- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Amazon.com (NasdaqGS:AMZN) Eyes TikTok Acquisition Amid 11% Weekly Stock Dip

Reviewed by Simply Wall St

Amazon.com (NasdaqGS:AMZN) recently made headlines with a last-minute bid for TikTok, amidst a turbulent market backdrop that saw the Dow and Nasdaq entering correction and bear market territories, respectively. Over the past week, Amazon's share price fell 11%, coinciding with widespread declines among technology stocks due to escalating trade tensions. The company's collaboration with AWS to enhance AI-driven services and the potential spin-off of its India operations demonstrates efforts to bolster its market position. However, these positive endeavors were overshadowed by broader market concerns, contributing to the stock's performance in a week marked by significant sell-offs across major indexes.

Buy, Hold or Sell Amazon.com? View our complete analysis and fair value estimate and you decide.

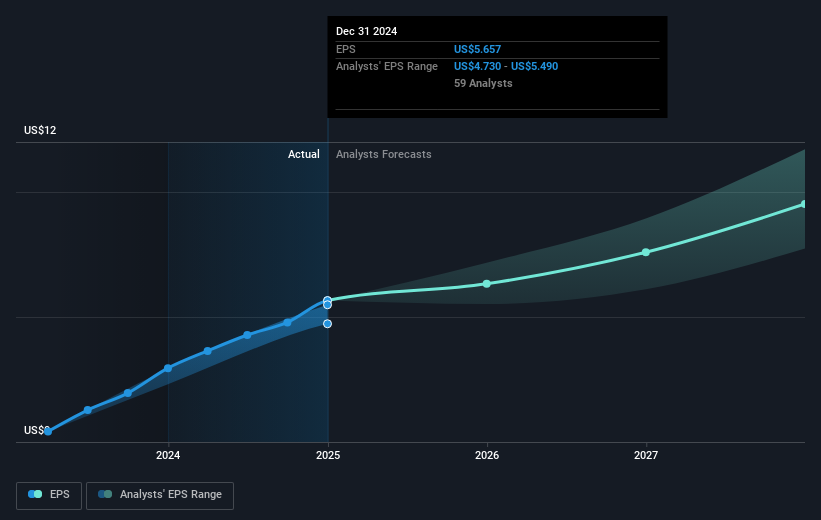

Over the last five years, Amazon's total shareholder return reached 74.68%, reflecting a remarkable performance considering the challenges in the broader market. Despite a decline over the past year compared to both the US market and the Multiline Retail industry, several key developments have shaped the company's longer-term performance. The rapid expansion of Amazon Web Services, focusing heavily on AI technologies, contributed significantly to this growth. In addition, Amazon's advertising segment has shown robust growth, contributing to margin expansion due to its high profitability.

Furthermore, ongoing investments in fulfillment automation and logistics have likely improved operational efficiencies and customer satisfaction, supporting revenue growth. However, factors like foreign exchange fluctuations and considerable capital expenditure on AI may have strained margins at times. Another contributing factor is the company's labor-related challenges, which underlined operational costs. Despite these hurdles, Amazon managed substantial revenue and net income growth over recent years, as evidenced by a considerable boost in earnings year-on-year, underpinning the overall shareholder returns in this period.

Explore historical data to track Amazon.com's performance over time in our past results report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives