- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Amazon.com (AMZN) Expands AWS Partner Network With Innovative Proprio Collaboration

Reviewed by Simply Wall St

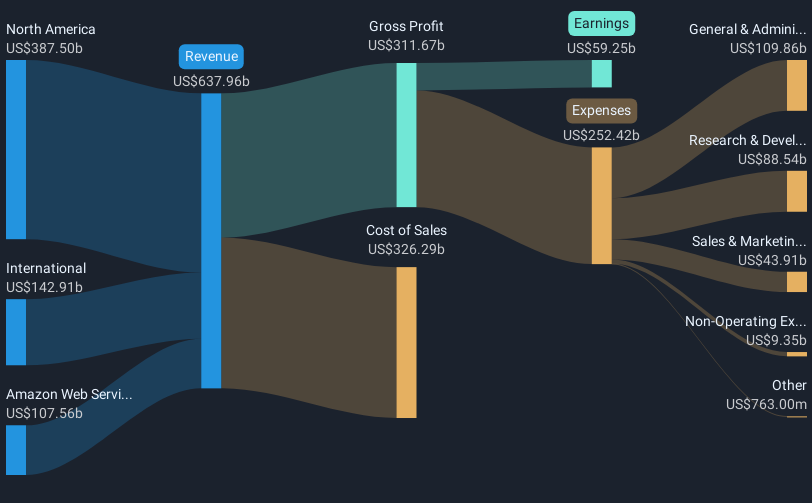

Amazon.com (AMZN) experienced a stock price rise of 25% in the last quarter, with significant partnerships and robust earnings contributing to this increase. Notably, the partnership with Proprio as part of the Amazon Web Services Partner Network marked an advancement in surgical technology, highlighting Amazon's continued innovation in various sectors. Strong Q1 earnings with revenue increases and positive corporate guidance provided a solid foundation for the share price uplift. While broader market trends remained relatively flat, these strategic moves and positive earnings outlook potentially bolstered investor confidence in Amazon's growth trajectory.

Buy, Hold or Sell Amazon.com? View our complete analysis and fair value estimate and you decide.

The recent surge in Amazon's stock price by 25% is aligned with its broader narrative of enhancing operational efficiency and expanding services. This short-term gain builds upon the company's AI-driven optimization of its fulfillment network and diversification of supply chains, potentially reducing costs and boosting margins. Over the past three years, Amazon's total shareholder return, including dividends, was 72.19%, indicating strong longer-term performance. This contrasts with the Multiline Retail industry's 1-year return of 26.9% and suggests consistent outperformance.

The partnership with Proprio and strong earnings appear to bolster investor confidence, potentially influencing revenue and earnings forecasts positively. Analysts expect the annual revenue growth to continue at 9.9%, with earnings projection reaching $104.8 billion by July 2028. The strategic maneuvers in AWS and advertising could support these forecasts, given the anticipated shift in IT spending towards cloud services.

Yet, the current share price of US$231.01 remains slightly below the consensus price target of US$249.76, representing an 8.99% discount. This indicates that while news has positively impacted the price, there remains considerable room based on analyst valuation estimates. Investors should weigh these forecasts against market risks such as tariffs and heightened competition, which could influence the company's ability to meet earnings projections.

Unlock comprehensive insights into our analysis of Amazon.com stock in this financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives