- United States

- /

- Specialty Stores

- /

- NYSE:BWMX

Investors Still Aren't Entirely Convinced By Betterware de México, S.A.P.I. de C.V.'s (NASDAQ:BWMX) Earnings Despite 26% Price Jump

Betterware de México, S.A.P.I. de C.V. (NASDAQ:BWMX) shareholders have had their patience rewarded with a 26% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 72% in the last year.

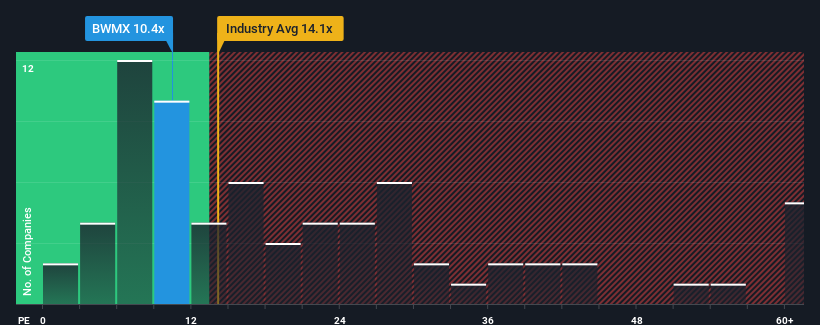

Even after such a large jump in price, Betterware de MéxicoP.I. de may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 10.4x, since almost half of all companies in the United States have P/E ratios greater than 17x and even P/E's higher than 32x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been pleasing for Betterware de MéxicoP.I. de as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Betterware de MéxicoP.I. de

Does Growth Match The Low P/E?

Betterware de MéxicoP.I. de's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered an exceptional 20% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 224% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 34% during the coming year according to the two analysts following the company. With the market only predicted to deliver 12%, the company is positioned for a stronger earnings result.

With this information, we find it odd that Betterware de MéxicoP.I. de is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Betterware de MéxicoP.I. de's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Betterware de MéxicoP.I. de's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Betterware de MéxicoP.I. de you should know about.

If you're unsure about the strength of Betterware de MéxicoP.I. de's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Betterware de MéxicoP.I. de might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BWMX

Betterware de MéxicoP.I. de

Operates as a direct-to-consumer selling company in the United Staes and Mexico.

Undervalued average dividend payer.

Market Insights

Community Narratives