- United States

- /

- Specialty Stores

- /

- NasdaqCM:KXIN

Slammed 75% Kaixin Holdings (NASDAQ:KXIN) Screens Well Here But There Might Be A Catch

Kaixin Holdings (NASDAQ:KXIN) shareholders won't be pleased to see that the share price has had a very rough month, dropping 75% and undoing the prior period's positive performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 98% loss during that time.

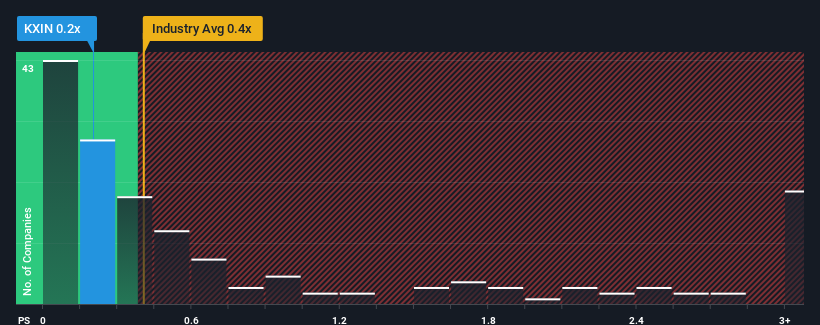

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Kaixin Holdings' P/S ratio of 0.2x, since the median price-to-sales (or "P/S") ratio for the Specialty Retail industry in the United States is also close to 0.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Kaixin Holdings

What Does Kaixin Holdings' P/S Mean For Shareholders?

For instance, Kaixin Holdings' receding revenue in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Kaixin Holdings will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For Kaixin Holdings?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Kaixin Holdings' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 81% decrease to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, despite the drawbacks experienced in the last 12 months. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

This is in contrast to the rest of the industry, which is expected to grow by 4.3% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's curious that Kaixin Holdings' P/S sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On Kaixin Holdings' P/S

With its share price dropping off a cliff, the P/S for Kaixin Holdings looks to be in line with the rest of the Specialty Retail industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

To our surprise, Kaixin Holdings revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Kaixin Holdings you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Kaixin Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:KXIN

Kaixin Holdings

An investment holding company, primarily sells domestic and imported automobiles in the People’s Republic of China and Hong Kong.

Slight and slightly overvalued.

Market Insights

Community Narratives