- United States

- /

- Retail Distributors

- /

- NasdaqGM:EDUC

Educational Development (NASDAQ:EDUC) Has Announced A Dividend Of US$0.10

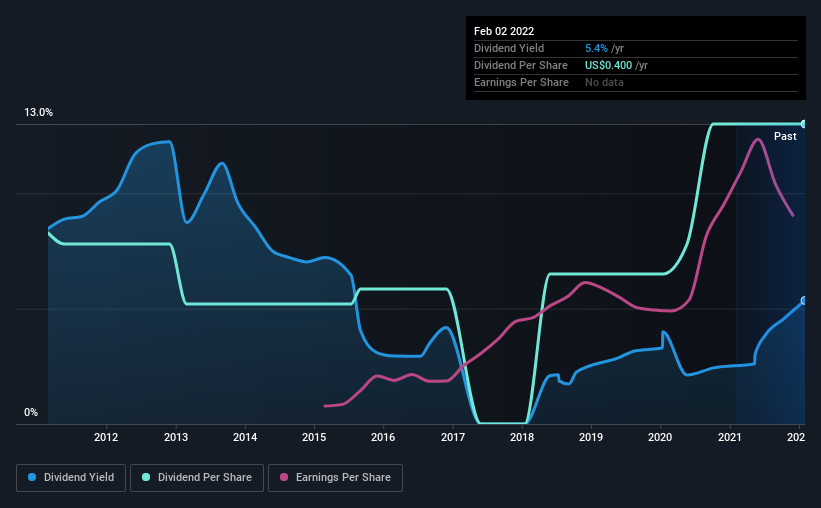

Educational Development Corporation (NASDAQ:EDUC) will pay a dividend of US$0.10 on the 10th of March. This makes the dividend yield 5.4%, which will augment investor returns quite nicely.

View our latest analysis for Educational Development

Educational Development's Dividend Is Well Covered By Earnings

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Prior to this announcement, Educational Development's earnings easily covered the dividend, but free cash flows were negative. We think that cash flows should take priority over earnings, so this is definitely a worry for the dividend going forward.

If the trend of the last few years continues, EPS will grow by 35.2% over the next 12 months. If the dividend continues along recent trends, we estimate the payout ratio will be 29%, which is in the range that makes us comfortable with the sustainability of the dividend.

Dividend Volatility

The company's dividend history has been marked by instability, with at least 1 cut in the last 10 years. Since 2012, the first annual payment was US$0.26, compared to the most recent full-year payment of US$0.40. This works out to be a compound annual growth rate (CAGR) of approximately 4.6% a year over that time. The dividend has seen some fluctuations in the past, so even though the dividend was raised this year, we should remember that it has been cut in the past.

The Dividend Looks Likely To Grow

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. We are encouraged to see that Educational Development has grown earnings per share at 35% per year over the past five years. Rapid earnings growth and a low payout ratio suggest this company has been effectively reinvesting in its business. Should that continue, this company could have a bright future.

In Summary

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. While the low payout ratio is redeeming feature, this is offset by the minimal cash to cover the payments. We don't think Educational Development is a great stock to add to your portfolio if income is your focus.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. To that end, Educational Development has 6 warning signs (and 2 which are a bit unpleasant) we think you should know about. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Educational Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:EDUC

Educational Development

Distributes children's books, educational toys and games, and related products in the United States.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Quanta Services (PWR): Strengthening the Backbone of the AI Power Grid.

KLA Corporation (KLAC): Engineering Yield in the Age of Chiplets and Sub-2nm Nodes.

Monolithic Power Systems (MPWR): The AI "Power Play" Facing a Transition from Scarcity to Scale.

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks