- United States

- /

- Retail REITs

- /

- NYSE:WSR

Exploring November 2024's Undervalued Small Caps With Insider Action In US

Reviewed by Simply Wall St

In the last week, the United States market has been flat, yet it has experienced a significant 32% increase over the past year with earnings forecasted to grow by 15% annually. In this dynamic environment, identifying small-cap stocks that appear undervalued and exhibit insider activity can be crucial for investors seeking potential opportunities.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Thryv Holdings | NA | 0.7x | 49.93% | ★★★★★☆ |

| Capital Bancorp | 14.2x | 2.9x | 48.01% | ★★★★☆☆ |

| Hanover Bancorp | 11.3x | 2.3x | 43.17% | ★★★★☆☆ |

| HighPeak Energy | 11.0x | 1.6x | 35.30% | ★★★★☆☆ |

| German American Bancorp | 16.5x | 5.5x | 39.36% | ★★★☆☆☆ |

| USCB Financial Holdings | 19.6x | 5.6x | 47.31% | ★★★☆☆☆ |

| First United | 13.8x | 3.1x | 46.10% | ★★★☆☆☆ |

| Orion Group Holdings | NA | 0.4x | -206.08% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Sabre | NA | 0.5x | -49.28% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

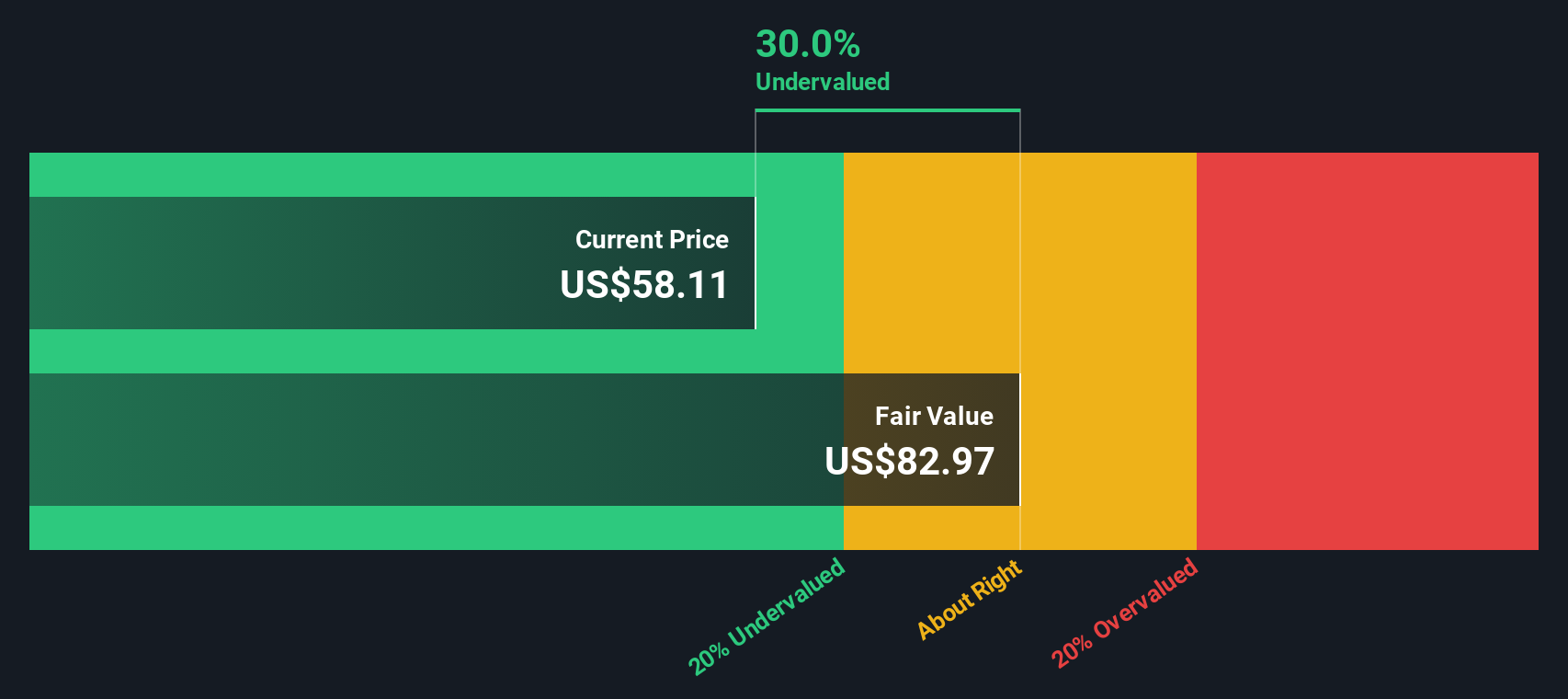

Capital Bancorp (NasdaqGS:CBNK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Capital Bancorp operates through segments including Opensky, Corporate, Commercial Bank, and Capital Bank Home Loans (CBHL), with a market cap of $0.27 billion.

Operations: Capital Bancorp's revenue streams are primarily driven by its Commercial Bank and Opensky segments, contributing $79.24 million and $69.46 million respectively. The company consistently reports a gross profit margin of 100%, indicating no reported cost of goods sold (COGS). Operating expenses, particularly general and administrative costs, form a significant portion of the company's expenditure, with recent figures around $92.24 million. Net income margins have shown variability over time, recently recorded at 20.57%.

PE: 14.2x

Capital Bancorp, a smaller U.S. financial entity, recently reported third-quarter net interest income of US$38.35 million, up from US$36.81 million the previous year, though net income dipped to US$8.67 million from US$9.79 million. Despite past shareholder dilution and increased net charge-offs of US$2.66 million this quarter compared to last year’s US$1.78 million, insider confidence is evident with recent share purchases in September 2024, suggesting potential growth prospects amidst challenges.

- Unlock comprehensive insights into our analysis of Capital Bancorp stock in this valuation report.

Examine Capital Bancorp's past performance report to understand how it has performed in the past.

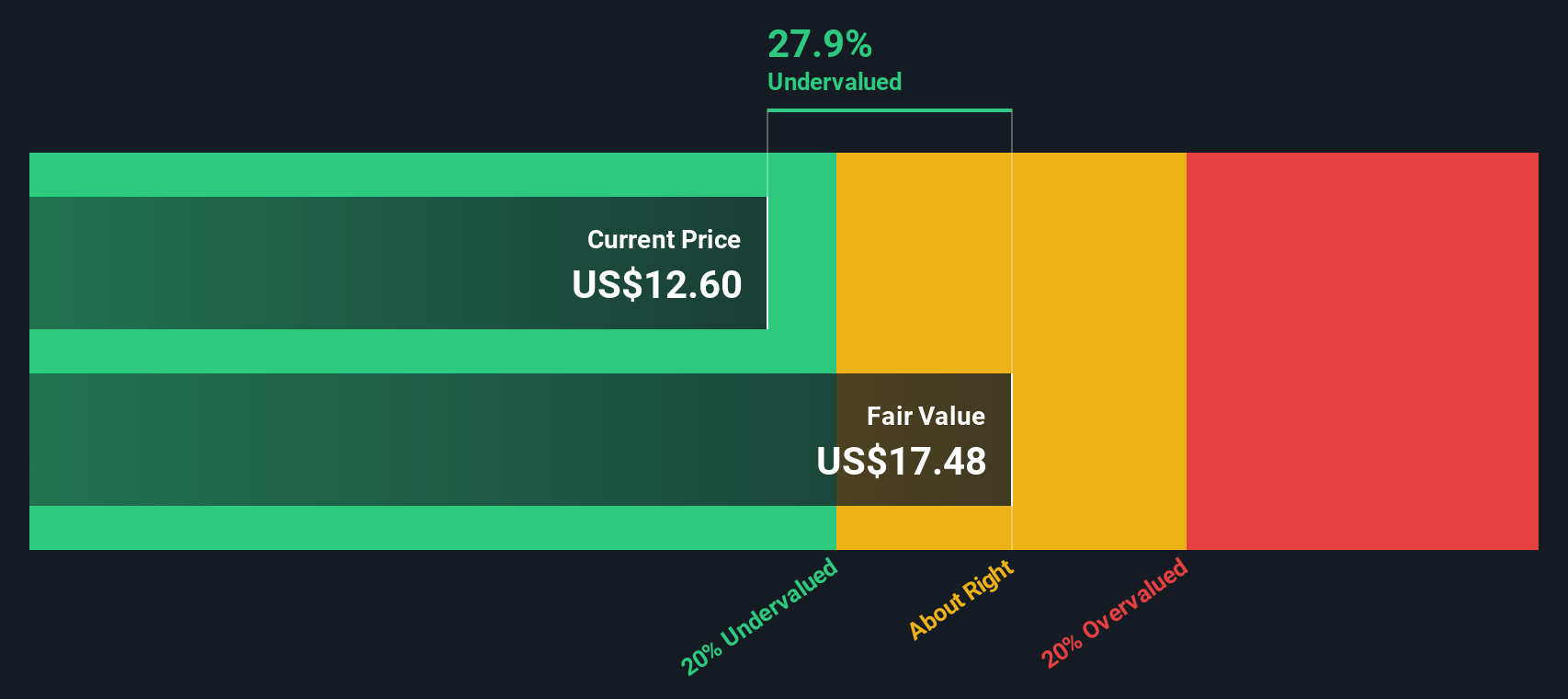

Heidrick & Struggles International (NasdaqGS:HSII)

Simply Wall St Value Rating: ★★★★★☆

Overview: Heidrick & Struggles International is a global executive search and consulting firm with operations across on-demand talent, Heidrick consulting, and executive search services in Europe, the Americas, and Asia Pacific, boasting a market capitalization of approximately $0.87 billion.

Operations: The company generates revenue primarily from Executive Search services in the Americas, Europe, and Asia Pacific, alongside On-Demand Talent and Heidrick Consulting. The gross profit margin has shown fluctuations, peaking at 31.89% in 2014-06-30 before decreasing to around 25.18% by 2024-09-30. Operating expenses are a significant cost component, with General & Administrative Expenses being a notable part of these costs across periods analyzed.

PE: 24.5x

Heidrick & Struggles International, a smaller U.S. company, recently reported Q3 2024 sales of US$278.56 million, up from US$263.16 million the previous year, though net income slightly decreased to US$14.83 million from US$14.99 million. Despite lower profit margins at 3.6%, insider confidence is evident with share purchases in recent months suggesting belief in future growth potential as earnings are expected to rise by 27% annually.

- Dive into the specifics of Heidrick & Struggles International here with our thorough valuation report.

Understand Heidrick & Struggles International's track record by examining our Past report.

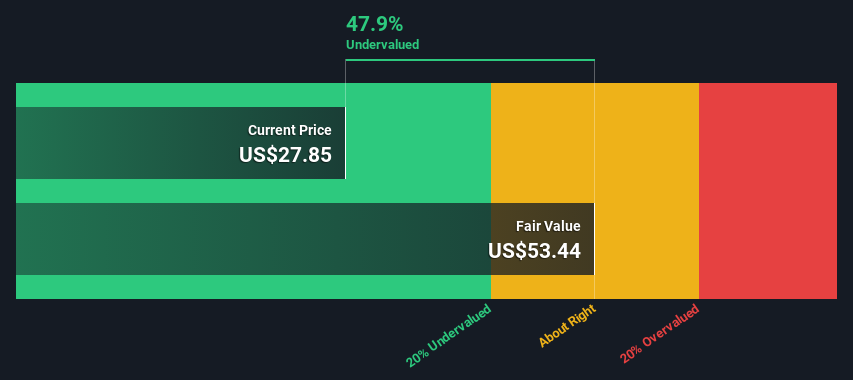

Whitestone REIT (NYSE:WSR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Whitestone REIT is a real estate investment trust focused on owning and operating community-centered commercial properties, with a market cap of approximately $0.51 billion.

Operations: The company generates revenue primarily through its commercial REIT operations, with a recent revenue figure of $149.45 million. Over the observed periods, the gross profit margin has shown variability, reaching up to 69.50%. Operating expenses and non-operating expenses are significant cost components impacting net income margins, which have exhibited fluctuations across different periods.

PE: 34.2x

Whitestone REIT, a smaller player in the U.S. market, recently reported third-quarter revenue of US$38.63 million, up from US$37.13 million last year, with net income jumping to US$7.62 million from US$2.49 million. Despite lower profit margins compared to last year and reliance on external borrowing for funding, insider confidence is evident through recent share purchases by executives over the past quarter. Newly appointed board members bring extensive real estate expertise that could enhance strategic direction and future growth prospects for Whitestone REIT.

- Click to explore a detailed breakdown of our findings in Whitestone REIT's valuation report.

Assess Whitestone REIT's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Gain an insight into the universe of 39 Undervalued US Small Caps With Insider Buying by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Whitestone REIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WSR

Whitestone REIT

Whitestone REIT (NYSE: WSR) is a community-centered real estate investment trust (REIT) that acquires, owns, operates, and develops open-air, retail centers located in some of the fastest growing markets in the country: Phoenix, Austin, Dallas-Fort Worth, Houston and San Antonio.

Moderate and fair value.