How Investors May Respond To JD (JD) Repurchasing Shares and Entering China's Local Services Market

Reviewed by Sasha Jovanovic

- Earlier this month, JD.com completed the repurchase of 80,900,000 shares, approximately 5.57% of its shares outstanding, for US$1.5 billion and officially launched its "JD Review" platform alongside a new food delivery app, marking its entry into China's local services market with AI-driven recommendations and integrated ordering.

- The move signals JD.com's commitment to integrating e-commerce with local services and leveraging technology to compete in a market historically dominated by other major players.

- We'll now examine how JD.com's expansion into local services could reshape its investment narrative and influence future growth prospects.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

JD.com Investment Narrative Recap

To own JD.com stock, you need to believe that its push into local services and commitment to tech-driven e-commerce will eventually deliver scalable returns and improve overall profitability, despite fierce competition and ongoing margin pressure. The recent share buyback and app launches point to an aggressive strategy, but these moves do not materially change the most important near-term catalyst: whether user growth and engagement in these new segments can offset the risks of losses from rapid expansion and heavy subsidies.

Among recent announcements, the completion of JD.com’s US$1.5 billion share buyback stands out, as it may temporarily support shareholder value and demonstrates management’s confidence in the business. However, this does not override the underlying risk that aggressive expansion, especially in food delivery, could further erode net income if new ventures do not scale efficiently and profitably.

Yet, it remains to be seen if JD.com’s food delivery push can overcome the entrenched competition or if sustained losses will continue to weigh on earnings and cash flow...

Read the full narrative on JD.com (it's free!)

JD.com's narrative projects CN¥1,517.4 billion revenue and CN¥45.1 billion earnings by 2028. This requires 6.2% yearly revenue growth and a CN¥6.4 billion earnings increase from the current earnings of CN¥38.7 billion.

Uncover how JD.com's forecasts yield a $45.26 fair value, a 56% upside to its current price.

Exploring Other Perspectives

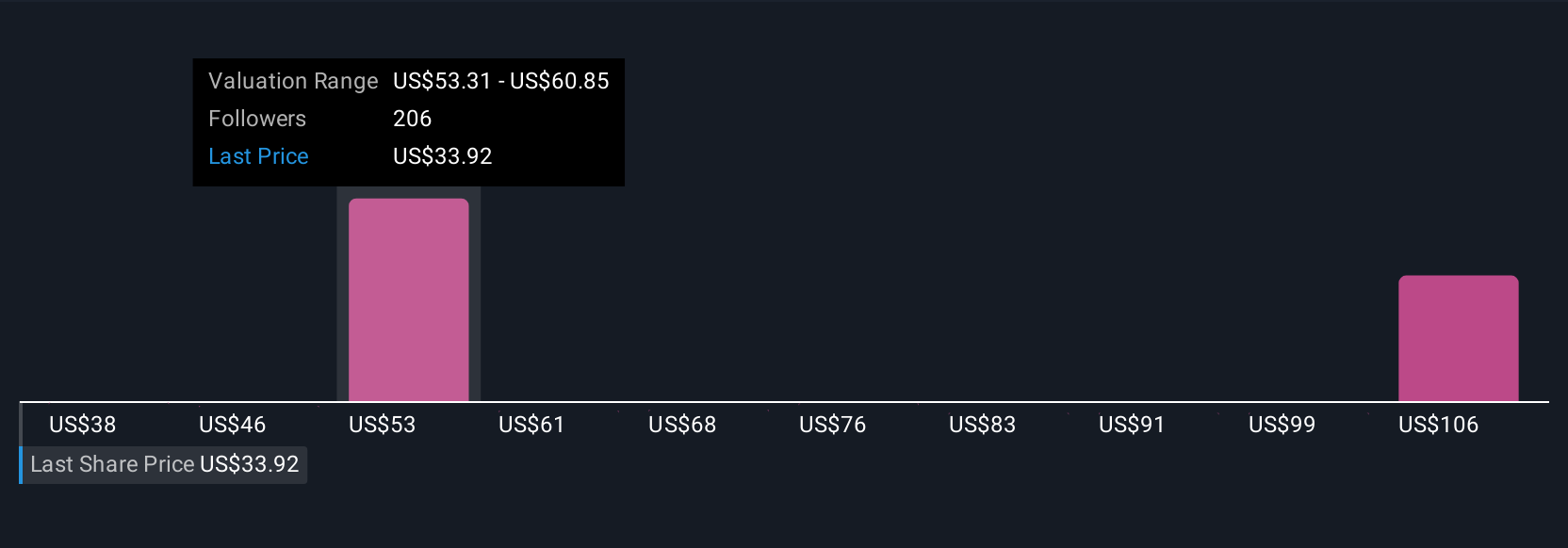

Twenty-five members of the Simply Wall St Community estimate JD.com's fair value between US$30 and US$82.68 per share. Opinions remain polarized, especially as rising fulfillment costs remain a persistent risk to margin improvement in a crowded market.

Explore 25 other fair value estimates on JD.com - why the stock might be worth over 2x more than the current price!

Build Your Own JD.com Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your JD.com research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free JD.com research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate JD.com's overall financial health at a glance.

No Opportunity In JD.com?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JD

JD.com

Operates as a supply chain-based technology and service provider in the People’s Republic of China.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives