- United States

- /

- Health Care REITs

- /

- NYSE:WELL

Welltower (WELL): A Fresh Look at Valuation After 42% Shareholder Return

Reviewed by Kshitija Bhandaru

Welltower (WELL) shares have climbed nearly 15% over the past three months, riding steady momentum as investors keep a close watch on this healthcare real estate company and its latest growth signals.

See our latest analysis for Welltower.

After a robust run over the past quarter, Welltower's momentum stands out even more when you zoom out to the past year, where its total shareholder return hit 42%. This mix of sustained gains and investor optimism around healthcare real estate has helped Welltower outperform many of its sector peers. Recent updates continue to reinforce its growth narrative, strengthening investor confidence.

If Welltower’s performance has you looking for more, see what other healthcare stocks are moving with our curated picks: See the full list for free.

With shares trading just shy of analyst targets and strong growth already fueling a 42% annual return, investors now face a key question: Is Welltower still undervalued, or has the market already priced in its future growth?

Most Popular Narrative: 5.2% Undervalued

Welltower’s last close of $175.04 sits below the narrative’s fair value target, hinting at some upside if bold growth assumptions play out. Here’s how those expectations stack up according to the most followed view.

“Significant acquisition activity, including the Amica Senior Living acquisition, is anticipated to provide value through acquisition at a discount and drive revenue growth. Their improved occupancy rates and strong pricing power in the Seniors Housing Operating portfolio are likely to drive revenue and margin expansion.”

Curious what’s really under the hood of this bullish outlook? The calculation leans on future profitability, margin gains, and revenue growth. These are numbers that turn heads in any market. Want to see what drives the consensus higher and which assumptions could shake up Welltower’s valuation? This one is not a typical REIT story. Unlock the full narrative and test if you agree with these sky-high projections.

Result: Fair Value of $184.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macroeconomic uncertainty and rising investment levels could pressure Welltower's occupancy rates and future net margins if conditions change unexpectedly.

Find out about the key risks to this Welltower narrative.

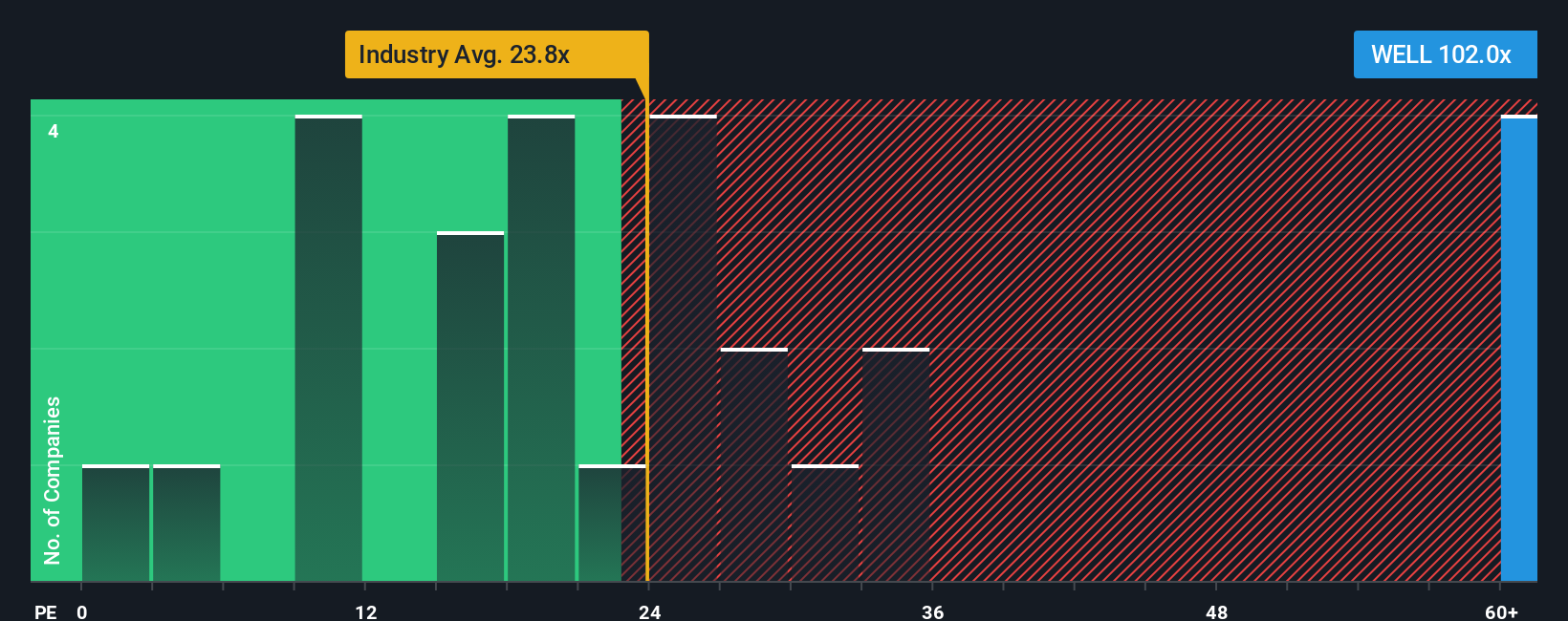

Another View: Price Ratios Say Expensive

Looking from a price-to-earnings perspective, Welltower is trading at 103.6x earnings, which stands well above the US Health Care REITs average of 33.2x and its closest peers at 74.9x. This is more than double the global industry average of 24.1x. Even the fair ratio, estimated at 42.1x, is far below where the shares trade. This suggests the market expects exceptional future growth or is potentially overlooking valuation risk. Could this premium be justified, or is optimism running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Welltower Narrative

If you see Welltower’s story differently or want to check the facts for yourself, it only takes a few minutes to craft your own perspective. Do it your way

A great starting point for your Welltower research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Sharpen your portfolio with fresh opportunities curated by Simply Wall Street. Don’t miss out; these strategies help you spot what others might overlook before the crowd catches on.

- Pinpoint growth potential by browsing these 3561 penny stocks with strong financials, featuring up-and-coming companies boasting strong financials and ambitious roadmaps.

- Boost your search for steady income with these 19 dividend stocks with yields > 3%, offering stocks that consistently deliver yields above 3%.

- Get ahead of tomorrow’s trends by reviewing these 24 AI penny stocks, focused on innovation in artificial intelligence and the next wave of market leaders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Welltower might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WELL

Welltower

Welltower Inc. (NYSE: WELL), an S&P 500 company, is one of the world's preeminent residential wellness and healthcare infrastructure companies.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives