- United States

- /

- Specialty Stores

- /

- OTCPK:BBBY.Q

Analyzing Insider Transactions can Unlock More Opportunities like Bed Bath & Beyond (NASDAQ:BBBY)

If we described the movement of Bed Bath & Beyond Inc. (Nasdaq: BBBY) stock in the last year or so, it was nothing short of erratic.

Yet, facing the profitability issues in the aftermath of 2020, it seems that the company is going through a "buy the rumor, sell the news "cycle.

View our latest analysis for Bed Bath & Beyond

Sale Proposal Hits the Table

The company just confirmed it would consider a sale proposal, sending the shares flying to the most significant gain in 30 years. The company is in talks with Ryan Cohen's RC Ventures, which currently has a 9.8% stake, the 4th largest on the record.

Cohen, a co-founder of online pet product retailer Chewy (NYSE: CHWY), is most known for being a board chairman of GameStop (NYSE: GME). Thus, it is likely that his latest move drew significant interest from the retail crowd to another highly-shorted stock.

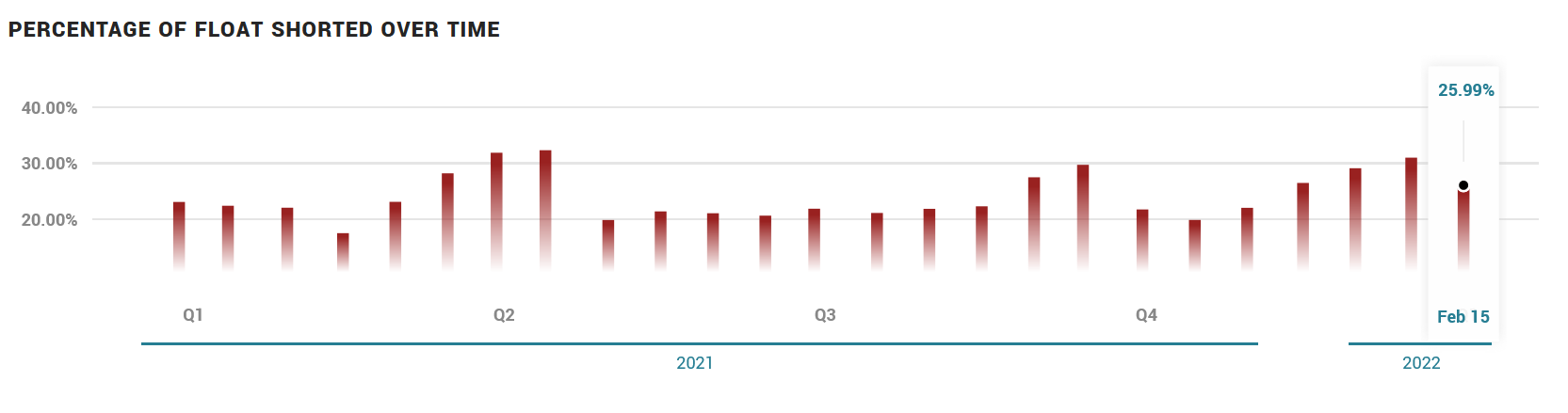

You can see the short interest trend in the graph below

While insider transactions are not the most important thing for long-term investing, we would consider it foolish to ignore insider transactions altogether.

Bed Bath & Beyond Insider Transactions Over The Last Year

In the last twelve months, the biggest single sale by an insider was when the COO, Executive VP & President of Buybuy BABY Inc, John Hartmann, sold US$1.4m worth of shares at US$31.94 per share. While we don't usually like to see insider selling, it's more concerning if the sales occur at a lower price. The silver lining is that this sell-down took place above the latest price (US$21.71).

Over the last year, we can see that insiders have bought 131.36k shares worth US$2.5m. But they sold 54.83k shares for US$1.7m. Over the previous twelve months, there was more buying than selling by Bed Bath & Beyond insiders. They paid about US$19.32 on average. It is certainly positive to see that insiders have invested their own money in the company. But we must note that the investments were made well below today's share price.

Below, you can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months. If you click on the chart, you can see all the individual transactions, including the share price, individual, and date.

Bed Bath & Beyond is not the only stock that insiders are buying. This free list of growing companies with recent insider purchasing could be just the ticket for those who like to find winning investments.

Insider Ownership

It is worth checking how many shares company insiders hold for a common shareholder. Bed Bath & Beyond insiders own about US$41m worth of shares. That equates to 2.7% of the company. We've certainly seen higher levels of insider ownership elsewhere, but these holdings are enough to suggest alignment between insiders and the other shareholders.

Conclusion

As an old proverb says, insiders sell their shares for many reasons but buy for only one - expecting the price to increase. Looking at our data, you can see that the buying pressure was elevated as early as the last November.

Two transactions of particular interest were made by the COO and a Senior Key Executive who sold shares at highs in July just to start repurchasing them at the lows. If you're a short/medium term investor, this can give you a framework of the trading range to work with.

While these insider transactions can help us build a thesis about the stock, it's also worthwhile knowing the risks facing this company. At Simply Wall St, we've found that Bed Bath & Beyond has 2 warning signs that deserve your attention before going any further with your analysis.

For this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

Valuation is complex, but we're here to simplify it.

Discover if Bed Bath & Beyond might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About OTCPK:BBBY.Q

Bed Bath & Beyond

Bed Bath & Beyond Inc., together with its subsidiaries, operates a chain of retail stores.

Moderate and slightly overvalued.

Similar Companies

Market Insights

Community Narratives