- United States

- /

- Retail Distributors

- /

- NasdaqGM:EDUC

Should You Buy Educational Development Corporation (NASDAQ:EDUC) For Its Upcoming Dividend?

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Educational Development Corporation (NASDAQ:EDUC) is about to go ex-dividend in just four days. This means that investors who purchase shares on or after the 22nd of February will not receive the dividend, which will be paid on the 11th of March.

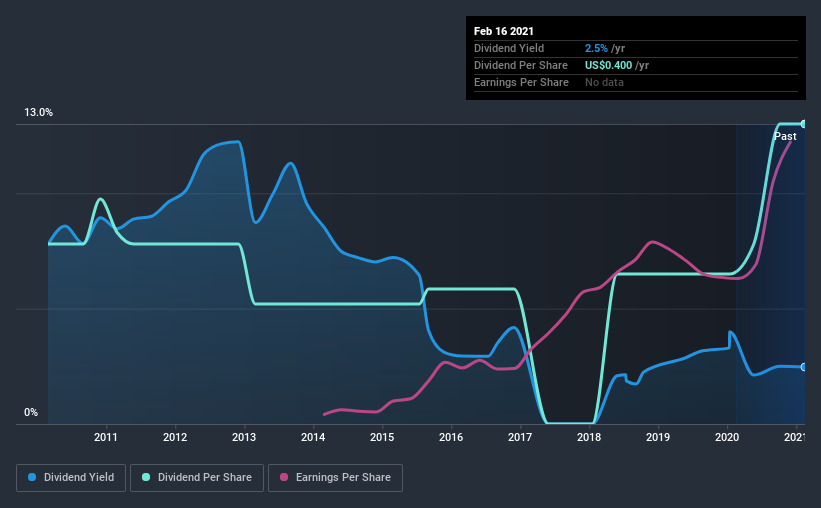

Educational Development's next dividend payment will be US$0.10 per share. Last year, in total, the company distributed US$0.40 to shareholders. Calculating the last year's worth of payments shows that Educational Development has a trailing yield of 2.5% on the current share price of $16.2. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! So we need to check whether the dividend payments are covered, and if earnings are growing.

Check out our latest analysis for Educational Development

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Educational Development has a low and conservative payout ratio of just 21% of its income after tax. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. Luckily it paid out just 5.6% of its free cash flow last year.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see how much of its profit Educational Development paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. That's why it's comforting to see Educational Development's earnings have been skyrocketing, up 65% per annum for the past five years. Educational Development earnings per share have been sprinting ahead like the Road Runner at a track and field day; scarcely stopping even for a cheeky "beep-beep". We also like that it is reinvesting most of its profits in its business.'

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Educational Development has delivered an average of 5.2% per year annual increase in its dividend, based on the past 10 years of dividend payments. Earnings per share have been growing much quicker than dividends, potentially because Educational Development is keeping back more of its profits to grow the business.

To Sum It Up

Should investors buy Educational Development for the upcoming dividend? It's great that Educational Development is growing earnings per share while simultaneously paying out a low percentage of both its earnings and cash flow. It's disappointing to see the dividend has been cut at least once in the past, but as things stand now, the low payout ratio suggests a conservative approach to dividends, which we like. There's a lot to like about Educational Development, and we would prioritise taking a closer look at it.

In light of that, while Educational Development has an appealing dividend, it's worth knowing the risks involved with this stock. Every company has risks, and we've spotted 1 warning sign for Educational Development you should know about.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade Educational Development, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Educational Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:EDUC

Educational Development

Distributes children's books, educational toys and games, and related products in the United States.

Good value with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.