- United States

- /

- Retail Distributors

- /

- NasdaqCM:KAVL

Kaival Brands Innovations Group, Inc. (NASDAQ:KAVL) Stocks Pounded By 29% But Not Lagging Industry On Growth Or Pricing

The Kaival Brands Innovations Group, Inc. (NASDAQ:KAVL) share price has fared very poorly over the last month, falling by a substantial 29%. For any long-term shareholders, the last month ends a year to forget by locking in a 55% share price decline.

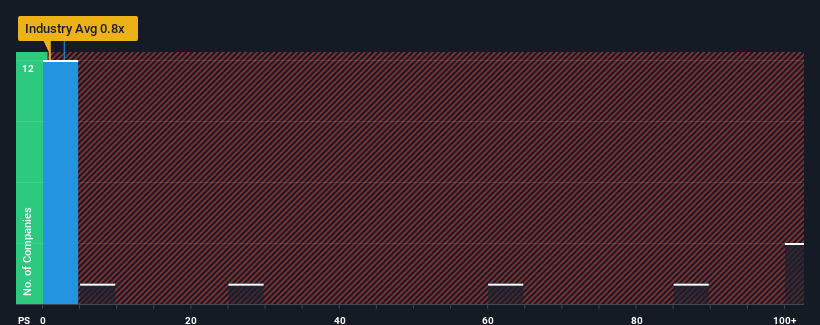

In spite of the heavy fall in price, when almost half of the companies in the United States' Retail Distributors industry have price-to-sales ratios (or "P/S") below 0.9x, you may still consider Kaival Brands Innovations Group as a stock probably not worth researching with its 2.8x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Kaival Brands Innovations Group

What Does Kaival Brands Innovations Group's Recent Performance Look Like?

Kaival Brands Innovations Group could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Kaival Brands Innovations Group.Is There Enough Revenue Growth Forecasted For Kaival Brands Innovations Group?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Kaival Brands Innovations Group's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 49% decrease to the company's top line. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 383% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 2.9%, which is noticeably less attractive.

In light of this, it's understandable that Kaival Brands Innovations Group's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Kaival Brands Innovations Group's P/S Mean For Investors?

Kaival Brands Innovations Group's P/S remain high even after its stock plunged. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Kaival Brands Innovations Group maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Retail Distributors industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Kaival Brands Innovations Group (of which 3 can't be ignored!) you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Kaival Brands Innovations Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:KAVL

Kaival Brands Innovations Group

Sells, markets, and distributes electronic nicotine delivery system (ENDS) products and related components in the United States.

Excellent balance sheet slight.

Market Insights

Community Narratives