- United States

- /

- Retail Distributors

- /

- NasdaqGM:GCT

Improved Earnings Required Before GigaCloud Technology Inc. (NASDAQ:GCT) Stock's 26% Jump Looks Justified

GigaCloud Technology Inc. (NASDAQ:GCT) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 63% share price drop in the last twelve months.

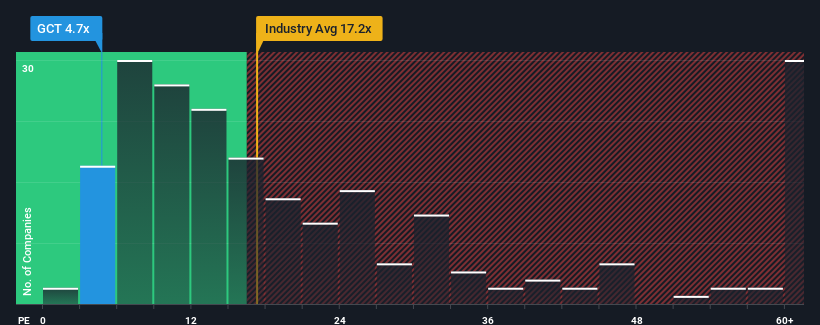

Even after such a large jump in price, GigaCloud Technology may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 4.7x, since almost half of all companies in the United States have P/E ratios greater than 18x and even P/E's higher than 32x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

GigaCloud Technology certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for GigaCloud Technology

How Is GigaCloud Technology's Growth Trending?

GigaCloud Technology's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 33% last year. The strong recent performance means it was also able to grow EPS by 258% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the three analysts covering the company suggest earnings growth is heading into negative territory, declining 18% over the next year. That's not great when the rest of the market is expected to grow by 13%.

In light of this, it's understandable that GigaCloud Technology's P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On GigaCloud Technology's P/E

GigaCloud Technology's recent share price jump still sees its P/E sitting firmly flat on the ground. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that GigaCloud Technology maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Having said that, be aware GigaCloud Technology is showing 1 warning sign in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on GigaCloud Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:GCT

GigaCloud Technology

Provides end-to-end B2B ecommerce solutions for large parcel merchandise in the United States and internationally.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026