- United States

- /

- Specialty Stores

- /

- NasdaqGS:ASO

Investors Still Aren't Entirely Convinced By Academy Sports and Outdoors, Inc.'s (NASDAQ:ASO) Earnings Despite 32% Price Jump

The Academy Sports and Outdoors, Inc. (NASDAQ:ASO) share price has done very well over the last month, posting an excellent gain of 32%. Looking further back, the 24% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

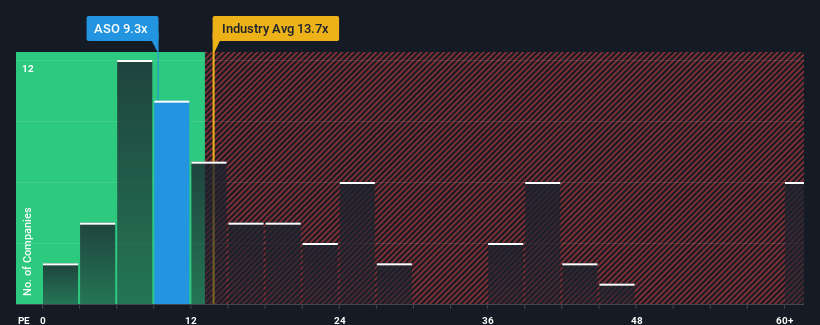

Even after such a large jump in price, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 17x, you may still consider Academy Sports and Outdoors as an attractive investment with its 9.3x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Academy Sports and Outdoors has been struggling lately as its earnings have declined faster than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

View our latest analysis for Academy Sports and Outdoors

What Are Growth Metrics Telling Us About The Low P/E?

Academy Sports and Outdoors' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered a frustrating 8.3% decrease to the company's bottom line. Even so, admirably EPS has lifted 115% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 13% each year as estimated by the analysts watching the company. With the market predicted to deliver 12% growth each year, the company is positioned for a comparable earnings result.

In light of this, it's peculiar that Academy Sports and Outdoors' P/E sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From Academy Sports and Outdoors' P/E?

Despite Academy Sports and Outdoors' shares building up a head of steam, its P/E still lags most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Academy Sports and Outdoors' analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Academy Sports and Outdoors with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Academy Sports and Outdoors, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ASO

Academy Sports and Outdoors

Through its subsidiaries, operates as a sporting goods and outdoor recreational retailer in the United States.

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives