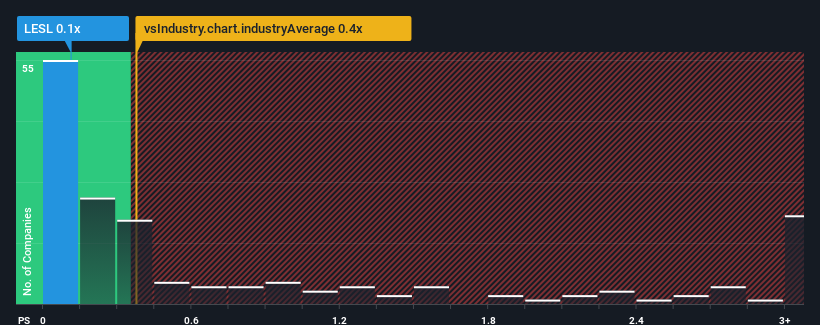

Even after such a large jump in price, there still wouldn't be many who think Leslie's' price-to-sales (or "P/S") ratio of 0.1x is worth a mention when the median P/S in the United States' Specialty Retail industry is similar at about 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Our free stock report includes 3 warning signs investors should be aware of before investing in Leslie's. Read for free now.Check out our latest analysis for Leslie's

How Leslie's Has Been Performing

Leslie's hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Leslie's.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Leslie's' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 6.1%. This means it has also seen a slide in revenue over the longer-term as revenue is down 6.9% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 1.9% as estimated by the eleven analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 5.3%, which is noticeably more attractive.

With this information, we find it interesting that Leslie's is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Leslie's' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

When you consider that Leslie's' revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

You should always think about risks. Case in point, we've spotted 3 warning signs for Leslie's you should be aware of, and 2 of them are potentially serious.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LESL

Leslie's

Operates as a direct-to-consumer pool and spa care brand in the United States.

Undervalued slight.

Similar Companies

Market Insights

Community Narratives