- United States

- /

- Specialty Stores

- /

- NasdaqGS:BGFV

Big 5 Sporting Goods Corporation (NASDAQ:BGFV) Shares May Have Slumped 27% But Getting In Cheap Is Still Unlikely

To the annoyance of some shareholders, Big 5 Sporting Goods Corporation (NASDAQ:BGFV) shares are down a considerable 27% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 49% in that time.

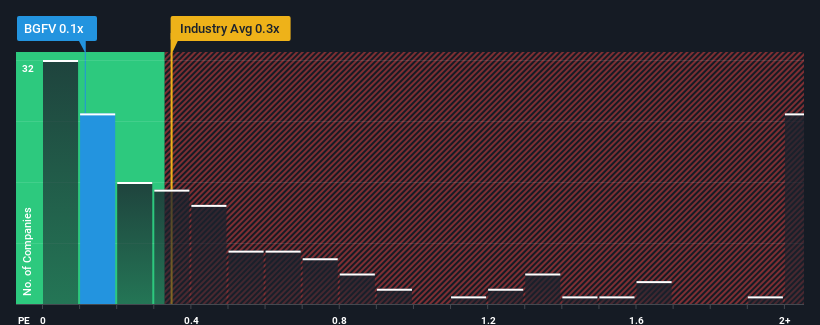

Although its price has dipped substantially, it's still not a stretch to say that Big 5 Sporting Goods' price-to-sales (or "P/S") ratio of 0.1x right now seems quite "middle-of-the-road" compared to the Specialty Retail industry in the United States, where the median P/S ratio is around 0.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Big 5 Sporting Goods

How Has Big 5 Sporting Goods Performed Recently?

While the industry has experienced revenue growth lately, Big 5 Sporting Goods' revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Big 5 Sporting Goods will help you uncover what's on the horizon.How Is Big 5 Sporting Goods' Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Big 5 Sporting Goods' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 10% decrease to the company's top line. As a result, revenue from three years ago have also fallen 6.8% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 4.1% as estimated by the one analyst watching the company. With the industry predicted to deliver 5.4% growth, that's a disappointing outcome.

With this information, we find it concerning that Big 5 Sporting Goods is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Final Word

With its share price dropping off a cliff, the P/S for Big 5 Sporting Goods looks to be in line with the rest of the Specialty Retail industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our check of Big 5 Sporting Goods' analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

Before you settle on your opinion, we've discovered 2 warning signs for Big 5 Sporting Goods (1 is significant!) that you should be aware of.

If these risks are making you reconsider your opinion on Big 5 Sporting Goods, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Big 5 Sporting Goods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:BGFV

Big 5 Sporting Goods

Operates as a sporting goods retailer in the western United States.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives