- United States

- /

- Specialized REITs

- /

- NYSE:WY

Weyerhaeuser (WY): Revisiting Valuation After Subtle Share Price Moves

Reviewed by Simply Wall St

Weyerhaeuser (WY) has recently seen movement in its share price that might have caught your attention, even in the absence of a headline-grabbing event. When a stock edges down 0.7% in the past month but manages a modest 1.1% gain over the past week, it can spark questions. Is something shifting below the surface, or are we just witnessing typical market churn? For investors weighing their next step, even subtle moves like these can serve as a signal to revisit the fundamentals.

Looking more broadly, the story for Weyerhaeuser is a bit of a mixed bag. For the year, shares are down over 16%, with a more moderate decline of 8% in the past 3 months, and a small gain in the last week. Longer-term results have been subdued as well, with only a 5.8% return over the past 5 years. That said, revenue and net income growth over the year remain positive, and it is worth watching to see whether this momentum can eventually translate into stronger share price performance.

Given this backdrop, the key question is whether Weyerhaeuser is being undervalued right now or if the market has already incorporated its future growth prospects. Is there real opportunity here, or are expectations running ahead of reality?

Most Popular Narrative: 24.1% Undervalued

The prevailing narrative views Weyerhaeuser as significantly undervalued, with analysts forecasting that current prices are well below fair value. This perspective is built on expectations that the company’s transformation efforts and business pivots could unlock material upside if key initiatives deliver as planned.

The carbon capture and sequestration (CCS) agreement with Occidental Petroleum represents a growth opportunity in Weyerhaeuser's Natural Climate Solutions business, likely boosting future earnings.

What fuels this bullish valuation? Analysts are focusing on assumptions about margin expansion, rising profits, and a major uptick in earnings power. The surprise lies in the narrative being anchored by projections that mirror companies from fast-moving sectors, suggesting financial targets that could influence traditional timberland operations. Interested in the numbers analysts consider possible? Explore the details that underpin this ambitious valuation.

Result: Fair Value of $33.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent macroeconomic uncertainty and international trade restrictions could quickly reverse recent momentum. This reminds investors how swiftly market narratives can change.

Find out about the key risks to this Weyerhaeuser narrative.Another View: What Do Market Ratios Say?

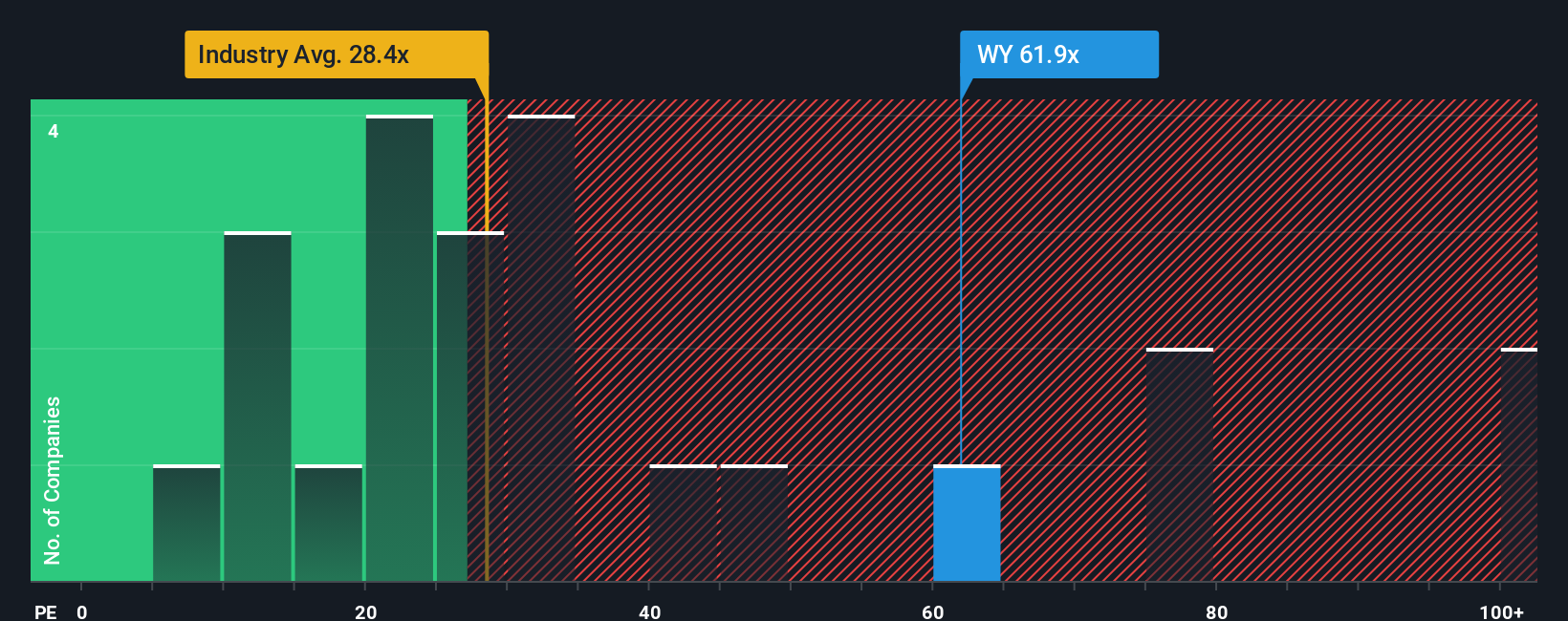

While optimism surrounds Weyerhaeuser’s long-term outlook, some investors point to market ratios suggesting the stock may be expensive compared to its industry peers. Could this raise doubts about the undervalued story? Or is the market missing something?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Weyerhaeuser Narrative

If you see things differently or want to dive deeper into the numbers yourself, you can build your own story in just a few minutes with our tools. Do it your way.

A great starting point for your Weyerhaeuser research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let a single stock limit your possibilities. Uncover fresh opportunities and set yourself up for smarter investment choices by using these powerful stock screening tools:

- Grow your wealth with high-yield picks by checking out dividend stocks with yields > 3% in sectors where steady income meets strong fundamentals.

- Get ahead of the curve as artificial intelligence transforms industries. Start your search with AI penny stocks and spot tomorrow’s leaders today.

- Seize undervalued gems trading below their true worth by exploring undervalued stocks based on cash flows now, before the broader market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Weyerhaeuser might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WY

Weyerhaeuser

Weyerhaeuser Company, one of the world's largest private owners of timberlands, began operations in 1900 and today owns or controls approximately 10.4 million acres of timberlands in the U.S., as well as additional public timberlands managed under long-term licenses in Canada.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives