- United States

- /

- Hotel and Resort REITs

- /

- NYSE:XHR

Does Xenia Hotels & Resorts' (XHR) Dividend Signal Steady Confidence or Market Caution Ahead?

Reviewed by Sasha Jovanovic

- Xenia Hotels & Resorts recently announced a fourth quarter cash dividend of US$0.14 per share, to be paid on January 15, 2026, to shareholders of record as of December 31, 2025.

- The company's Q3 2025 earnings came in with funds from operations matching expectations, but revenue fell slightly short, leading management to adopt a cautious outlook while highlighting preliminary recovery in group demand and RevPAR in October.

- With the board affirming its dividend and management emphasizing upcoming growth drivers, we'll explore how these developments reshape Xenia's investment narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Xenia Hotels & Resorts Investment Narrative Recap

To be a shareholder in Xenia Hotels & Resorts, you need to believe in the recovery of high-end business and group travel, as well as Xenia’s ability to capture demand in premium urban markets. The recent dividend affirmation and management's commentary do not materially change the key short term catalyst, sustained group demand growth driving RevPAR performance, nor do they ease the main risk of ongoing softness in leisure travel and higher labor costs pressuring margins.

The Q4 2025 dividend announcement is particularly relevant as it highlights the company’s continued focus on shareholder returns, even as revenue came in below expectations in the latest quarter. While this speaks to management’s confidence, the sustainability of such distributions ultimately hinges on the ongoing recovery in group business and the ability to offset cost pressures.

However, investors should be aware that, despite the focus on dividend consistency, worsening trends in leisure demand and rising expenses could...

Read the full narrative on Xenia Hotels & Resorts (it's free!)

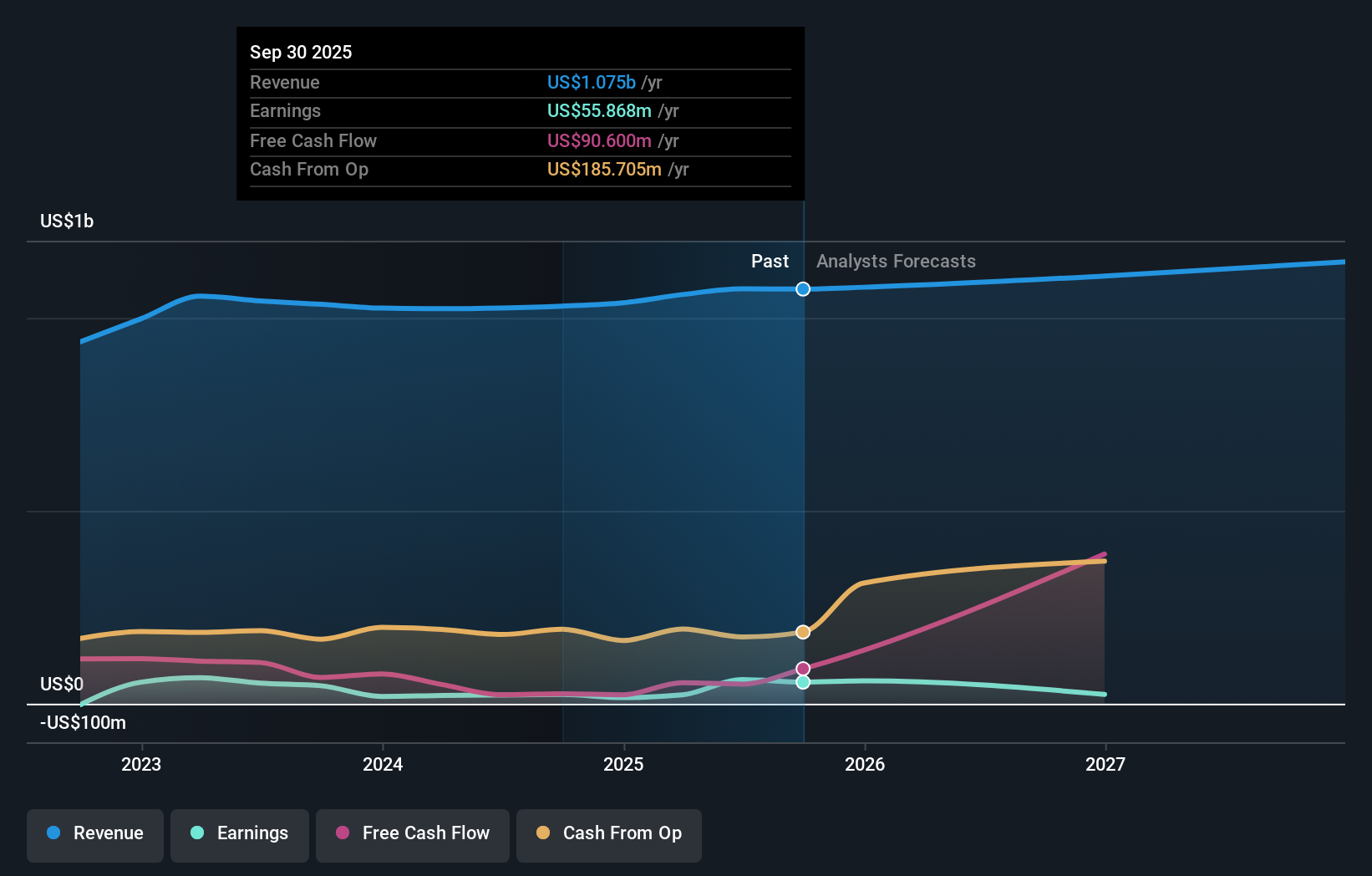

Xenia Hotels & Resorts' narrative projects $1.1 billion revenue and $4.1 million earnings by 2028. This requires 1.8% yearly revenue growth and a $58.4 million earnings decrease from $62.5 million currently.

Uncover how Xenia Hotels & Resorts' forecasts yield a $15.00 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members set Xenia’s fair value between US$15.00 and US$23.04 based on two unique growth forecasts. Views about group demand’s critical role in next year’s outlook highlight just how much opinions can differ, so consider reviewing multiple perspectives before making any decisions.

Explore 2 other fair value estimates on Xenia Hotels & Resorts - why the stock might be worth just $15.00!

Build Your Own Xenia Hotels & Resorts Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Xenia Hotels & Resorts research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Xenia Hotels & Resorts research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Xenia Hotels & Resorts' overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XHR

Xenia Hotels & Resorts

A self-advised and self-administered REIT that invests in uniquely positioned luxury and upper upscale hotels and resorts with a focus on the top 25 lodging markets as well as key leisure destinations in the United States.

Proven track record with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success