- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:HEPS

Even With A 35% Surge, Cautious Investors Are Not Rewarding D-Market Elektronik Hizmetler ve Ticaret A.S.'s (NASDAQ:HEPS) Performance Completely

D-Market Elektronik Hizmetler ve Ticaret A.S. (NASDAQ:HEPS) shareholders are no doubt pleased to see that the share price has bounced 35% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 48% over that time.

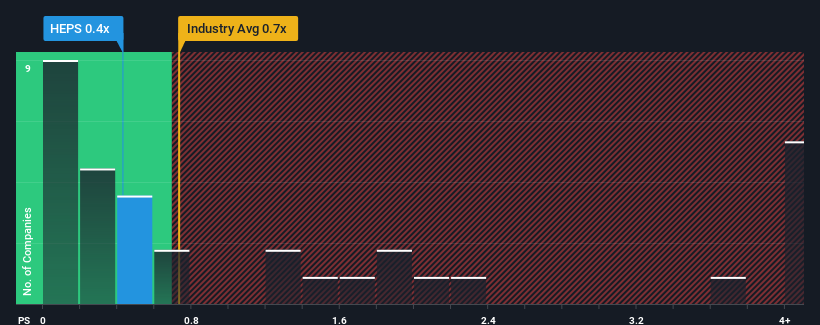

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about D-Market Elektronik Hizmetler ve Ticaret's P/S ratio of 0.4x, since the median price-to-sales (or "P/S") ratio for the Multiline Retail industry in the United States is also close to 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for D-Market Elektronik Hizmetler ve Ticaret

How Has D-Market Elektronik Hizmetler ve Ticaret Performed Recently?

D-Market Elektronik Hizmetler ve Ticaret certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on D-Market Elektronik Hizmetler ve Ticaret will help you uncover what's on the horizon.How Is D-Market Elektronik Hizmetler ve Ticaret's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like D-Market Elektronik Hizmetler ve Ticaret's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 113% last year. This great performance means it was also able to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 39% per year during the coming three years according to the four analysts following the company. With the industry only predicted to deliver 12% per annum, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that D-Market Elektronik Hizmetler ve Ticaret's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does D-Market Elektronik Hizmetler ve Ticaret's P/S Mean For Investors?

Its shares have lifted substantially and now D-Market Elektronik Hizmetler ve Ticaret's P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Looking at D-Market Elektronik Hizmetler ve Ticaret's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

It is also worth noting that we have found 2 warning signs for D-Market Elektronik Hizmetler ve Ticaret that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:HEPS

D-Market Elektronik Hizmetler ve Ticaret

D-Market Elektronik Hizmetler ve Ticaret A.S.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026