- United States

- /

- Specialty Stores

- /

- NasdaqGS:FIVE

Is Five Below (FIVE) Shares Fairly Valued After Strong Recent Gains?

Reviewed by Simply Wall St

Five Below (FIVE) stock has delivered steady returns in recent months, with its shares rising about 18% over the past 3 months and nearly 64% over the past year. Investors often keep an eye on growing retailers like Five Below, especially because of its consistent revenue and net income growth.

See our latest analysis for Five Below.

Momentum has been building for Five Below, with its recent share price gains underlining renewed investor confidence in the company’s outlook and growth story. Over the past year, the stock’s 63.94% total shareholder return and strong year-to-date gains confirm that sentiment toward Five Below continues to improve in both the short and long term.

If you’re wondering where else you might spot opportunity in the market, this could be a great moment to broaden your search and discover fast growing stocks with high insider ownership

With such impressive upward momentum and solid fundamentals, investors are left to consider the real question: Is Five Below still trading below its true value, or has the market already factored in all of its future growth potential?

Most Popular Narrative: 1.8% Undervalued

With Five Below’s current price just below the consensus fair value, the market appears to be pricing the company right in line with expectations set by its most widely followed narrative. Investors are now watching to see whether the assumptions baked into the fair value will hold as growth catalysts play out in the real world.

Five Below's commitment to providing extreme value and trend-right products at low price points is driving broad-based transaction growth, especially as consumers across demographics become increasingly value-focused due to persistent economic pressures. This is expanding the store traffic and addressable market, supporting higher revenue and potential sustained comp sales growth.

What’s really fueling this price target? It is not just about trendy merchandise or a loyal customer base. There is a key blend of operational changes and big financial forecasts. Curious whose buying power is propelling these targets higher, and what surprising assumptions are behind that fair value? See the narrative for the full story.

Result: Fair Value of $160 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing tariff pressures and aggressive expansion could squeeze margins, raising real questions about Five Below’s ability to sustain its current growth narrative.

Find out about the key risks to this Five Below narrative.

Another View: Are Shares Actually Expensive?

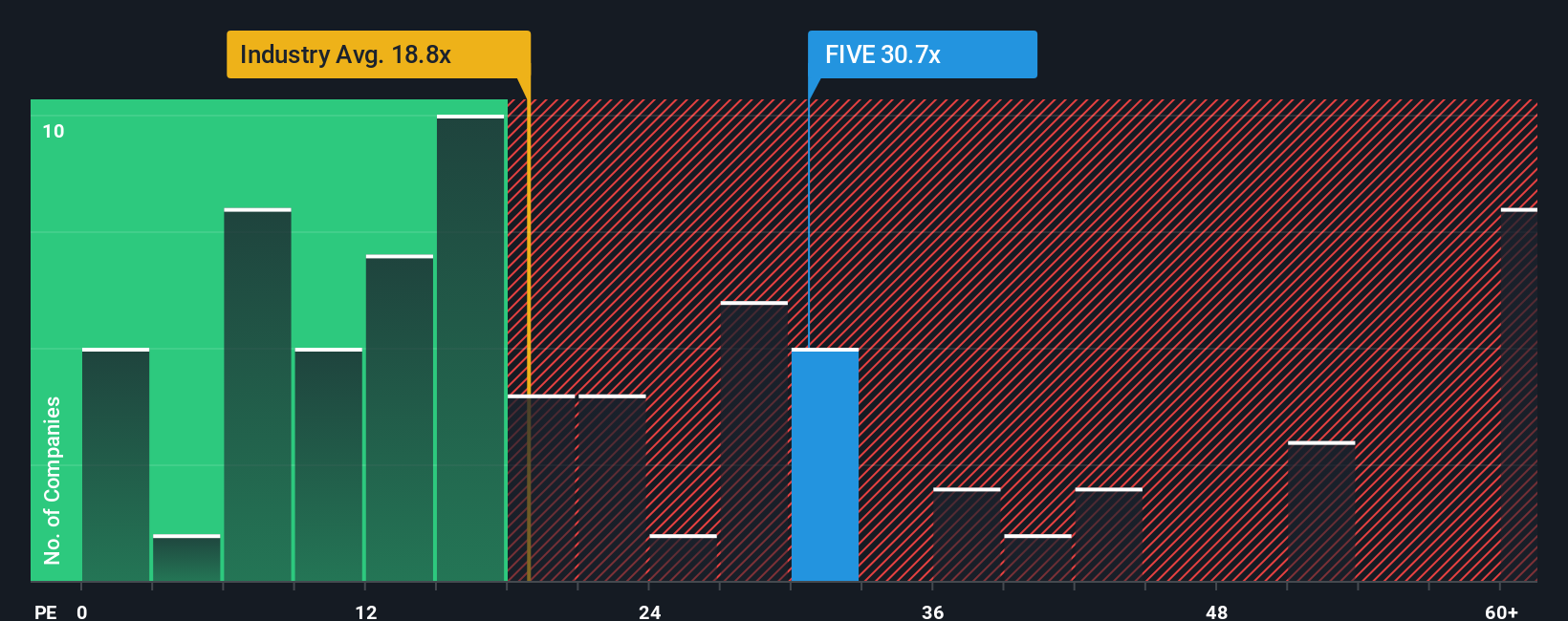

While most analysts see Five Below as modestly undervalued based on its expected growth, a look at its price-to-earnings ratio tells a different story. The stock is trading at about 32 times earnings, which is much higher than both the industry average of 16.5x and its fair ratio of 20x. This signals potential valuation risk if the market shifts its expectations. Could future growth really justify this premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Five Below Narrative

If you want to see the numbers for yourself or challenge the consensus view, you can craft your own well-supported narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Five Below.

Looking for more investment ideas?

Move quickly—there are smart opportunities in every corner of the market. Uncover stocks with strong growth potential, reliable income, and untapped technology trends today.

- Kickstart your search for regular income by viewing these 22 dividend stocks with yields > 3% which offers attractive yields and steady cash flow potential.

- Unlock the latest in artificial intelligence by checking out these 26 AI penny stocks designed to benefit from rapid advancements across industries.

- Catch undervalued gems early in their growth story with these 832 undervalued stocks based on cash flows before the crowd takes notice.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FIVE

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives