- United States

- /

- Specialized REITs

- /

- NYSE:WY

Weyerhaeuser (NYSE:WY) Declares US$1,000 Million Buyback and Quarterly Dividend

Reviewed by Simply Wall St

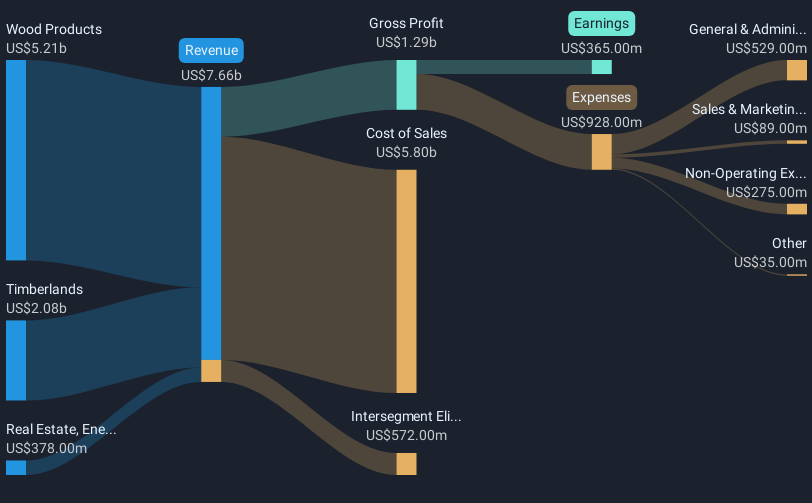

Weyerhaeuser (NYSE:WY) recently announced the completion of a $1 billion share repurchase program and declared a quarterly cash dividend of $0.21 per share, reflecting its commitment to enhancing shareholder value. Over the past month, the company's stock price rose 5%, supported by these shareholder-focused actions, which likely added positive weight to broader market movements. Despite reporting a drop in first-quarter earnings compared to the previous year, the robust buyback and dividend declaration likely bolstered investor sentiment amid a slightly declining market environment. This combination of corporate maneuvers contributed to Weyerhaeuser's steady performance, aligned with market trends.

The recent completion of Weyerhaeuser's US$1 billion share repurchase program and its dividend announcement are key strategies that may bolster investor confidence, despite a recent drop in first-quarter earnings. Over the past five years, Weyerhaeuser shares have delivered a total return of 79%, underscoring a solid longer-term performance. This return outpaces the more recent one-year period, in which the company's performance lagged behind the US Specialized REITs industry, which saw a 13.1% return.

These shareholder-focused initiatives, such as the buyback, may positively impact revenue and earnings forecasts. The move is expected to reduce outstanding shares by 0.51% annually, potentially enhancing earnings per share over time. However, the company's PE ratio remains significantly above industry averages, suggesting a higher growth expectation. Analysts have set a consensus price target of US$34.25, which is approximately 25.4% higher than the current share price of US$25.54, signaling potential room for share price appreciation if growth projections align with analyst forecasts.

Click to explore a detailed breakdown of our findings in Weyerhaeuser's financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Weyerhaeuser might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WY

Weyerhaeuser

Weyerhaeuser Company, one of the world's largest private owners of timberlands, began operations in 1900.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives