- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Amazon (AMZN): Margin Expansion Reinforces Bullish Narratives, Quality of Earnings Under Scrutiny

Reviewed by Simply Wall St

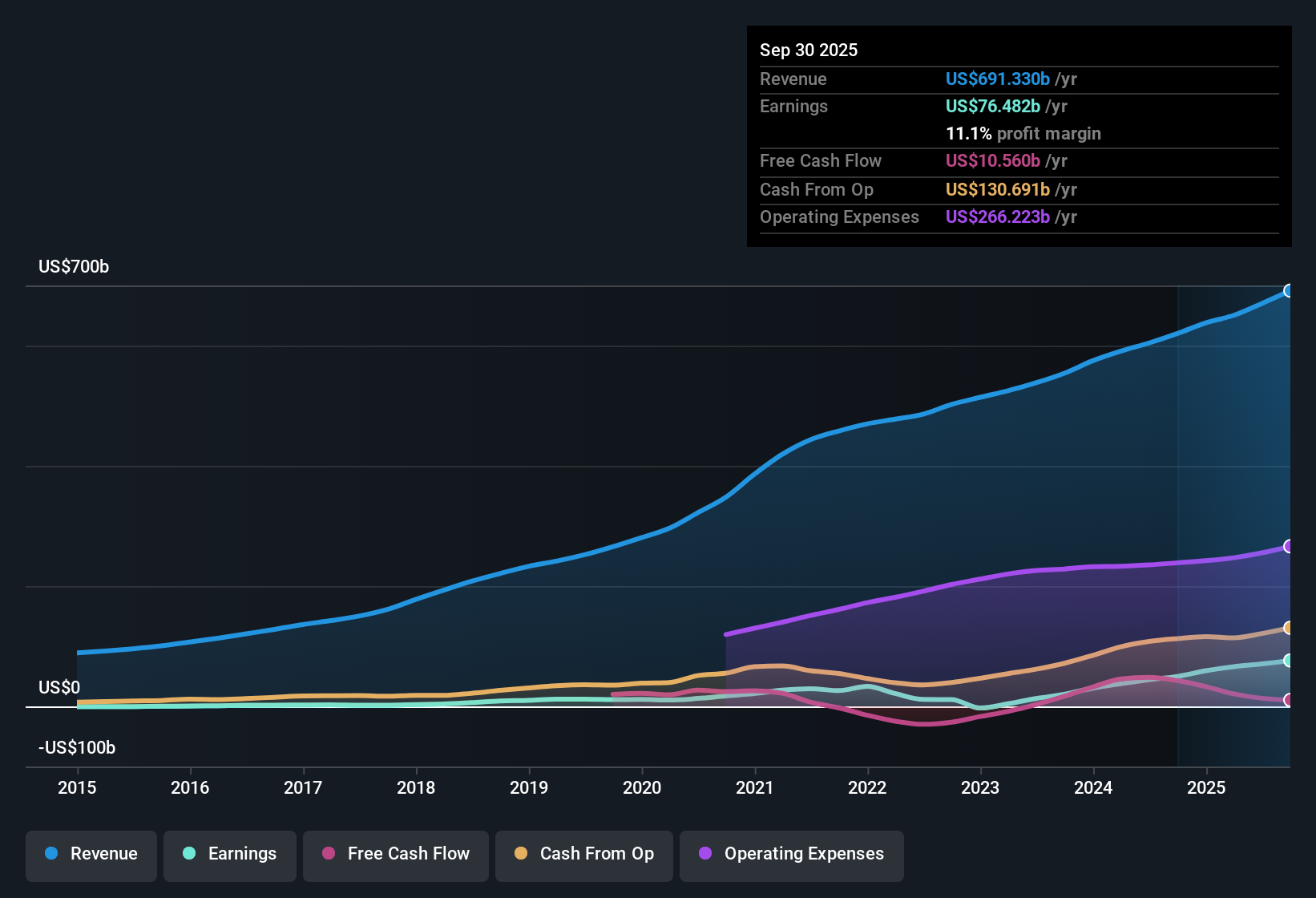

Amazon.com (AMZN) delivered standout numbers over the past year, with earnings growth of 53.4% compared to its five-year average of 30.9% per year. Net profit margins hit 11.1%, up from 8% last year, and earnings are forecast to grow at an annual pace of 15.17%. The stock is currently trading at $244.22, below the estimated fair value of $275.88. The ongoing combination of strong historical growth, rising margins, and forward-looking earnings forecasts sets the tone for how investors might view Amazon’s current valuation and market position.

See our full analysis for Amazon.com.The next section will put these headline numbers side by side with the most widely followed narratives for Amazon, highlighting where the storylines converge and where they might be challenged.

See what the community is saying about Amazon.com

AWS Powers Margin Expansion Beyond Retail

- Amazon Web Services (AWS) remains the main engine for high-margin growth, with management highlighting that 85 to 90% of global IT spend still sits outside the cloud. This gives AWS a major runway for structural expansion as digital adoption accelerates.

- Analysts' consensus view points to AWS's leadership in generative AI and deep integration with enterprise clients as central profit drivers, fueling operating leverage and future margin gains.

- This is visible through the focus on AWS's proprietary silicon and new AI-powered services, which underpin bullish expectations for sustained premium margins well above Amazon's core retail business.

- Consensus narrative also notes that Amazon’s logistics and fulfillment automation should feed back into the AWS flywheel, helping drive higher consolidated net margins, currently at 11.1%, over the next three years.

- Analysts agree these tech-driven catalysts, especially the cloud opportunity, frame Amazon’s best-case outlook. The full Consensus Narrative outlines how these angles support long-term growth expectations. 📊 Read the full Amazon.com Consensus Narrative.

Non-Cash Earnings Signal Quality Caution

- Despite robust historical growth and improved operating margins, the EDGAR summary flags a primary risk around earnings quality, with a high proportion of non-cash profits fueling recent gains instead of purely cash-based earnings.

- Analysts' consensus narrative warns that mounting capex in AWS infrastructure, paired with increased competition and regulatory scrutiny, could pressure profit quality and consistency.

- Bears highlight that persistent supply chain risks and the sheer scale of ongoing investment, especially in custom chips and automation, may put Amazon’s margin improvement to the test.

- Consensus narrative singles out the challenge of balancing margin expansion in AWS while containing cost escalation in logistics and core retail operations.

Valuation: Discount to Peers, Premium to Industry

- Shares trade at $244.22, below both the analyst price target of $287.57 and the DCF fair value of $275.88, with a Price-To-Earnings ratio of 33.8x. This is lower than select peers (41.6x), but materially above the global retail sector average (20.3x).

- Analysts' consensus narrative sees this as a sign that investors are pricing in Amazon’s outsized growth outlook but also a recognition that risks remain, especially if sector momentum slows or margin expansion underwhelms.

- The modest 9.5% upside to the analyst target frames current sentiment as optimistic yet not euphoric, indicating a market that values future growth but applies a discount for execution risk.

- Consensus narrative suggests that for the target to be justified, Amazon will need revenue of $905.9 billion and $111.9 billion in annual earnings by 2028, with sustained profit margin improvements.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Amazon.com on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you interpret the figures in a unique way? Take just a few minutes to shape your own perspective and analysis. Do it your way.

A great starting point for your Amazon.com research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While Amazon’s rapid growth and margin gains impress, concerns remain over the quality of earnings, heavy reliance on non-cash profits, and rising investment risks.

If you worry that these factors could challenge stability, use our stable growth stocks screener (2100 results) to zero in on stocks that consistently turn strong results into steady, reliable growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives